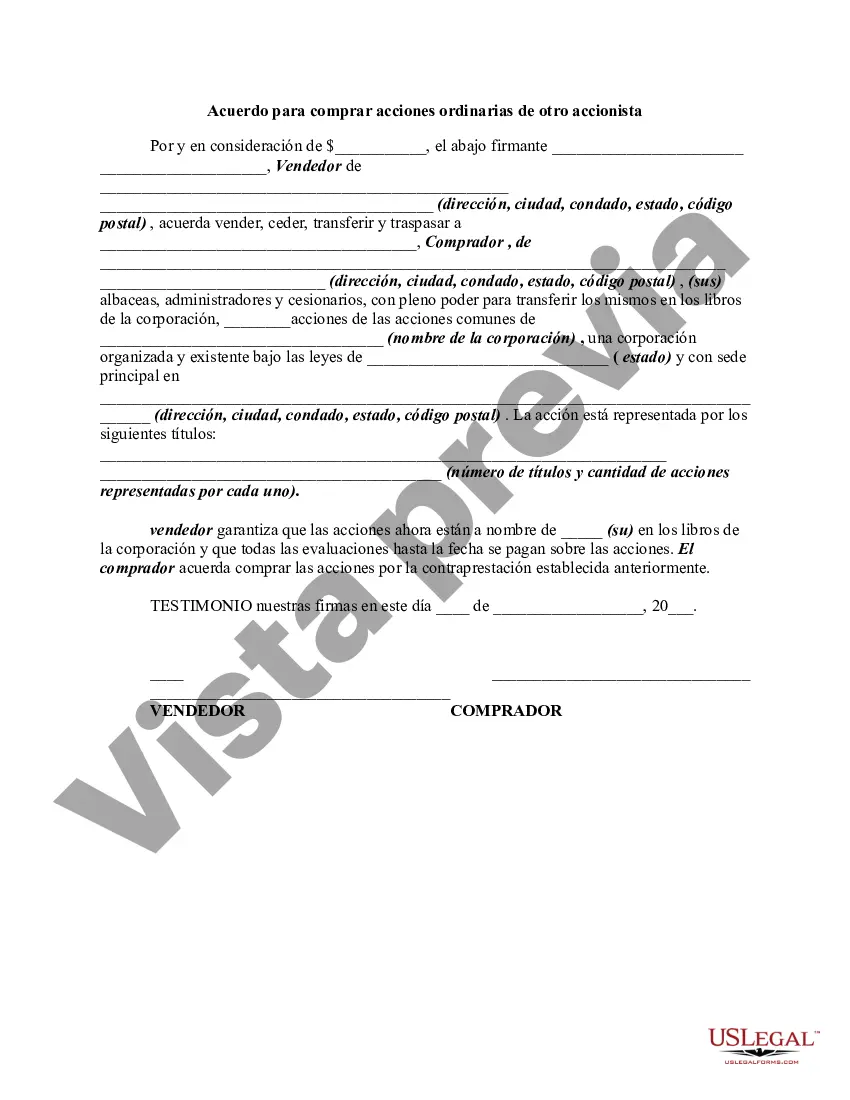

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

Title: Bexar Texas Agreement to Purchase Common Stock from another Stockholder — Overview, Types, and Key Provisions Introduction: The Bexar Texas Agreement to Purchase Common Stock from another Stockholder is a legally binding agreement between two stockholders, facilitating the sale and transfer of common stock within the jurisdiction of Bexar County, Texas. This article aims to provide a detailed description of this agreement, highlighting its types and essential elements. 1. Types of Bexar Texas Agreements to Purchase Common Stock: a) One-time Purchase Agreement: This type of agreement involves a single transaction of purchasing common stock from one stockholder to another. It outlines the terms, conditions, and price of the stock sale, as well as any warranties or representations made by the selling stockholder. b) Installment Purchase Agreement: In an installment purchase agreement, the stock buyer agrees to acquire the common stock in multiple payments rather than a lump sum. This type of agreement typically includes detailed provisions regarding payment schedules, interest rates, and consequences for defaulting on payments. c) Option Agreement: An option agreement provides the stock buyer with the right, but not the obligation, to purchase common stock from the stockholder at a predetermined price within a specified time frame. These agreements often include provisions for the exercise of the option and the consequences of non-exercise. d) Rights of First Refusal Agreement: This agreement grants the stockholder certain preemptive rights, enabling them to purchase additional common stock if another stockholder intends to sell. It sets out the terms under which the stockholder can exercise their right of first refusal and the process for notifying the stockholder of a potential sale. 2. Key Provisions: a) Purchase Price and Payment Terms: The agreement stipulates the purchase price and any payment terms, including the mode of payment (cash, check, wire transfer, etc.), deposit requirements, and any applicable interest rates. b) Closing Conditions: The agreement outlines the conditions that must be met before the stock purchase can be finalized, such as obtaining necessary approvals, meeting regulatory requirements, and any necessary consents from third parties. c) Representations and Warranties: Both parties provide assurances regarding the accuracy of information related to the stock being sold, financial statements, and compliance with laws. These representations and warranties protect the buyer from undisclosed risks or liabilities associated with the common stock. d) Indemnification: This provision safeguards the buyer from any losses or damages incurred due to misrepresentation of information, breach of agreement, or any potential legal claims arising from the purchase of common stock. e) Governing Law and Jurisdiction: The agreement specifies that Bexar County, Texas law governs the agreement and delineates the jurisdiction for resolving disputes, should any arise. Conclusion: The Bexar Texas Agreement to Purchase Common Stock from another Stockholder serves as a vital legal instrument to facilitate the transfer of common stock ownership. Understanding the different types of agreements and their key provisions is crucial for stockholders engaging in stock purchase transactions within Bexar County, Texas. Seeking legal guidance is highly recommended ensuring compliance with pertinent laws and protect the interests of all parties involved.Title: Bexar Texas Agreement to Purchase Common Stock from another Stockholder — Overview, Types, and Key Provisions Introduction: The Bexar Texas Agreement to Purchase Common Stock from another Stockholder is a legally binding agreement between two stockholders, facilitating the sale and transfer of common stock within the jurisdiction of Bexar County, Texas. This article aims to provide a detailed description of this agreement, highlighting its types and essential elements. 