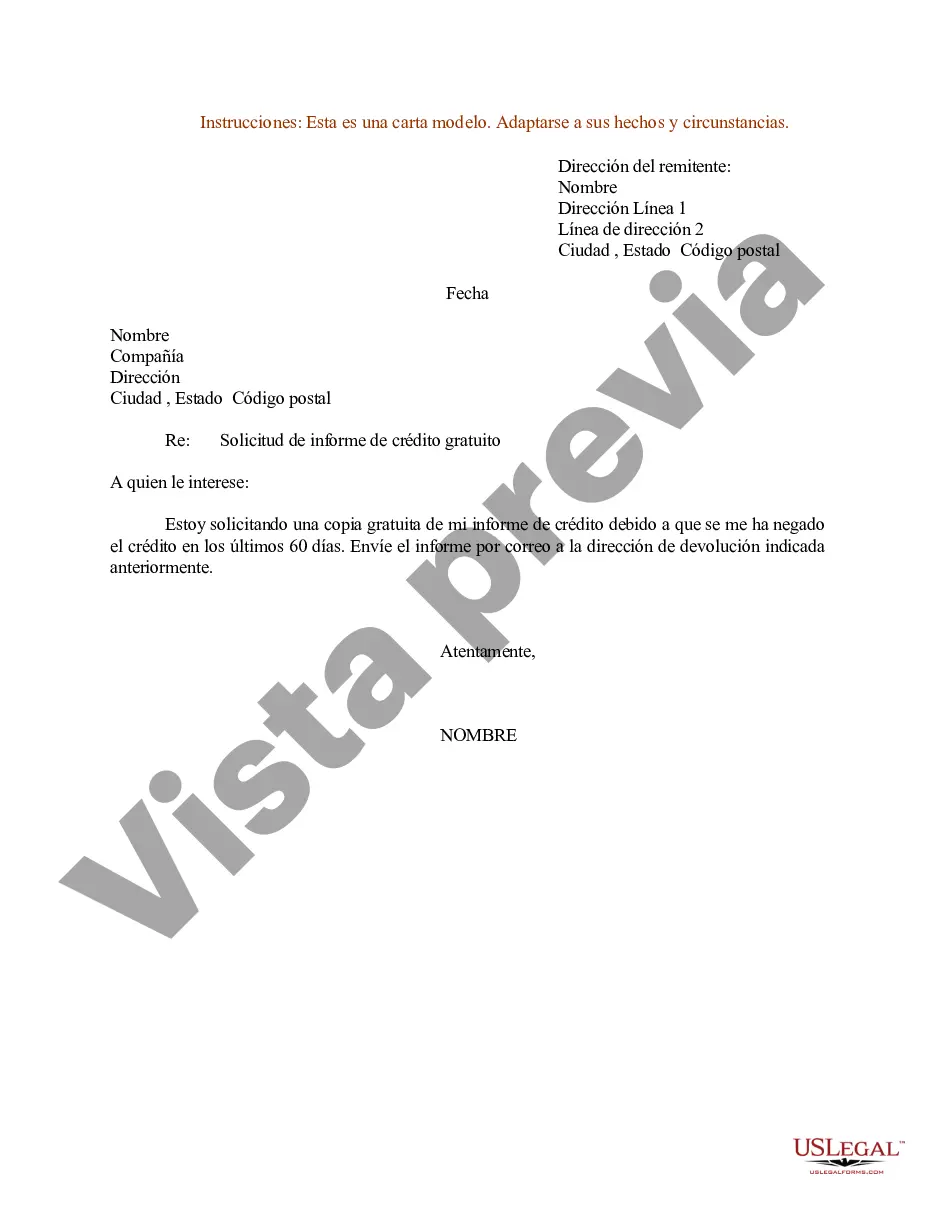

Dear [Credit Reporting Bureau], I am writing to formally request a free copy of my credit report based on the recent denial of credit. I recently applied for credit and was denied, which under the Fair Credit Reporting Act (FCRA), entitles me to obtain a free copy of my credit report from your agency within 60 days of the denial. As per the FCRA guidelines, I have enclosed the necessary information to complete this request. Please find the following details included with this letter: 1. Full Name: [Your Full Name] 2. Date of Birth: [Your Date of Birth] 3. Social Security Number: [Your Social Security Number] 4. Address: [Your Full Address] Furthermore, I would like to provide additional context regarding the denial of credit. The denial notice I received mentioned that the decision was based on information obtained from your credit reporting agency. In order to understand the reasons behind this decision, I kindly request a detailed copy of my credit report. Kindly note that according to FCRA section 611(a)(2), I am entitled to receive a free copy of my credit report within 60 days of adverse action or denial of credit. I appreciate your prompt attention in this matter and request that you send the credit report to the mailing address provided above. In case any additional information or documentation is required to process this request, please let me know promptly. I trust that you will handle this request in accordance with the FCRA and any other applicable laws. Thank you for your assistance, and I look forward to receiving my credit report within the mandated timeframe. Sincerely, [Your Name] [Your Contact Information]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Modelo de carta de solicitud de informe de crédito gratuito basado en la denegación de crédito - Sample Letter for Request for Free Credit Report Based on Denial of Credit

