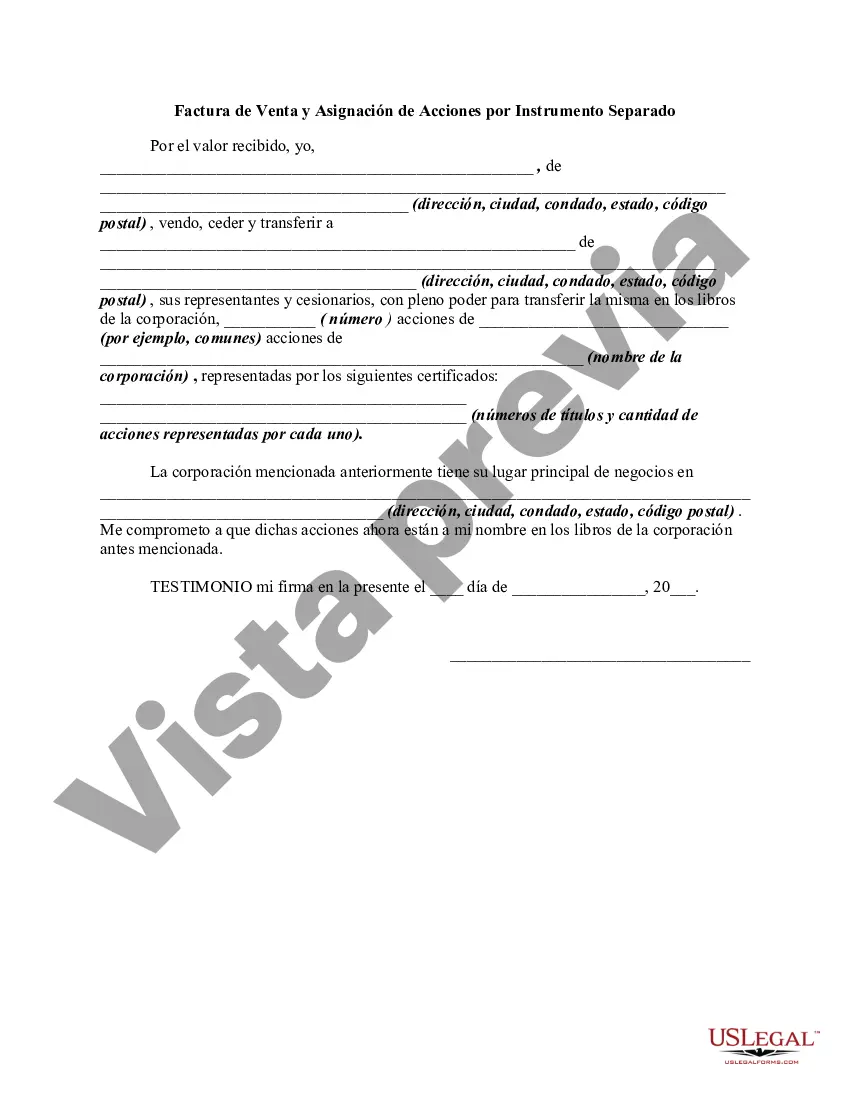

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

Maricopa Arizona Bill of Sale and Assignment of Stock by Separate Instrument is a legally binding document used when transferring ownership rights of stocks or shares in Maricopa, Arizona. This document is crucial in ensuring a smooth and transparent transfer of ownership and protecting the rights of all parties involved. A Maricopa Arizona Bill of Sale and Assignment of Stock by Separate Instrument is typically used when an individual or entity wishes to sell or transfer their stocks to another party. It serves as evidence of the transaction and provides legal protection for both the buyer and seller. Key elements included in this document are: 1. Parties Involved: The bill of sale and assignment of stock will include the names and addresses of both the seller (assignor) and the buyer (assignee). It is important to provide accurate and up-to-date information to avoid any discrepancies. 2. Stock Description: A detailed description of the stock being transferred should be mentioned, including the stock symbol, class, series, and number of shares being assigned. This clarity helps in avoiding confusion or disputes in the future. 3. Consideration: The agreed-upon amount or consideration to be paid in exchange for the assigned stocks must be clearly stated. It could be a monetary value or any other form of consideration agreed upon by both parties, such as valuable services or assets. 4. Representations and Warranties: This section outlines the assurances made by the seller regarding the ownership and transferability of the stock. It also declares that the stock being transferred is free from any liens, encumbrances, or claims. 5. Governing Law: The document should mention that it is governed by the laws of the state of Arizona, particularly Maricopa County, ensuring compliance with relevant regulations and statutes. Different types of Maricopa Arizona Bill of Sale and Assignment of Stock by Separate Instrument may include variations based on the specific circumstances of the transaction. These variations can include: 1. Restricted Stock Agreement: This type of bill of sale is used when the transfer of stocks is subject to certain restrictions, such as lock-up periods or limitations on selling to specific parties, allowing for better control over the shares' transferability. 2. Stock Purchase Agreement: In certain cases, a separate stock purchase agreement may be required when the transfer involves additional terms and conditions, such as installment payments or representations and warranties specific to the transaction. 3. Stock Assignment for Estate: This type of bill of sale is utilized when stocks are being transferred as part of an estate plan, where the assignor assigns the stocks to a specific beneficiary or trustee. In conclusion, a Maricopa Arizona Bill of Sale and Assignment of Stock by Separate Instrument is a vital legal document used to transfer ownership rights of stocks in Maricopa, Arizona. Depending on the circumstances, different types of bill of sale and assignment of stock may be required, such as a restricted stock agreement, stock purchase agreement, or stock