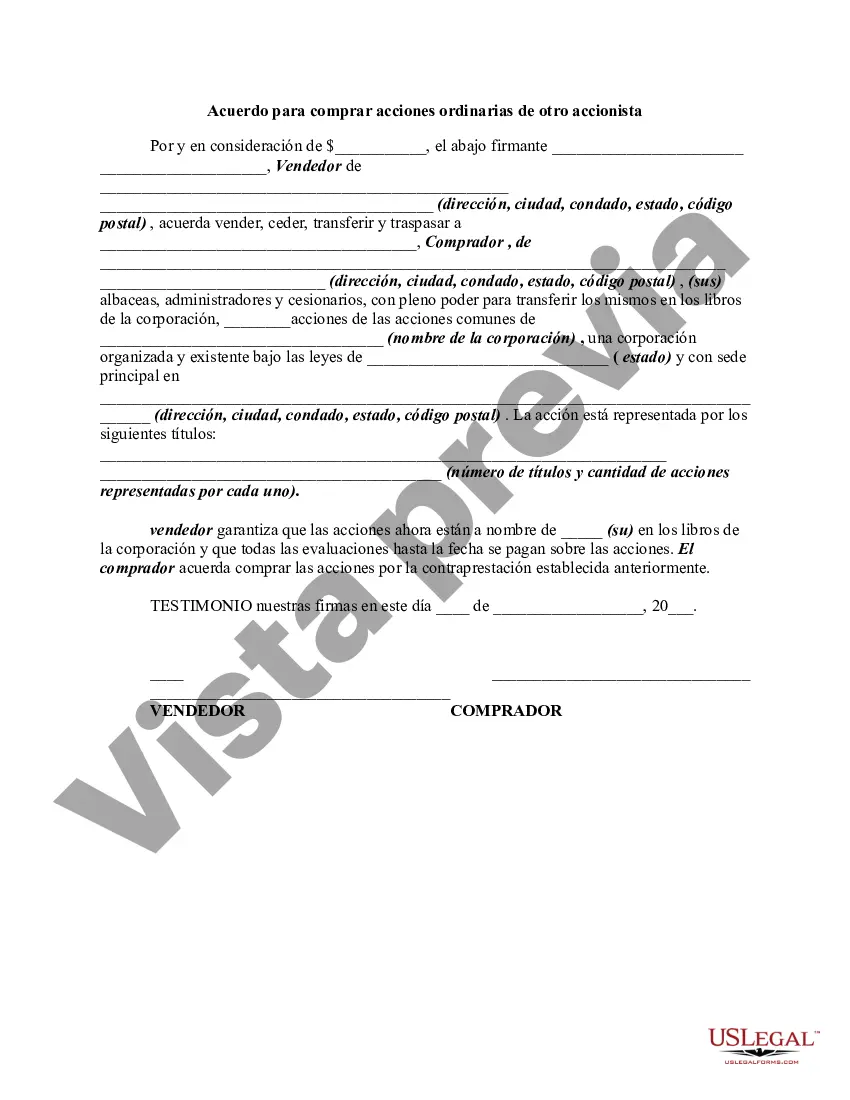

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

The Kings New York Agreement to Purchase Common Stock from another Stockholder is a legally binding contract that outlines the terms and conditions for the acquisition of common stock by one stockholder from another within the Kings New York Stock Exchange. This agreement sets forth the specific details of the transaction, ensuring a smooth and transparent process for both parties involved. The Kings New York Agreement to Purchase Common Stock consists of various types, each catering to different scenarios and requirements. Some notable types include: 1. Traditional Purchase Agreement: This type of agreement occurs when one stockholder wishes to purchase common stock directly from another stockholder. It covers essential aspects such as the number of shares, purchase price, payment terms, and any applicable conditions or restrictions. 2. Option Agreement: In some cases, a stockholder may grant another stockholder an option to purchase common stock at a later date at a predetermined price. This agreement allows the buyer to decide whether they want to exercise their right to buy the shares within a specified timeframe. 3. Rights Agreement: When a stockholder intends to sell common stock, but certain rights are attached to the shares, a rights' agreement comes into play. This agreement details the transfer of ownership while also ensuring that all attached rights, such as voting rights or dividend entitlements, are adequately transferred to the new stockholder. 4. Escrow Agreement: In complex or high-value transactions, an escrow agreement may be utilized to facilitate the purchase of common stock. This agreement places the shares in the custody of a neutral third party until all conditions have been fulfilled, providing security and assurance to both the buyer and seller. The Kings New York Agreement to Purchase Common Stock is governed by the laws and regulations of the Kings New York Stock Exchange, ensuring compliance with the exchange's policies and procedures. It safeguards the interests of both parties involved and helps establish a fair and transparent exchange of common stock within the Kings New York market. In conclusion, the Kings New York Agreement to Purchase Common Stock from another Stockholder is a comprehensive legal document that encompasses various types, each suited to different circumstances. It plays a vital role in facilitating transactions within the Kings New York Stock Exchange, providing clarity, security, and enforceability to the parties involved.The Kings New York Agreement to Purchase Common Stock from another Stockholder is a legally binding contract that outlines the terms and conditions for the acquisition of common stock by one stockholder from another within the Kings New York Stock Exchange. This agreement sets forth the specific details of the transaction, ensuring a smooth and transparent process for both parties involved. The Kings New York Agreement to Purchase Common Stock consists of various types, each catering to different scenarios and requirements. Some notable types include: 1. Traditional Purchase Agreement: This type of agreement occurs when one stockholder wishes to purchase common stock directly from another stockholder. It covers essential aspects such as the number of shares, purchase price, payment terms, and any applicable conditions or restrictions. 2. Option Agreement: In some cases, a stockholder may grant another stockholder an option to purchase common stock at a later date at a predetermined price. This agreement allows the buyer to decide whether they want to exercise their right to buy the shares within a specified timeframe. 3. Rights Agreement: When a stockholder intends to sell common stock, but certain rights are attached to the shares, a rights' agreement comes into play. This agreement details the transfer of ownership while also ensuring that all attached rights, such as voting rights or dividend entitlements, are adequately transferred to the new stockholder. 4. Escrow Agreement: In complex or high-value transactions, an escrow agreement may be utilized to facilitate the purchase of common stock. This agreement places the shares in the custody of a neutral third party until all conditions have been fulfilled, providing security and assurance to both the buyer and seller. The Kings New York Agreement to Purchase Common Stock is governed by the laws and regulations of the Kings New York Stock Exchange, ensuring compliance with the exchange's policies and procedures. It safeguards the interests of both parties involved and helps establish a fair and transparent exchange of common stock within the Kings New York market. In conclusion, the Kings New York Agreement to Purchase Common Stock from another Stockholder is a comprehensive legal document that encompasses various types, each suited to different circumstances. It plays a vital role in facilitating transactions within the Kings New York Stock Exchange, providing clarity, security, and enforceability to the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.