A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

Montgomery Maryland Bill of Sale and Assignment of Stock by Separate Instrument is a legal document that enables the transfer of ownership rights from one party to another within the jurisdiction of Montgomery County, Maryland. This document is commonly used in various business transactions and ensures a smooth transfer of ownership while safeguarding the rights and interests of both parties involved. The Montgomery Maryland Bill of Sale and Assignment of Stock by Separate Instrument is typically prepared in accordance with the local laws and regulations. It includes detailed information about the buyer, the seller, and the stock being transferred. This document outlines the terms and conditions of the sale, including the purchase price, payment method, and any additional provisions or warranties agreed upon by both parties. Different types of Montgomery Maryland Bill of Sale and Assignment of Stock by Separate Instrument may be classified based on the specific transaction or stock type involved. Examples of such variations include: 1. Standard Bill of Sale and Assignment of Common Stock: This type of document is commonly used when transferring common stock ownership from one party to another. It details the number of shares being transferred and any specific conditions attached to the sale. 2. Bill of Sale and Assignment of Preferred Stock: This specific type of document is used when transferring ownership of preferred stock, which may have different rights and privileges compared to common stock. The document highlights the unique characteristics of the preferred stock being transferred. 3. Bill of Sale and Assignment of Restricted Stock: in cases where stocks are subject to certain restrictions, such as vesting periods or transfer limitations, a special Bill of Sale and Assignment is used. It outlines the restrictions and conditions imposed on the transfer of stock. 4. Bill of Sale and Assignment of Voting Stock: This type of document is employed when transferring ownership of stock with voting rights. It specifies the voting power associated with the transferred stock and any restrictions or conditions related to voting. However, it's important to consult with a legal professional to determine the appropriate type of Montgomery Maryland Bill of Sale and Assignment of Stock by separate instrument for your specific situation. This will ensure compliance with local laws, accurate documentation, and protection of your rights and interests.Montgomery Maryland Bill of Sale and Assignment of Stock by Separate Instrument is a legal document that enables the transfer of ownership rights from one party to another within the jurisdiction of Montgomery County, Maryland. This document is commonly used in various business transactions and ensures a smooth transfer of ownership while safeguarding the rights and interests of both parties involved. The Montgomery Maryland Bill of Sale and Assignment of Stock by Separate Instrument is typically prepared in accordance with the local laws and regulations. It includes detailed information about the buyer, the seller, and the stock being transferred. This document outlines the terms and conditions of the sale, including the purchase price, payment method, and any additional provisions or warranties agreed upon by both parties. Different types of Montgomery Maryland Bill of Sale and Assignment of Stock by Separate Instrument may be classified based on the specific transaction or stock type involved. Examples of such variations include: 1. Standard Bill of Sale and Assignment of Common Stock: This type of document is commonly used when transferring common stock ownership from one party to another. It details the number of shares being transferred and any specific conditions attached to the sale. 2. Bill of Sale and Assignment of Preferred Stock: This specific type of document is used when transferring ownership of preferred stock, which may have different rights and privileges compared to common stock. The document highlights the unique characteristics of the preferred stock being transferred. 3. Bill of Sale and Assignment of Restricted Stock: in cases where stocks are subject to certain restrictions, such as vesting periods or transfer limitations, a special Bill of Sale and Assignment is used. It outlines the restrictions and conditions imposed on the transfer of stock. 4. Bill of Sale and Assignment of Voting Stock: This type of document is employed when transferring ownership of stock with voting rights. It specifies the voting power associated with the transferred stock and any restrictions or conditions related to voting. However, it's important to consult with a legal professional to determine the appropriate type of Montgomery Maryland Bill of Sale and Assignment of Stock by separate instrument for your specific situation. This will ensure compliance with local laws, accurate documentation, and protection of your rights and interests.

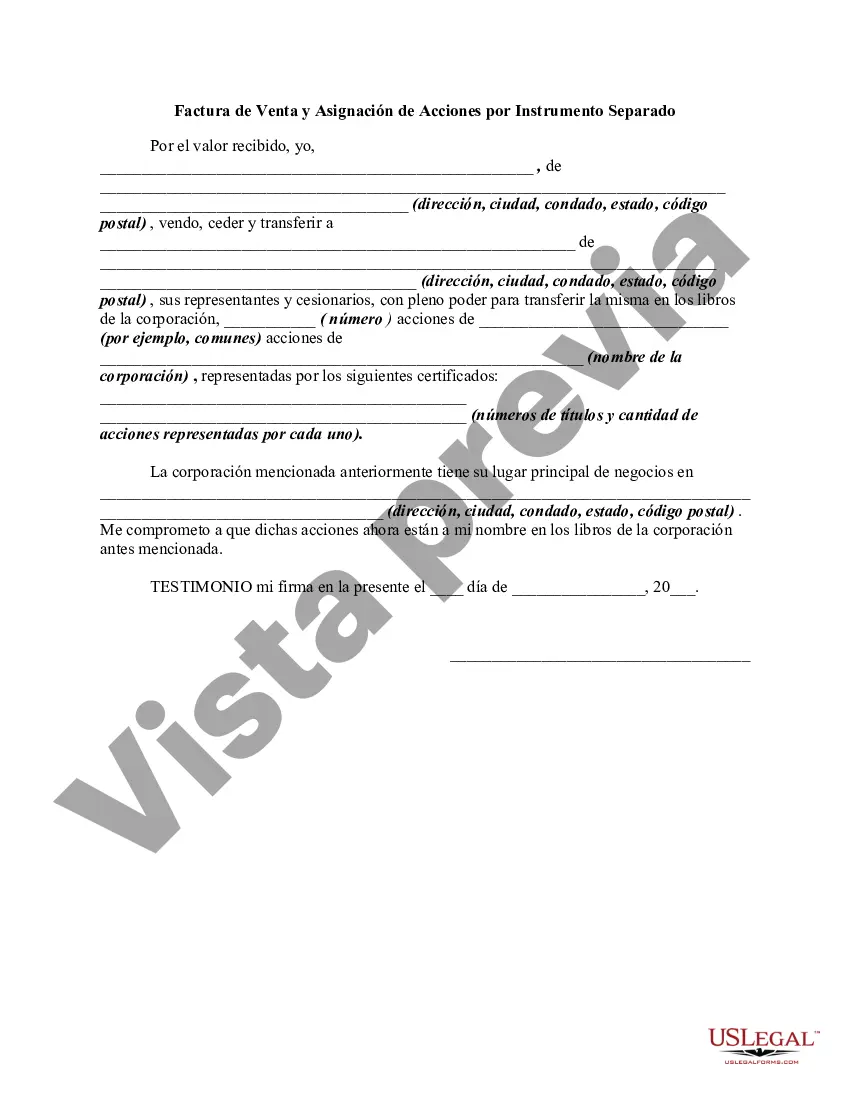

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.