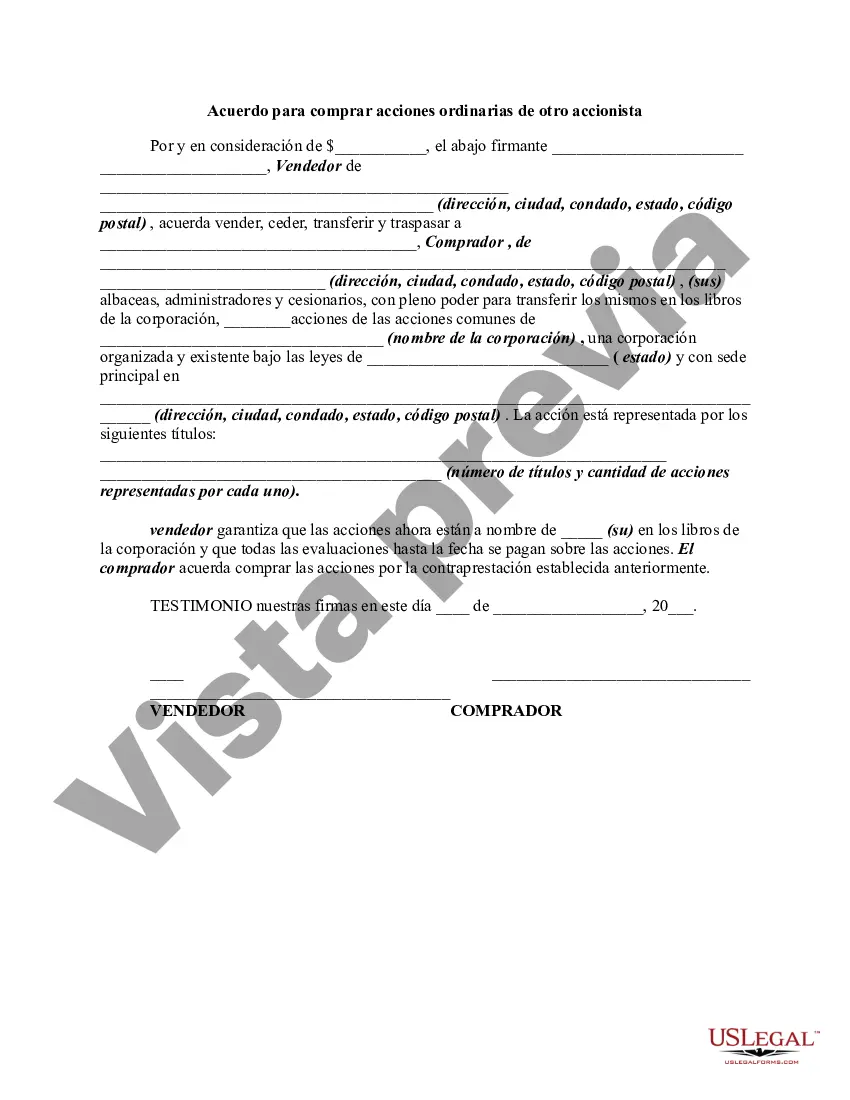

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

The Wake North Carolina Agreement to Purchase Common Stock from another Stockholder is a legal document that outlines the terms and conditions for the acquisition of common stock from an existing stockholder in Wake, North Carolina. This agreement is designed to protect the interests of both parties involved in the transaction and ensures a smooth transfer of ownership. When drafting a Wake North Carolina Agreement to Purchase Common Stock from another Stockholder, there are various types that can be considered, depending on the specific circumstances of the transaction. Some common types include: 1. Stock Purchase Agreement: This type of agreement outlines the terms of the purchase, including the number of shares to be acquired, the purchase price, and the payment terms. It also specifies any warranties or representations made by the selling stockholder regarding the stock being sold. 2. Voting Agreement: In some cases, an agreement may include provisions related to voting rights. This type of agreement outlines how the voting rights associated with the purchased stock will be exercised, ensuring the buyer has the desired control or influence in the company. 3. Share Restriction Agreement: A share restriction agreement may be included if there are certain restrictions or conditions imposed on the shares being purchased, such as lock-up periods, transfer restrictions, or shareholders' rights agreements. 4. Right of First Refusal Agreement: This type of agreement provides the opportunity for existing shareholders to purchase the stock being sold before it is offered to external buyers. It gives them the right of first refusal, ensuring existing shareholders have the opportunity to maintain or increase their ownership stake. When drafting a Wake North Carolina Agreement to Purchase Common Stock from another Stockholder, it is important to include key elements such as: — Identification of the parties involved, including their legal names and addresses. — Detailed description of the stock being purchased, including the number of shares, class of stock, and any special rights or privileges associated with the stock. — Purchase price and payment terms, including any installment payments, if applicable. — Representations and warranties made by the selling stockholder regarding the stock being sold, such as its ownership, legality, and absence of liens or encumbrances. — Conditions precedent to the completion of the transaction, such as obtaining necessary regulatory approvals or consents. — Indemnification provisions to protect the buyer in case of any misrepresentations or breaches of the agreement by the selling stockholder. — Governing law and dispute resolution mechanism to determine which jurisdiction's laws will apply and how any conflicts will be resolved. In conclusion, a Wake North Carolina Agreement to Purchase Common Stock from another Stockholder is a legally binding document that facilitates the acquisition of common stock in Wake, North Carolina. By carefully considering the specific types of agreements and including all necessary provisions, both parties can ensure a