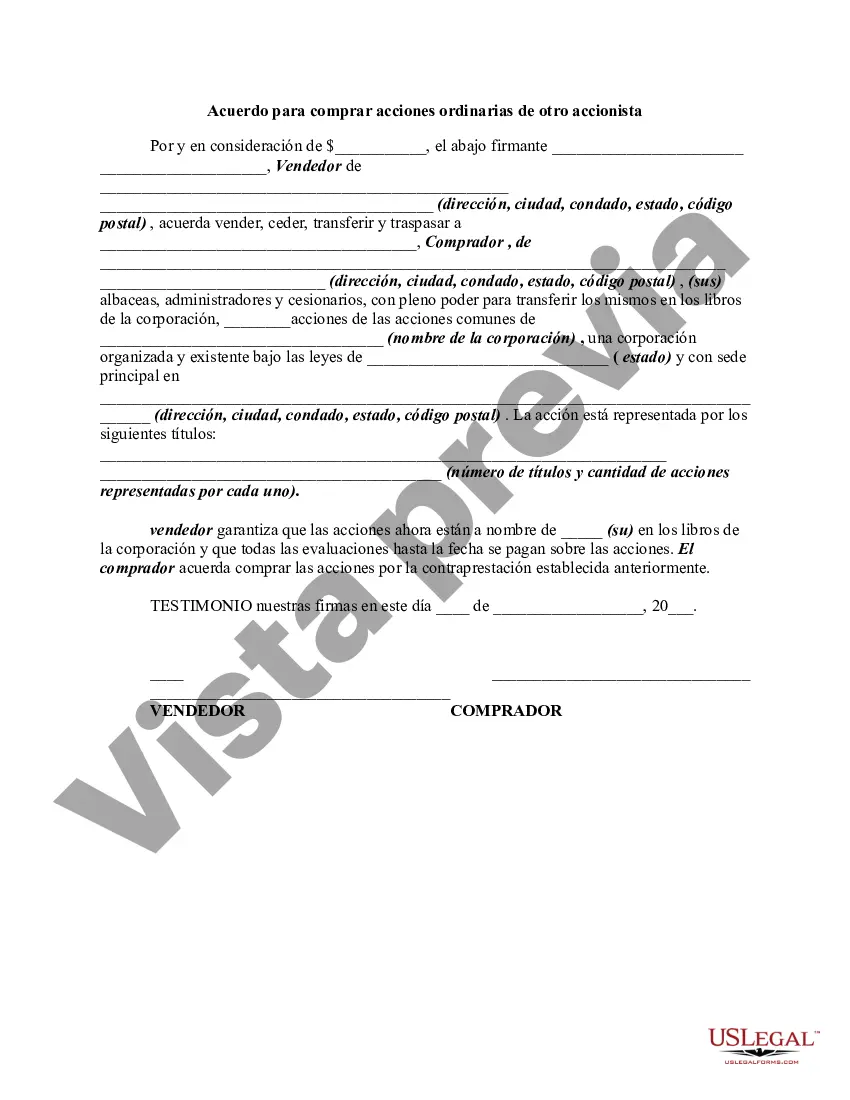

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

The Fulton Georgia Agreement to Purchase Common Stock from another Stockholder is a legally binding contract that outlines the terms and conditions of the acquisition of common stock from an existing stockholder. This agreement serves as a crucial document in corporate transactions and offers a framework for the transfer of ownership in a stock holding company. One type of Fulton Georgia Agreement to Purchase Common Stock is the "Stock Purchase Agreement" which ensures a smooth and well-defined process of buying and selling the common stock of a company. This agreement typically includes important details such as the purchase price, the number of shares being acquired, and any warranties or representations made by the seller regarding the stock being sold. Another type of Fulton Georgia Agreement to Purchase Common Stock is the "Share Purchase Agreement" which focuses on the acquisition of a specific number of shares or percentage of ownership in a company. This agreement may include provisions related to the transfer of any associated rights or privileges, shareholder voting rights, or even conditions precedent that must be met before the transaction can be completed. Key elements commonly featured in the Fulton Georgia Agreement to Purchase Common Stock include: 1. Parties Involved: Identify and describe the buyer, seller, and the company whose common stock is being purchased. Include their legal names, addresses, and any additional details that establish their identities. 2. Purchase Price: Clearly state the agreed-upon price that the buyer will pay for the common stock. Include specifics on the currency, payment terms, and any adjustments or conditions that may affect the final amount. 3. Shares and Stock Ownership: Specify the number of shares being purchased and any relevant details about the stock ownership, such as class or series of stock. This section may also discuss any associated rights, dividends, or preferences tied to the stock. 4. Representations and Warranties: Detail the assurances made by both buyer and seller regarding the validity of the stock being sold. This may include representations related to the legality of the transaction, ownership of the stock, or any other relevant matters. 5. Conditions Precedent: Outline any requirements that must be fulfilled before the stock purchase can be completed. These may include regulatory approvals, third-party consents, or the absence of any outstanding litigation or legal issues. 6. Confidentiality and Non-Disclosure: Address the need to maintain confidentiality and restrict the disclosure of any sensitive information related to the transaction, ensuring the protection of trade secrets or proprietary knowledge. 7. Governing Law and Jurisdiction: Define the jurisdiction whose laws will govern the agreement and any disputes that may arise from it. Specify the court or arbitration proceedings that will handle such matters. 8. Termination: Include provisions that allow for the termination of the agreement under certain circumstances, such as a breach of contract, failure to meet conditions precedent, or mutual agreement between the parties. It is important to note that the specifics of the Fulton Georgia Agreement to Purchase Common Stock may vary depending on the unique circumstances of the transaction and the preferences of the parties involved. Therefore, seeking legal advice and guidance when drafting or reviewing such an agreement is highly recommended ensuring compliance with relevant laws and to