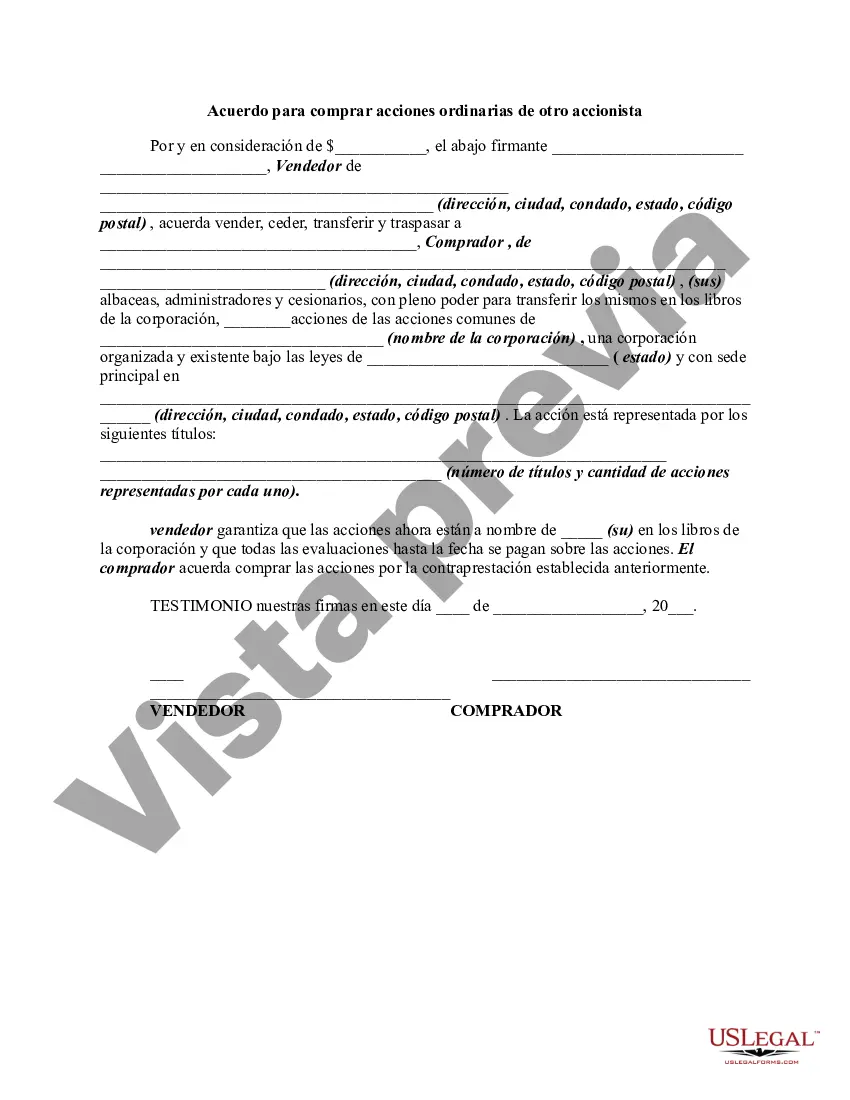

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

A Houston Texas Agreement to Purchase Common Stock from another Stockholder is a legally binding document that outlines the terms and conditions agreed upon by the buyer and seller for the purchase of common stock in a company. This type of agreement is commonly used in Houston, Texas, and is essential for individuals or entities seeking to acquire shares of common stock from an existing stockholder. The agreement serves as evidence of the transaction and protects the interests of both parties involved. It typically includes crucial details such as the identity of the buyer and seller, the number of shares being purchased, the purchase price, and the payment terms. Additionally, it outlines any conditions precedent to the purchase, such as regulatory approvals or due diligence requirements. There are various types of Houston Texas Agreements to Purchase Common Stock from another Stockholder that may cater to different situations and specific requirements. These include: 1. Simple Stock Purchase Agreement: This agreement is suitable for straightforward transactions where the buyer purchases common stock directly from the selling stockholder without any additional conditions or complexities. 2. Escrow Stock Purchase Agreement: In more complex transactions, an escrow agreement may be established to hold the purchase price in a separate account until certain conditions are fulfilled. This provides an extra layer of security for both the buyer and seller. 3. Stock Purchase Agreement with Earn-Out Provisions: When the purchase price is contingent upon the future performance of the company or specific metrics, such as revenue or profitability targets, this agreement type is used. Earn-out provisions ensure that the buyer pays an additional amount to the seller if certain criteria are met. 4. Stock Purchase Agreement with Non-Compete Clause: In certain cases, buyers may include a non-compete clause to prevent the selling stockholder from competing with the purchased company or disclosing confidential information to competitors. This type of agreement provides additional protection for the buyer. 5. Stock Purchase Agreement with Shareholder's Agreement: For more complex transactions involving multiple stockholders or involving a change in control of the company, a stock purchase agreement may be combined with a shareholder's agreement. The shareholder's agreement outlines the rights, responsibilities, and obligations of the shareholders. It is crucial for individuals or entities involved in stock transactions to consult with legal professionals experienced in Houston, Texas, corporate law to ensure compliance with state and federal regulations.A Houston Texas Agreement to Purchase Common Stock from another Stockholder is a legally binding document that outlines the terms and conditions agreed upon by the buyer and seller for the purchase of common stock in a company. This type of agreement is commonly used in Houston, Texas, and is essential for individuals or entities seeking to acquire shares of common stock from an existing stockholder. The agreement serves as evidence of the transaction and protects the interests of both parties involved. It typically includes crucial details such as the identity of the buyer and seller, the number of shares being purchased, the purchase price, and the payment terms. Additionally, it outlines any conditions precedent to the purchase, such as regulatory approvals or due diligence requirements. There are various types of Houston Texas Agreements to Purchase Common Stock from another Stockholder that may cater to different situations and specific requirements. These include: 1. Simple Stock Purchase Agreement: This agreement is suitable for straightforward transactions where the buyer purchases common stock directly from the selling stockholder without any additional conditions or complexities. 2. Escrow Stock Purchase Agreement: In more complex transactions, an escrow agreement may be established to hold the purchase price in a separate account until certain conditions are fulfilled. This provides an extra layer of security for both the buyer and seller. 3. Stock Purchase Agreement with Earn-Out Provisions: When the purchase price is contingent upon the future performance of the company or specific metrics, such as revenue or profitability targets, this agreement type is used. Earn-out provisions ensure that the buyer pays an additional amount to the seller if certain criteria are met. 4. Stock Purchase Agreement with Non-Compete Clause: In certain cases, buyers may include a non-compete clause to prevent the selling stockholder from competing with the purchased company or disclosing confidential information to competitors. This type of agreement provides additional protection for the buyer. 5. Stock Purchase Agreement with Shareholder's Agreement: For more complex transactions involving multiple stockholders or involving a change in control of the company, a stock purchase agreement may be combined with a shareholder's agreement. The shareholder's agreement outlines the rights, responsibilities, and obligations of the shareholders. It is crucial for individuals or entities involved in stock transactions to consult with legal professionals experienced in Houston, Texas, corporate law to ensure compliance with state and federal regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.