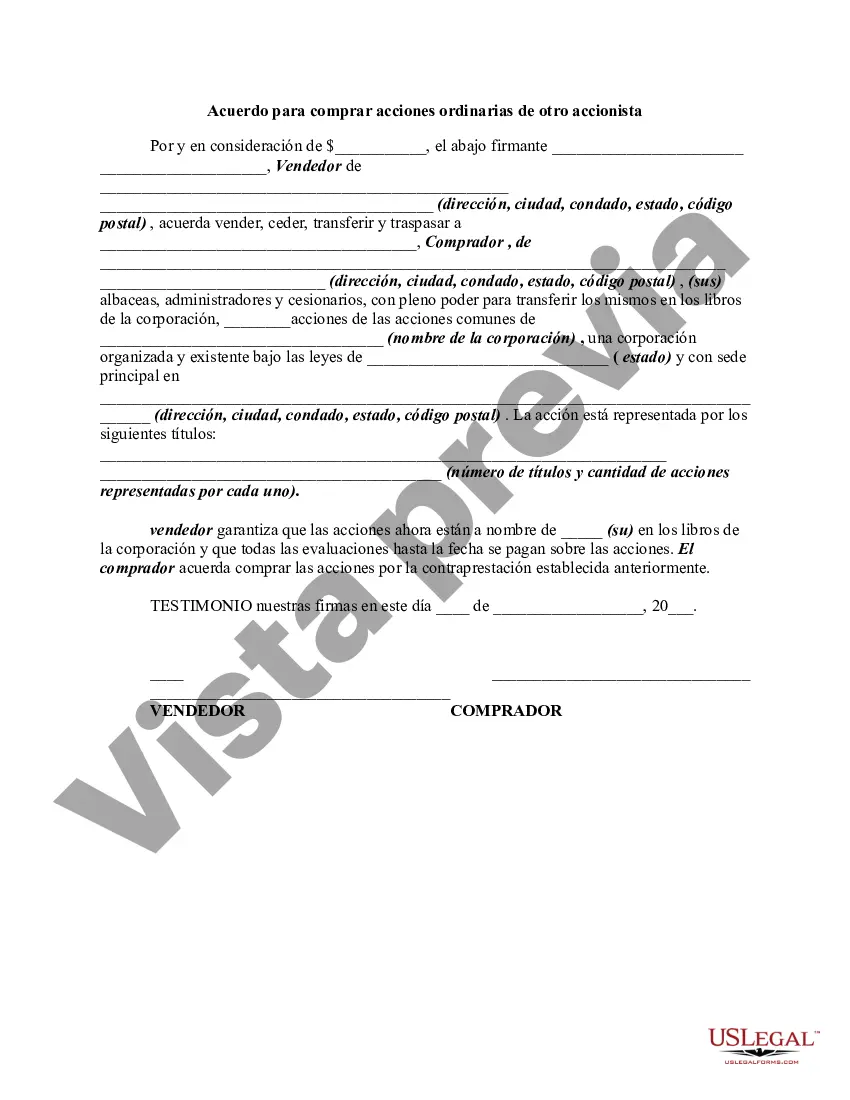

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

The Cook Illinois Agreement to Purchase Common Stock from another Stockholder is a legal contract that outlines the terms and conditions for the acquisition of common stock from a current stockholder by Cook Illinois Corporation. This agreement is crucial for transferring ownership and maintaining accurate records of stock ownership. In this agreement, Cook Illinois, as the buyer, agrees to purchase a predetermined number of common stock shares from the seller, another stockholder. The agreement includes details like the price per share, total purchase price, payment terms, and any specific conditions or contingencies that need to be met for the completion of the transaction. There can be different types of Cook Illinois Agreements to Purchase Common Stock from another Stockholder, depending on the specific circumstances and intentions of the parties involved. Some common variations may include: 1. Stock Purchase Agreement: This type of agreement is the most basic and general version, covering the purchase of stock from a stockholder. It outlines the essential terms and conditions of the transaction. 2. Stock Purchase Agreement with Earn out Provision: In certain cases, parties may add a Darn out provision to the agreement. This provision allows the seller to receive additional compensation based on future performance metrics or specific milestones achieved by the company after the stock purchase. 3. Stock Purchase Agreement with Non-Compete Clause: When a stockholder sells their shares, it may be necessary to restrict their ability to compete with the company. This type of agreement includes a non-compete clause, which prevents the seller from engaging in similar business activities that may harm the buyer's interests. 4. Stock Purchase Agreement with Right of First Refusal: In situations where the company wants to retain control over who can purchase the stock, the agreement may include a right of first refusal. This provision ensures that the selling stockholder must first offer their shares to Cook Illinois before considering other potential buyers. It is important to note that the specific terms and variations of Cook Illinois Agreements to Purchase Common Stock from another Stockholder may vary based on the negotiation between the parties involved and the requirements of applicable laws and regulations. Seeking legal advice and expertise is highly recommended ensuring the agreement accurately reflects the intended transaction and safeguards the interests of all parties involved.The Cook Illinois Agreement to Purchase Common Stock from another Stockholder is a legal contract that outlines the terms and conditions for the acquisition of common stock from a current stockholder by Cook Illinois Corporation. This agreement is crucial for transferring ownership and maintaining accurate records of stock ownership. In this agreement, Cook Illinois, as the buyer, agrees to purchase a predetermined number of common stock shares from the seller, another stockholder. The agreement includes details like the price per share, total purchase price, payment terms, and any specific conditions or contingencies that need to be met for the completion of the transaction. There can be different types of Cook Illinois Agreements to Purchase Common Stock from another Stockholder, depending on the specific circumstances and intentions of the parties involved. Some common variations may include: 1. Stock Purchase Agreement: This type of agreement is the most basic and general version, covering the purchase of stock from a stockholder. It outlines the essential terms and conditions of the transaction. 2. Stock Purchase Agreement with Earn out Provision: In certain cases, parties may add a Darn out provision to the agreement. This provision allows the seller to receive additional compensation based on future performance metrics or specific milestones achieved by the company after the stock purchase. 3. Stock Purchase Agreement with Non-Compete Clause: When a stockholder sells their shares, it may be necessary to restrict their ability to compete with the company. This type of agreement includes a non-compete clause, which prevents the seller from engaging in similar business activities that may harm the buyer's interests. 4. Stock Purchase Agreement with Right of First Refusal: In situations where the company wants to retain control over who can purchase the stock, the agreement may include a right of first refusal. This provision ensures that the selling stockholder must first offer their shares to Cook Illinois before considering other potential buyers. It is important to note that the specific terms and variations of Cook Illinois Agreements to Purchase Common Stock from another Stockholder may vary based on the negotiation between the parties involved and the requirements of applicable laws and regulations. Seeking legal advice and expertise is highly recommended ensuring the agreement accurately reflects the intended transaction and safeguards the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.