protect the interests of all parties involved.The Fulton Georgia Agreement to Purchase Common Stock from another Stockholder is a legally binding contract that outlines the terms and conditions of the acquisition of common stock from an existing stockholder. This agreement serves as a crucial document in corporate transactions and offers a framework for the transfer of ownership in a stock holding company. One type of Fulton Georgia Agreement to Purchase Common Stock is the "Stock Purchase Agreement" which ensures a smooth and well-defined process of buying and selling the common stock of a company. This agreement typically includes important details such as the purchase price, the number of shares being acquired, and any warranties or representations made by the seller regarding the stock being sold. Another type of Fulton Georgia Agreement to Purchase Common Stock is the "Share Purchase Agreement" which focuses on the acquisition of a specific number of shares or percentage of ownership in a company. This agreement may include provisions related to the transfer of any associated rights or privileges, shareholder voting rights, or even conditions precedent that must be met before the transaction can be completed. Key elements commonly featured in the Fulton Georgia Agreement to Purchase Common Stock include: 1. Parties Involved: Identify and describe the buyer, seller, and the company whose common stock is being purchased. Include their legal names, addresses, and any additional details that establish their identities. 2. Purchase Price: Clearly state the agreed-upon price that the buyer will pay for the common stock. Include specifics on the currency, payment terms, and any adjustments or conditions that may affect the final amount. 3. Shares and Stock Ownership: Specify the number of shares being purchased and any relevant details about the stock ownership, such as class or series of stock. This section may also discuss any associated rights, dividends, or preferences tied to the stock. 4. Representations and Warranties: Detail the assurances made by both buyer and seller regarding the validity of the stock being sold. This may include representations related to the legality of the transaction, ownership of the stock, or any other relevant matters. 5. Conditions Precedent: Outline any requirements that must be fulfilled before the stock purchase can be completed. These may include regulatory approvals, third-party consents, or the absence of any outstanding litigation or legal issues. 6. Confidentiality and Non-Disclosure: Address the need to maintain confidentiality and restrict the disclosure of any sensitive information related to the transaction, ensuring the protection of trade secrets or proprietary knowledge. 7. Governing Law and Jurisdiction: Define the jurisdiction whose laws will govern the agreement and any disputes that may arise from it. Specify the court or arbitration proceedings that will handle such matters. 8. Termination: Include provisions that allow for the termination of the agreement under certain circumstances, such as a breach of contract, failure to meet conditions precedent, or mutual agreement between the parties. It is important to note that the specifics of the Fulton Georgia Agreement to Purchase Common Stock may vary depending on the unique circumstances of the transaction and the preferences of the parties involved. Therefore, seeking legal advice and guidance when drafting or reviewing such an agreement is highly recommended ensuring compliance with relevant laws and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.