A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

The Salt Lake Utah Agreement to Purchase Common Stock from another Stockholder is a legally binding contract that sets out the terms and conditions for the transfer of common stock ownership between two parties in Salt Lake City, Utah. This type of agreement is commonly used in the financial and business sectors when an individual or entity wishes to acquire common stock from an existing shareholder. The agreement outlines the specific details of the transaction, including the number of shares being purchased, the purchase price per share, and any other considerations agreed upon by both parties. It also includes provisions regarding the transfer of ownership, warranties and representations made by the seller, and potential remedies in case of breach. Different types of Salt Lake Utah Agreements to Purchase Common Stock from another Stockholder may include: 1. Asset Purchase Agreement: This type of agreement involves the purchase of common stock along with the associated assets and liabilities of the company. It allows the buyer to acquire not only the shares but also the tangible and intangible assets of the business. 2. Stock Purchase Agreement: This agreement solely focuses on the transfer of common stock ownership, with no inclusion of the company's assets or liabilities. It is typically used when the buyer only intends to acquire a portion of the company's ownership. 3. Merger or Acquisition Agreement: In certain cases, the purchase of common stock may be part of a larger merger or acquisition deal. This agreement encompasses various aspects of the transaction, including the transfer of stock, assets, liabilities, and the overall restructuring of the companies involved. 4. Share Subscription Agreement: This type of agreement mainly applies to new investors wanting to acquire common stock directly from the company. It sets out the terms of the subscription, such as the number of shares to be issued, the price per share, and any additional rights or restrictions. Regardless of the specific type of Salt Lake Utah Agreement to Purchase Common Stock from another Stockholder, it is crucial to involve legal professionals to ensure compliance with state laws and regulations while safeguarding the interests of both parties involved.

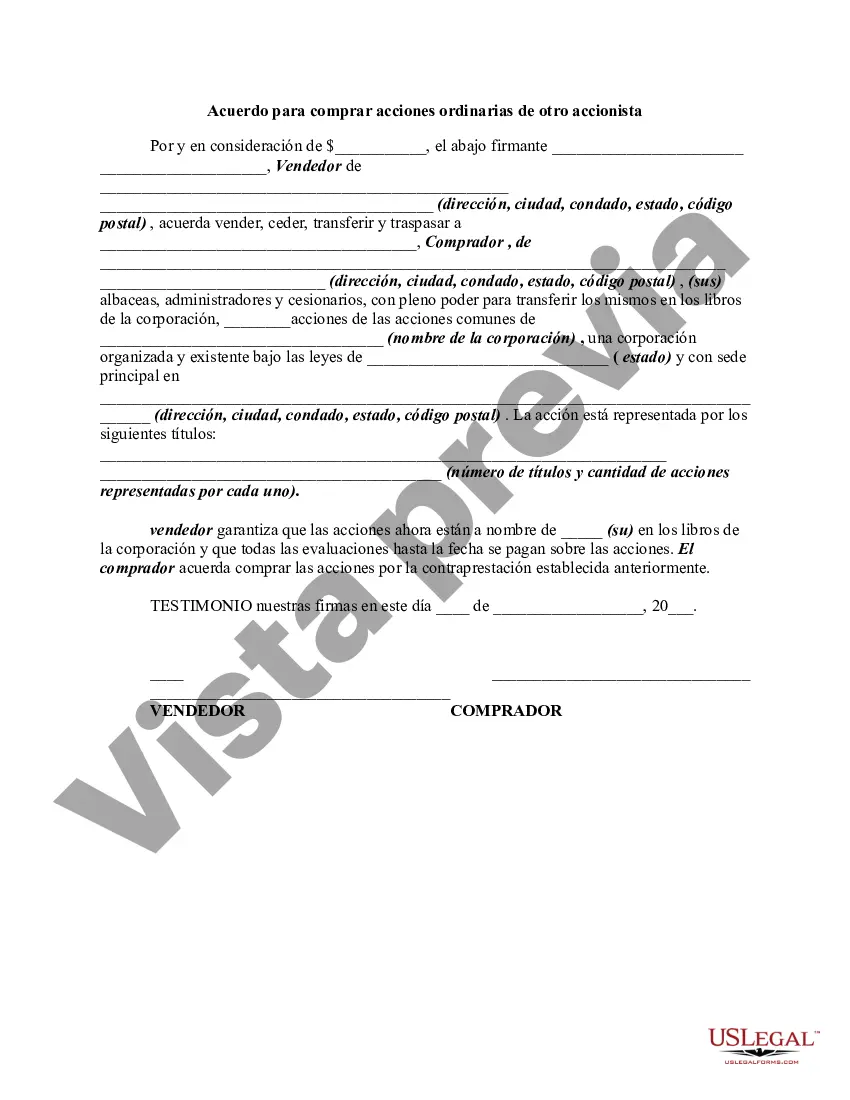

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.