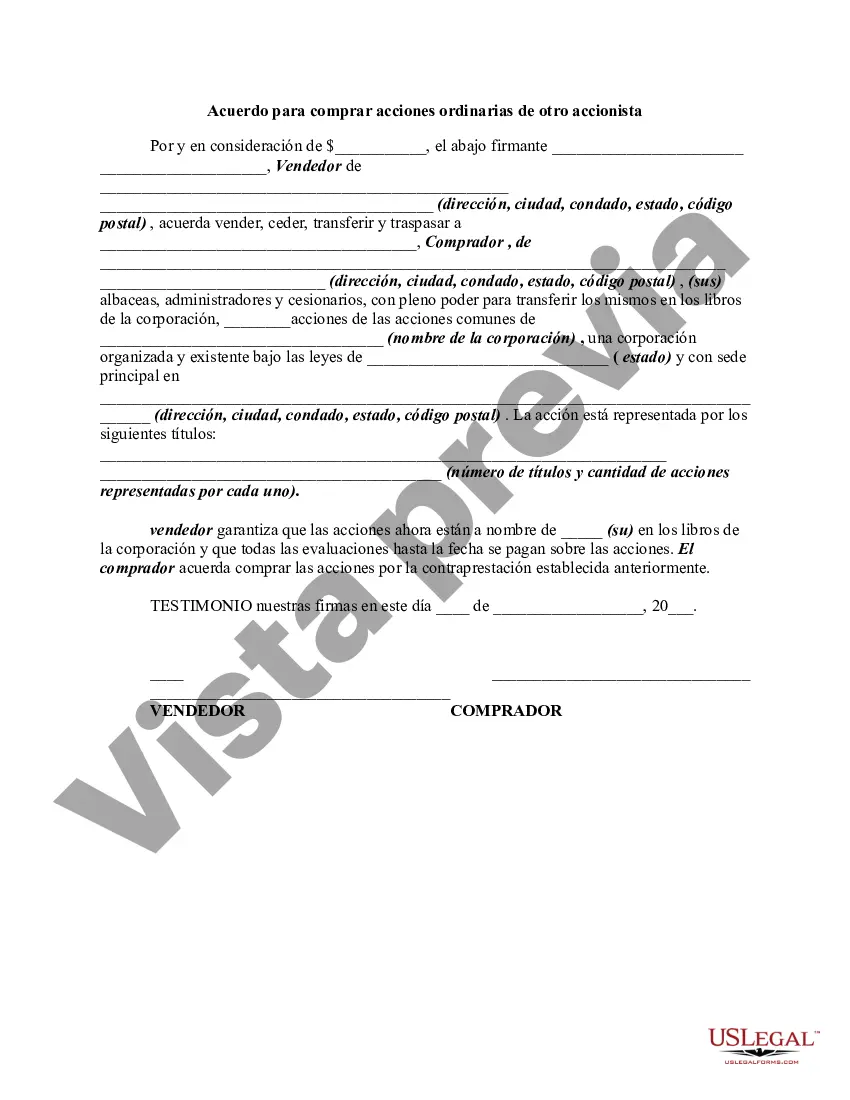

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

Franklin Ohio Agreement to Purchase Common Stock from another Stockholder is a legally binding document outlining the terms and conditions under which a stockholder in Franklin, Ohio, agrees to acquire common stock from another stockholder. This agreement ensures that both parties are clear about their rights, responsibilities, and obligations throughout the stock purchase transaction. The Franklin Ohio Agreement to Purchase Common Stock serves as a safeguard to protect the interests of the buyer and seller involved in the transaction. It sets out the purchase price, the number of shares to be acquired, and any conditions or contingencies that must be met before the transaction can be completed. Key terms and provisions commonly found in the Franklin Ohio Agreement to Purchase Common Stock from another Stockholder may include: 1. Parties: Full names, addresses, and contact information of the buyer and seller must be clearly stated. In case of a corporate entity, the agreement should specify the authorized person(s) representing the company. 2. Stock Details: The agreement should specify the number of shares being purchased and the class or type of common stock involved. It is also important to define any restrictions or limitations associated with the shares such as transferability or voting rights. 3. Purchase Price: The agreement must clearly state the purchase price per share and the total value of the stock being acquired. It may also outline the payment method, whether it's a lump sum or installment-based, along with any adjustments or assumptions. 4. Contingencies and Conditions Precedent: This section outlines any conditions that must be fulfilled before the stock purchase can be completed. For example, the agreement may require the approval of third parties, such as regulatory authorities or internal board approvals. 5. Representations and Warranties: Both parties usually provide representations and warranties regarding their authority, ownership, title, and compliance with laws. These ensure that the seller has the legal right to sell the stock and the buyer has the financial capability to complete the transaction. 6. Confidentiality and Non-Disclosure: To protect proprietary or sensitive information, a confidentiality or non-disclosure clause may be included, preventing either party from disclosing or using confidential information for any purpose other than the stock purchase. 7. Dispute Resolution: This section outlines the process for settling any disputes that may arise from the agreement. It may include negotiation, mediation, or arbitration, and specify the jurisdiction or laws governing the agreement. Some possible variations or types of Franklin Ohio Agreements to Purchase Common Stock from another Stockholder may include agreements specific to different industries, such as the Franklin Ohio Agreement to Purchase Common Stock in the technology sector, healthcare industry, or real estate sector. These variations might include additional industry-specific clauses based on the unique requirements and regulations of the respective sectors. In conclusion, the Franklin Ohio Agreement to Purchase Common Stock from another Stockholder is a legally binding document that establishes the terms and conditions for the acquisition of common stock. It protects the interests of both parties and ensures the smooth