smooth and fair transaction.The Wake North Carolina Agreement to Purchase Common Stock from another Stockholder is a legal document that outlines the terms and conditions for the acquisition of common stock from an existing stockholder in Wake, North Carolina. This agreement is designed to protect the interests of both parties involved in the transaction and ensures a smooth transfer of ownership. When drafting a Wake North Carolina Agreement to Purchase Common Stock from another Stockholder, there are various types that can be considered, depending on the specific circumstances of the transaction. Some common types include: 1. Stock Purchase Agreement: This type of agreement outlines the terms of the purchase, including the number of shares to be acquired, the purchase price, and the payment terms. It also specifies any warranties or representations made by the selling stockholder regarding the stock being sold. 2. Voting Agreement: In some cases, an agreement may include provisions related to voting rights. This type of agreement outlines how the voting rights associated with the purchased stock will be exercised, ensuring the buyer has the desired control or influence in the company. 3. Share Restriction Agreement: A share restriction agreement may be included if there are certain restrictions or conditions imposed on the shares being purchased, such as lock-up periods, transfer restrictions, or shareholders' rights agreements. 4. Right of First Refusal Agreement: This type of agreement provides the opportunity for existing shareholders to purchase the stock being sold before it is offered to external buyers. It gives them the right of first refusal, ensuring existing shareholders have the opportunity to maintain or increase their ownership stake. When drafting a Wake North Carolina Agreement to Purchase Common Stock from another Stockholder, it is important to include key elements such as: — Identification of the parties involved, including their legal names and addresses. — Detailed description of the stock being purchased, including the number of shares, class of stock, and any special rights or privileges associated with the stock. — Purchase price and payment terms, including any installment payments, if applicable. — Representations and warranties made by the selling stockholder regarding the stock being sold, such as its ownership, legality, and absence of liens or encumbrances. — Conditions precedent to the completion of the transaction, such as obtaining necessary regulatory approvals or consents. — Indemnification provisions to protect the buyer in case of any misrepresentations or breaches of the agreement by the selling stockholder. — Governing law and dispute resolution mechanism to determine which jurisdiction's laws will apply and how any conflicts will be resolved. In conclusion, a Wake North Carolina Agreement to Purchase Common Stock from another Stockholder is a legally binding document that facilitates the acquisition of common stock in Wake, North Carolina. By carefully considering the specific types of agreements and including all necessary provisions, both parties can ensure a smooth and fair transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.