Description

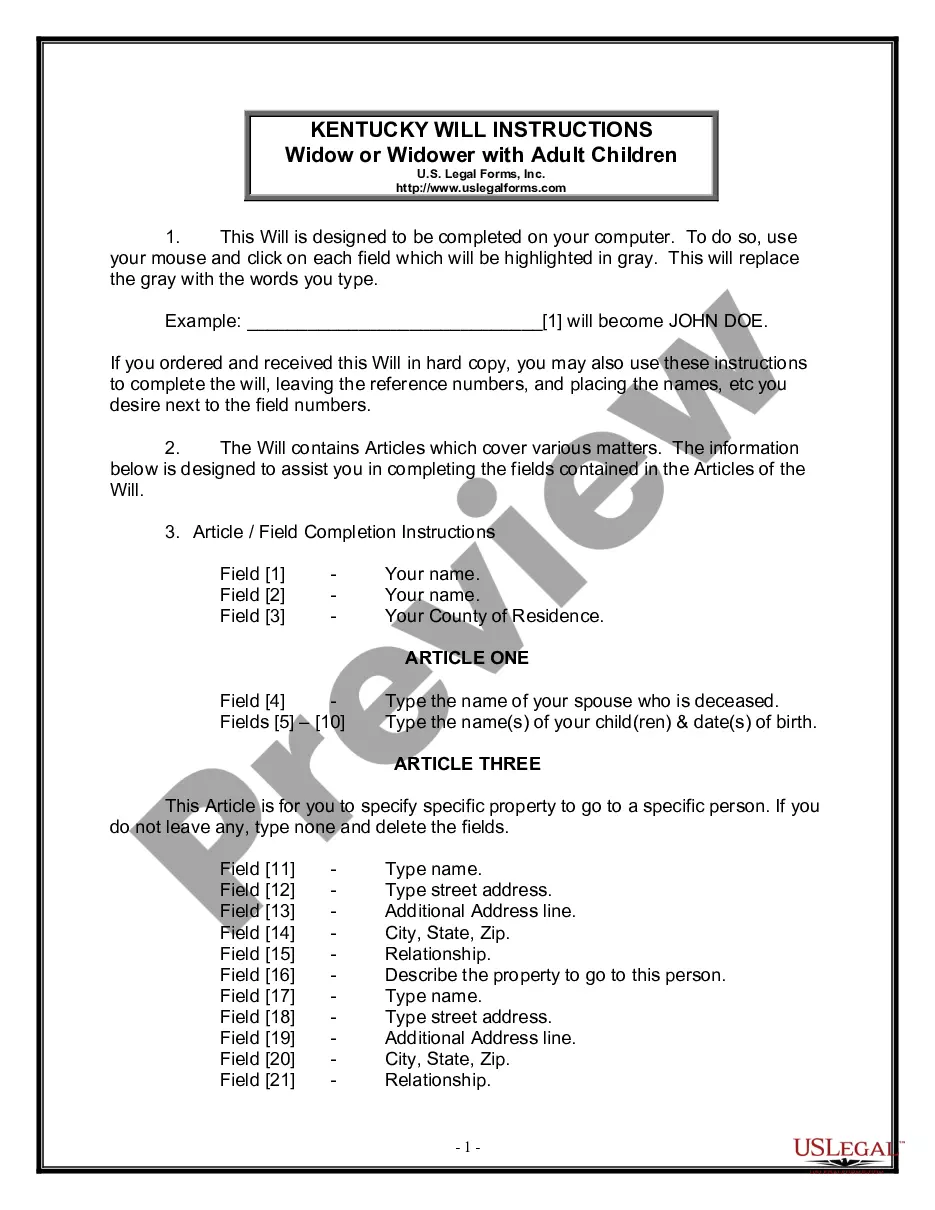

How to fill out Oakland Michigan Modelo De Carta De Solicitud De Informe De Crédito Gratuito Basado En La Denegación De Crédito?

Creating forms, like Oakland Sample Letter for Request for Free Credit Report Based on Denial of Credit, to take care of your legal affairs is a challenging and time-consumming process. Many cases require an attorney’s participation, which also makes this task expensive. However, you can consider your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents crafted for a variety of scenarios and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Oakland Sample Letter for Request for Free Credit Report Based on Denial of Credit form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before getting Oakland Sample Letter for Request for Free Credit Report Based on Denial of Credit:

- Make sure that your form is compliant with your state/county since the rules for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Oakland Sample Letter for Request for Free Credit Report Based on Denial of Credit isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start using our website and get the form.

- Everything looks great on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

¿Como puede disputar una deuda? Dentro de treinta dias de haber recibido la notificacion de la deuda por escrito, envie una carta a la agencia de cobranza disputando la deuda. Puede utilizar esta Carta de Disputa Ejemplar (PDF).

¿Como limpiar tu Buro de Credito? - Ponte al corriente con los pagos. - Si tu situacion economica no te permite regularizar pagos, contacta con la institucion financiera que tienes el adeudo para negociar una reestructura de tu credito. - En caso de no llegar a un acuerdo para reestructurar tu deuda, negocia una quita.

5 maneras de mejorar su puntaje de credito Su historial de pago juega un papel importante al determinar su puntaje de credito. Trate de mantener sus saldos por debajo del 30% de su credito total disponible. Mantener abiertas las cuentas de tarjetas de credito antiguas puede mejorar su salud crediticia.