1. Types of Bexar Texas Agreements to Purchase Common Stock: a) One-time Purchase Agreement: This type of agreement involves a single transaction of purchasing common stock from one stockholder to another. It outlines the terms, conditions, and price of the stock sale, as well as any warranties or representations made by the selling stockholder. b) Installment Purchase Agreement: In an installment purchase agreement, the stock buyer agrees to acquire the common stock in multiple payments rather than a lump sum. This type of agreement typically includes detailed provisions regarding payment schedules, interest rates, and consequences for defaulting on payments. c) Option Agreement: An option agreement provides the stock buyer with the right, but not the obligation, to purchase common stock from the stockholder at a predetermined price within a specified time frame. These agreements often include provisions for the exercise of the option and the consequences of non-exercise. d) Rights of First Refusal Agreement: This agreement grants the stockholder certain preemptive rights, enabling them to purchase additional common stock if another stockholder intends to sell. It sets out the terms under which the stockholder can exercise their right of first refusal and the process for notifying the stockholder of a potential sale. 2. Key Provisions: a) Purchase Price and Payment Terms: The agreement stipulates the purchase price and any payment terms, including the mode of payment (cash, check, wire transfer, etc.), deposit requirements, and any applicable interest rates. b) Closing Conditions: The agreement outlines the conditions that must be met before the stock purchase can be finalized, such as obtaining necessary approvals, meeting regulatory requirements, and any necessary consents from third parties. c) Representations and Warranties: Both parties provide assurances regarding the accuracy of information related to the stock being sold, financial statements, and compliance with laws. These representations and warranties protect the buyer from undisclosed risks or liabilities associated with the common stock. d) Indemnification: This provision safeguards the buyer from any losses or damages incurred due to misrepresentation of information, breach of agreement, or any potential legal claims arising from the purchase of common stock. e) Governing Law and Jurisdiction: The agreement specifies that Bexar County, Texas law governs the agreement and delineates the jurisdiction for resolving disputes, should any arise. Conclusion: The Bexar Texas Agreement to Purchase Common Stock from another Stockholder serves as a vital legal instrument to facilitate the transfer of common stock ownership. Understanding the different types of agreements and their key provisions is crucial for stockholders engaging in stock purchase transactions within Bexar County, Texas. Seeking legal guidance is highly recommended ensuring compliance with pertinent laws and protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.