assignment for estate.Maricopa Arizona Bill of Sale and Assignment of Stock by Separate Instrument is a legally binding document used when transferring ownership rights of stocks or shares in Maricopa, Arizona. This document is crucial in ensuring a smooth and transparent transfer of ownership and protecting the rights of all parties involved. A Maricopa Arizona Bill of Sale and Assignment of Stock by Separate Instrument is typically used when an individual or entity wishes to sell or transfer their stocks to another party. It serves as evidence of the transaction and provides legal protection for both the buyer and seller. Key elements included in this document are: 1. Parties Involved: The bill of sale and assignment of stock will include the names and addresses of both the seller (assignor) and the buyer (assignee). It is important to provide accurate and up-to-date information to avoid any discrepancies. 2. Stock Description: A detailed description of the stock being transferred should be mentioned, including the stock symbol, class, series, and number of shares being assigned. This clarity helps in avoiding confusion or disputes in the future. 3. Consideration: The agreed-upon amount or consideration to be paid in exchange for the assigned stocks must be clearly stated. It could be a monetary value or any other form of consideration agreed upon by both parties, such as valuable services or assets. 4. Representations and Warranties: This section outlines the assurances made by the seller regarding the ownership and transferability of the stock. It also declares that the stock being transferred is free from any liens, encumbrances, or claims. 5. Governing Law: The document should mention that it is governed by the laws of the state of Arizona, particularly Maricopa County, ensuring compliance with relevant regulations and statutes. Different types of Maricopa Arizona Bill of Sale and Assignment of Stock by Separate Instrument may include variations based on the specific circumstances of the transaction. These variations can include: 1. Restricted Stock Agreement: This type of bill of sale is used when the transfer of stocks is subject to certain restrictions, such as lock-up periods or limitations on selling to specific parties, allowing for better control over the shares' transferability. 2. Stock Purchase Agreement: In certain cases, a separate stock purchase agreement may be required when the transfer involves additional terms and conditions, such as installment payments or representations and warranties specific to the transaction. 3. Stock Assignment for Estate: This type of bill of sale is utilized when stocks are being transferred as part of an estate plan, where the assignor assigns the stocks to a specific beneficiary or trustee. In conclusion, a Maricopa Arizona Bill of Sale and Assignment of Stock by Separate Instrument is a vital legal document used to transfer ownership rights of stocks in Maricopa, Arizona. Depending on the circumstances, different types of bill of sale and assignment of stock may be required, such as a restricted stock agreement, stock purchase agreement, or stock assignment for estate.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.