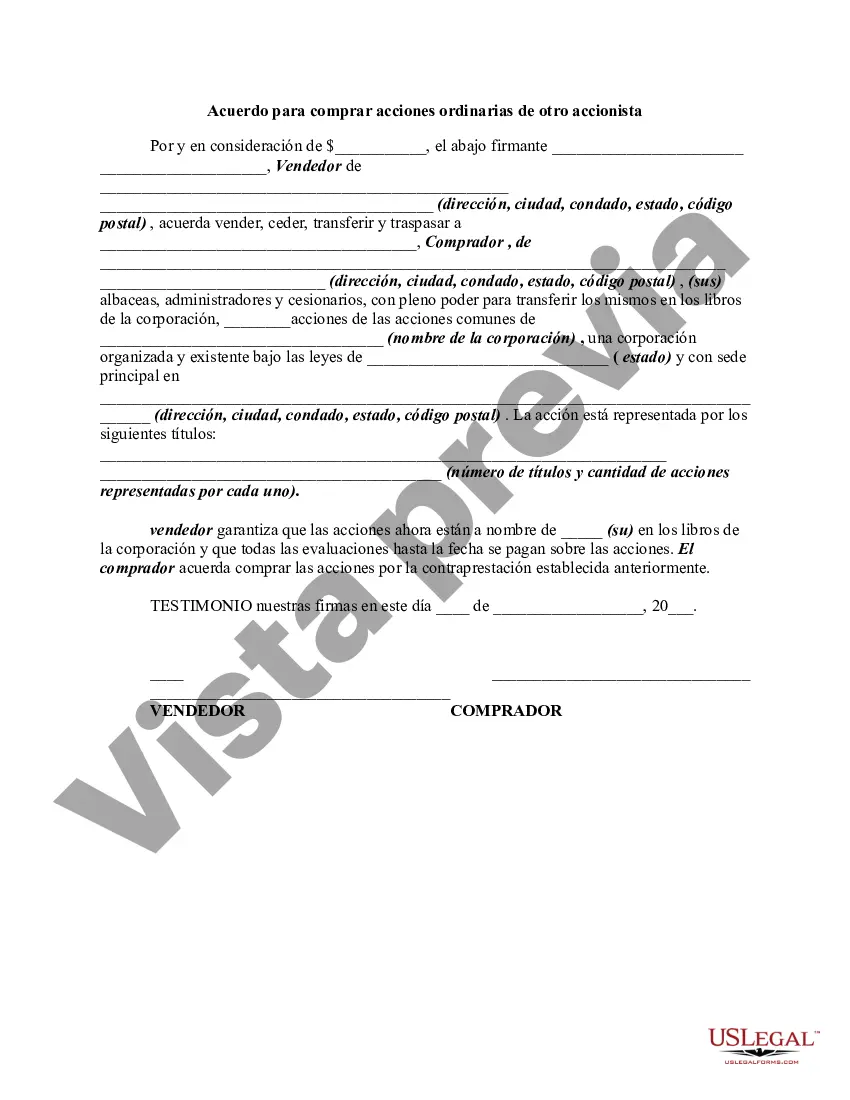

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

The Phoenix Arizona Agreement to Purchase Common Stock from another Stockholder is a legal contract that outlines the terms and conditions for the acquisition of common stock in a company located in Phoenix, Arizona. This agreement is essential when one stockholder intends to purchase shares from another stockholder, ensuring both parties are clear about the transaction's details and responsibilities. The main purpose of this agreement is to protect the rights and interests of both the buyer and seller during the purchase of common stock. It includes provisions for the purchase price, payment terms, and any additional agreements or conditions the parties have agreed upon. There are various types of Phoenix Arizona Agreements to Purchase Common Stock from another Stockholder, each serving different purposes or circumstances. These include: 1. Stock Purchase Agreement: This type of agreement outlines the purchase of common stock from one stockholder to another. It covers aspects such as the number of shares, purchase price per share, and the payment method. It also includes representations and warranties made by both parties regarding the stock being sold. 2. Stock Buy-Sell Agreement: This agreement is used when there is a predetermined process for buying and selling stock among stockholders. It typically includes provisions for the situations triggering the buy-sell process (such as death, disability, or retirement of a stockholder), the valuation of the stock, and the terms and conditions for the purchase. 3. Stock Option Agreement: This type of agreement grants the option to purchase common stock to a specified party, usually an employee or director of the company. It details the terms of the option, including the exercise price, vesting schedule, and expiration date. 4. Right of First Refusal Agreement: In this agreement, a stockholder grants other stockholders the right of first refusal to purchase their common stock before selling it to a third party. It ensures existing stockholders have the opportunity to purchase additional shares and maintain their proportional ownership in the company. In conclusion, the Phoenix Arizona Agreement to Purchase Common Stock from another Stockholder is a legally binding contract that sets out the terms and conditions for the acquisition of common stock within a company located in Phoenix, Arizona. The specific type of agreement used depends on the circumstances and desired outcomes, such as a stock purchase agreement, stock buy-sell agreement, stock option agreement, or right of first refusal agreement.The Phoenix Arizona Agreement to Purchase Common Stock from another Stockholder is a legal contract that outlines the terms and conditions for the acquisition of common stock in a company located in Phoenix, Arizona. This agreement is essential when one stockholder intends to purchase shares from another stockholder, ensuring both parties are clear about the transaction's details and responsibilities. The main purpose of this agreement is to protect the rights and interests of both the buyer and seller during the purchase of common stock. It includes provisions for the purchase price, payment terms, and any additional agreements or conditions the parties have agreed upon. There are various types of Phoenix Arizona Agreements to Purchase Common Stock from another Stockholder, each serving different purposes or circumstances. These include: 1. Stock Purchase Agreement: This type of agreement outlines the purchase of common stock from one stockholder to another. It covers aspects such as the number of shares, purchase price per share, and the payment method. It also includes representations and warranties made by both parties regarding the stock being sold. 2. Stock Buy-Sell Agreement: This agreement is used when there is a predetermined process for buying and selling stock among stockholders. It typically includes provisions for the situations triggering the buy-sell process (such as death, disability, or retirement of a stockholder), the valuation of the stock, and the terms and conditions for the purchase. 3. Stock Option Agreement: This type of agreement grants the option to purchase common stock to a specified party, usually an employee or director of the company. It details the terms of the option, including the exercise price, vesting schedule, and expiration date. 4. Right of First Refusal Agreement: In this agreement, a stockholder grants other stockholders the right of first refusal to purchase their common stock before selling it to a third party. It ensures existing stockholders have the opportunity to purchase additional shares and maintain their proportional ownership in the company. In conclusion, the Phoenix Arizona Agreement to Purchase Common Stock from another Stockholder is a legally binding contract that sets out the terms and conditions for the acquisition of common stock within a company located in Phoenix, Arizona. The specific type of agreement used depends on the circumstances and desired outcomes, such as a stock purchase agreement, stock buy-sell agreement, stock option agreement, or right of first refusal agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.