A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

The Cuyahoga Ohio Bill of Sale and Assignment of Stock by Separate Instrument is a legal document that signifies the transfer of ownership of stock from one party to another in the Cuyahoga County region of Ohio. This document serves as proof of the transaction and outlines the terms and conditions agreed upon by both parties involved. The Cuyahoga Ohio Bill of Sale and Assignment of Stock by Separate Instrument is a crucial legal instrument that ensures a smooth transfer of stock ownership while protecting the rights and interests of both the buyer and the seller. This document includes important details such as the names and contact information of the buyer and seller, a description of the stock being transferred, and the agreed-upon purchase price. It is important to note that there can be different types of Cuyahoga Ohio Bill of Sale and Assignment of Stock by Separate Instrument, each designed to cater to specific scenarios and requirements. Some common types include: 1. General Bill of Sale and Assignment of Stock by Separate Instrument: This type of bill of sale is used in standard stock transfer transactions where the buyer and seller agree on a straightforward exchange of stock ownership. 2. Conditional Bill of Sale and Assignment of Stock by Separate Instrument: In certain cases, a conditional bill of sale may be used. This type of bill of sale includes specific conditions that must be met before the transfer of stock ownership can take place. These conditions might include the fulfillment of certain obligations or achievement of specific milestones agreed upon by both parties. 3. Partial Bill of Sale and Assignment of Stock by Separate Instrument: In some situations, a partial bill of sale may be necessary when only a portion of the stock is being transferred, leaving the remaining shares with the seller. This type of bill of sale clearly identifies the exact number or percentage of shares being transferred. Whether it is a general bill of sale, a conditional bill of sale, or a partial bill of sale, the Cuyahoga Ohio Bill of Sale and Assignment of Stock by Separate Instrument serves as a legally binding agreement that protects the interests of both parties involved in the stock transfer transaction. It is always recommended consulting with a legal professional to ensure compliance with relevant laws and regulations and to customize the document according to specific circumstances.The Cuyahoga Ohio Bill of Sale and Assignment of Stock by Separate Instrument is a legal document that signifies the transfer of ownership of stock from one party to another in the Cuyahoga County region of Ohio. This document serves as proof of the transaction and outlines the terms and conditions agreed upon by both parties involved. The Cuyahoga Ohio Bill of Sale and Assignment of Stock by Separate Instrument is a crucial legal instrument that ensures a smooth transfer of stock ownership while protecting the rights and interests of both the buyer and the seller. This document includes important details such as the names and contact information of the buyer and seller, a description of the stock being transferred, and the agreed-upon purchase price. It is important to note that there can be different types of Cuyahoga Ohio Bill of Sale and Assignment of Stock by Separate Instrument, each designed to cater to specific scenarios and requirements. Some common types include: 1. General Bill of Sale and Assignment of Stock by Separate Instrument: This type of bill of sale is used in standard stock transfer transactions where the buyer and seller agree on a straightforward exchange of stock ownership. 2. Conditional Bill of Sale and Assignment of Stock by Separate Instrument: In certain cases, a conditional bill of sale may be used. This type of bill of sale includes specific conditions that must be met before the transfer of stock ownership can take place. These conditions might include the fulfillment of certain obligations or achievement of specific milestones agreed upon by both parties. 3. Partial Bill of Sale and Assignment of Stock by Separate Instrument: In some situations, a partial bill of sale may be necessary when only a portion of the stock is being transferred, leaving the remaining shares with the seller. This type of bill of sale clearly identifies the exact number or percentage of shares being transferred. Whether it is a general bill of sale, a conditional bill of sale, or a partial bill of sale, the Cuyahoga Ohio Bill of Sale and Assignment of Stock by Separate Instrument serves as a legally binding agreement that protects the interests of both parties involved in the stock transfer transaction. It is always recommended consulting with a legal professional to ensure compliance with relevant laws and regulations and to customize the document according to specific circumstances.

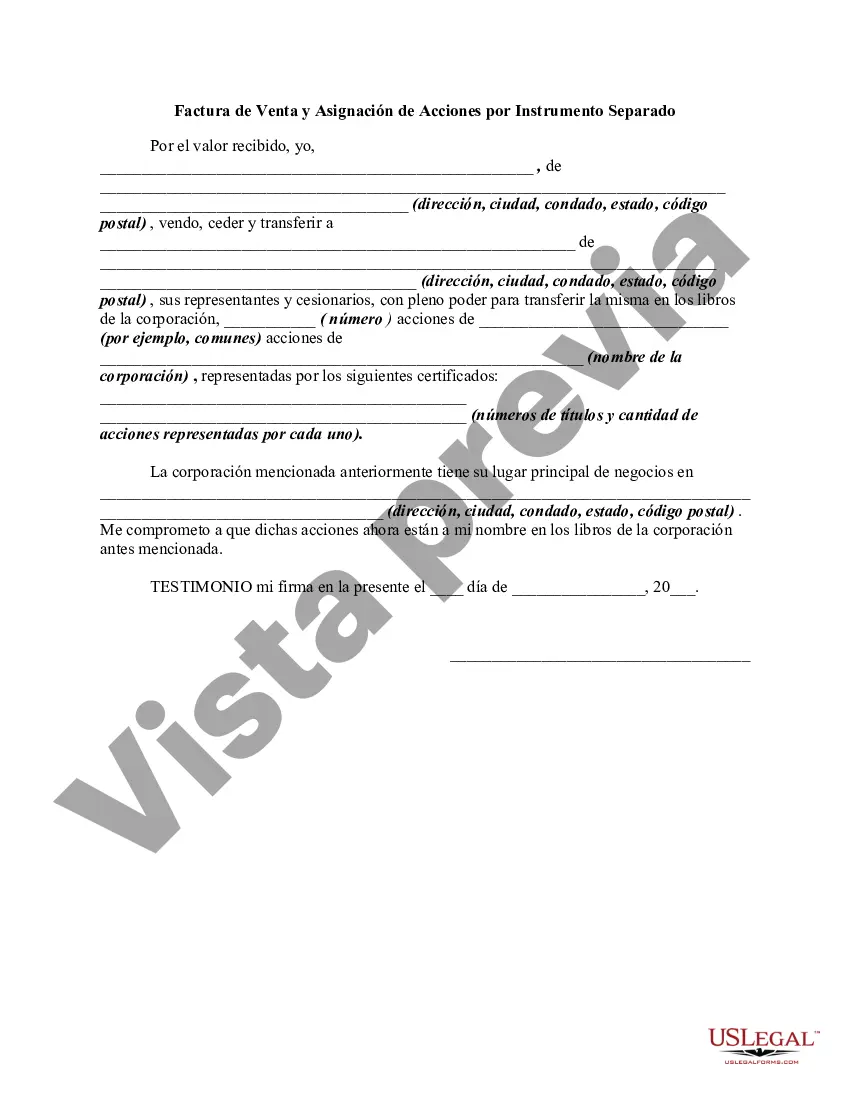

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.