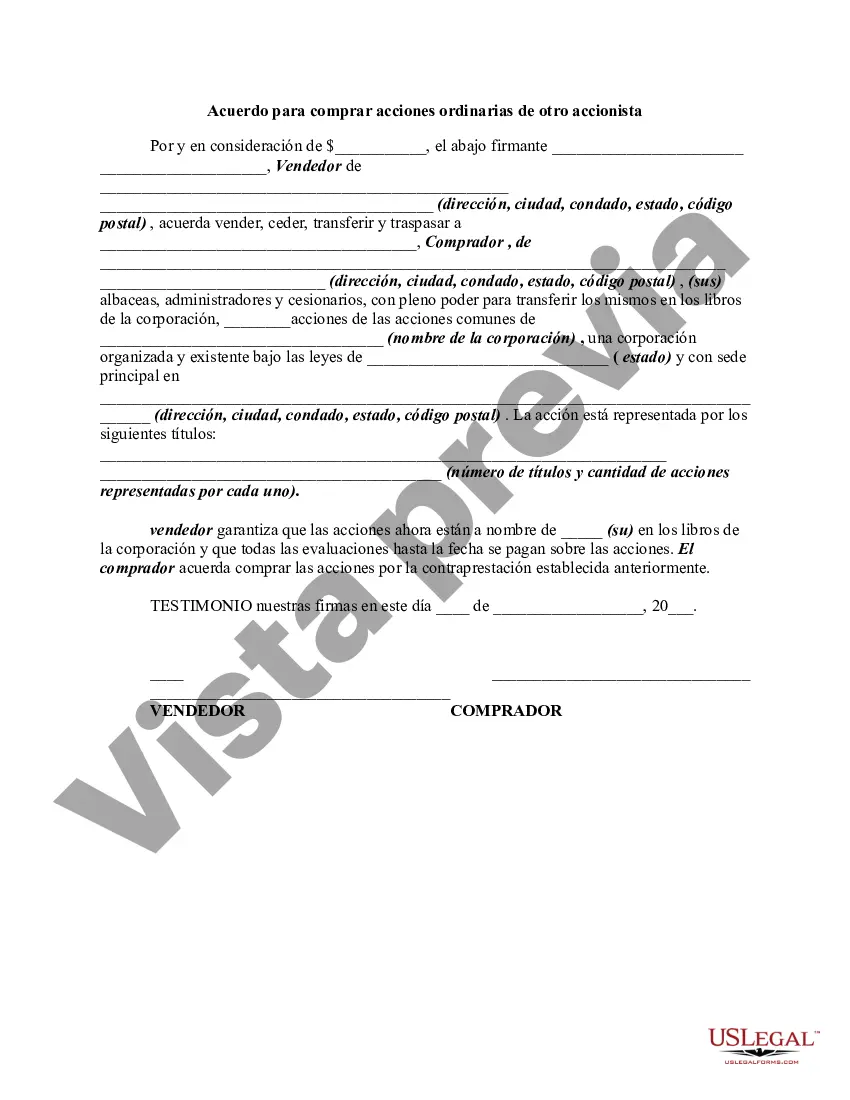

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

A San Antonio Texas Agreement to Purchase Common Stock from another Stockholder is a legally binding document that outlines the terms and conditions surrounding the acquisition of common stock from an existing stockholder in a company based in San Antonio, Texas. This agreement serves as a means for an individual or entity to purchase shares of common stock from another stockholder, thereby facilitating the transfer of ownership and associated rights. The Agreement to Purchase Common Stock typically includes essential details such as the names and contact information of both the buyer and the seller, the specific number of shares being acquired, the purchase price per share, and the total purchase price. Additionally, the agreement may provide provisions for any conditions precedent, representations and warranties, and indemnification clauses to protect the interests of both parties involved in the transaction. There can be different types or variations of the San Antonio Texas Agreement to Purchase Common Stock, depending on the specific circumstances or requirements of the parties involved. These may include: 1. Stock Purchase Agreement: This is the most common type of agreement, where the buyer agrees to purchase a specific number of shares of common stock from the seller, usually with a lump-sum payment or installment basis. 2. Share Sale and Purchase Agreement: In some cases, the agreement may encompass the sale and purchase of both common stock and other types of equity shares, such as preferred stock or restricted stock, depending on the composition of the company's capital structure. 3. Stock Option Purchase Agreement: This type of agreement is specific to the transfer of stock options, which are rights to buy or sell common stock at a predetermined price within a specified time frame. The agreement would outline the terms of exercising the stock option and any associated obligations or restrictions. 4. Stock Subscription Agreement: In situations where the company is raising capital through the issuance of new common stock, potential investors may enter into a stock subscription agreement to purchase newly issued shares directly from the company, rather than from existing stockholders. It is crucial for parties involved in such transactions to consult legal professionals to ensure that all necessary documentation, disclosures, and regulatory compliance are met. Additionally, it is recommended to conduct thorough due diligence regarding the financial health and prospects of the company before entering into any San Antonio Texas Agreement to Purchase Common Stock from another Stockholder.A San Antonio Texas Agreement to Purchase Common Stock from another Stockholder is a legally binding document that outlines the terms and conditions surrounding the acquisition of common stock from an existing stockholder in a company based in San Antonio, Texas. This agreement serves as a means for an individual or entity to purchase shares of common stock from another stockholder, thereby facilitating the transfer of ownership and associated rights. The Agreement to Purchase Common Stock typically includes essential details such as the names and contact information of both the buyer and the seller, the specific number of shares being acquired, the purchase price per share, and the total purchase price. Additionally, the agreement may provide provisions for any conditions precedent, representations and warranties, and indemnification clauses to protect the interests of both parties involved in the transaction. There can be different types or variations of the San Antonio Texas Agreement to Purchase Common Stock, depending on the specific circumstances or requirements of the parties involved. These may include: 1. Stock Purchase Agreement: This is the most common type of agreement, where the buyer agrees to purchase a specific number of shares of common stock from the seller, usually with a lump-sum payment or installment basis. 2. Share Sale and Purchase Agreement: In some cases, the agreement may encompass the sale and purchase of both common stock and other types of equity shares, such as preferred stock or restricted stock, depending on the composition of the company's capital structure. 3. Stock Option Purchase Agreement: This type of agreement is specific to the transfer of stock options, which are rights to buy or sell common stock at a predetermined price within a specified time frame. The agreement would outline the terms of exercising the stock option and any associated obligations or restrictions. 4. Stock Subscription Agreement: In situations where the company is raising capital through the issuance of new common stock, potential investors may enter into a stock subscription agreement to purchase newly issued shares directly from the company, rather than from existing stockholders. It is crucial for parties involved in such transactions to consult legal professionals to ensure that all necessary documentation, disclosures, and regulatory compliance are met. Additionally, it is recommended to conduct thorough due diligence regarding the financial health and prospects of the company before entering into any San Antonio Texas Agreement to Purchase Common Stock from another Stockholder.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.