El credito o la historia de pago pueden eliminarse despues de 72 meses, contados a partir de la fecha de liquidacion, siempre y cuando el Otorgante de Credito haya reportado la fecha de cierre o a partir de la ultima vez que fue reportado a Buro de Credito.

Las deudas menores o iguales a 25 UDIS (179.75 pesos), se eliminan despues de un ano. Los adeudos mayores a 25 UDIS y que no rebasen 500 UDIS (3 mil 595 pesos), desaparecen en dos anos. Las deudas mayores a 500 y un maximo de 1000 UDIS (7 mil 190 pesos), se descartan despues de cuatro anos.

Una carta de disputa de credito es un documento que puede enviar a las agencias de credito para senalar inexactitudes en sus informes de credito y solicitar la eliminacion de los errores (en ingles). En la carta, puede explicar por que cree que las informaciones son inexactas y proveer los documentos de respaldo.

La ley estipula que las agencias de reporte de credito no deben reportar los casos de bancarrota despues de (10) anos de la fecha en que el caso de bancarrota fue presentado. Generalmente, la informacion de mal credito es eliminada despues de siete (7) anos.

Estas son las unicas maneras de solicitar sus informes de credito gratuitos: En internet, visite AnnualCreditReport.com. Por telefono, llame al 1-877-322-8228.

Esto tarda en borrarse una deuda en Buro de Credito Deudas menores o iguales a 25 UDIS, se eliminan despues de un ano. Deudas mayores a 25 UDIS y hasta 500 UDIS, se borran luego de dos anos. Deudas mayores a 500 UDIS y hasta 1000 UDIS, desaparecen despues de cuatro anos.

Ocho pasos para eliminar deudas antiguas de tu reporte crediticio Verifica la antiguedad.Confirma la antiguedad de la deuda saldada.Obten los tres reportes de credito.Envia cartas a las agencias de credito.Envia una carta al acreedor informante.Consigue una atencion especial.