transfer of ownership.Franklin Ohio Agreement to Purchase Common Stock from another Stockholder is a legally binding document outlining the terms and conditions under which a stockholder in Franklin, Ohio, agrees to acquire common stock from another stockholder. This agreement ensures that both parties are clear about their rights, responsibilities, and obligations throughout the stock purchase transaction. The Franklin Ohio Agreement to Purchase Common Stock serves as a safeguard to protect the interests of the buyer and seller involved in the transaction. It sets out the purchase price, the number of shares to be acquired, and any conditions or contingencies that must be met before the transaction can be completed. Key terms and provisions commonly found in the Franklin Ohio Agreement to Purchase Common Stock from another Stockholder may include: 1. Parties: Full names, addresses, and contact information of the buyer and seller must be clearly stated. In case of a corporate entity, the agreement should specify the authorized person(s) representing the company. 2. Stock Details: The agreement should specify the number of shares being purchased and the class or type of common stock involved. It is also important to define any restrictions or limitations associated with the shares such as transferability or voting rights. 3. Purchase Price: The agreement must clearly state the purchase price per share and the total value of the stock being acquired. It may also outline the payment method, whether it's a lump sum or installment-based, along with any adjustments or assumptions. 4. Contingencies and Conditions Precedent: This section outlines any conditions that must be fulfilled before the stock purchase can be completed. For example, the agreement may require the approval of third parties, such as regulatory authorities or internal board approvals. 5. Representations and Warranties: Both parties usually provide representations and warranties regarding their authority, ownership, title, and compliance with laws. These ensure that the seller has the legal right to sell the stock and the buyer has the financial capability to complete the transaction. 6. Confidentiality and Non-Disclosure: To protect proprietary or sensitive information, a confidentiality or non-disclosure clause may be included, preventing either party from disclosing or using confidential information for any purpose other than the stock purchase. 7. Dispute Resolution: This section outlines the process for settling any disputes that may arise from the agreement. It may include negotiation, mediation, or arbitration, and specify the jurisdiction or laws governing the agreement. Some possible variations or types of Franklin Ohio Agreements to Purchase Common Stock from another Stockholder may include agreements specific to different industries, such as the Franklin Ohio Agreement to Purchase Common Stock in the technology sector, healthcare industry, or real estate sector. These variations might include additional industry-specific clauses based on the unique requirements and regulations of the respective sectors. In conclusion, the Franklin Ohio Agreement to Purchase Common Stock from another Stockholder is a legally binding document that establishes the terms and conditions for the acquisition of common stock. It protects the interests of both parties and ensures the smooth transfer of ownership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.