In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Alameda, California Security Agreement with Farm Products as Collateral: A security agreement is a legal contract established between a borrower and a lender to secure collateral against a loan or debt. In the case of Alameda, California, farmers and agricultural businesses can enter into a specific type of security agreement known as the Alameda California Security Agreement with Farm Products as Collateral. This agreement provides protection to lenders by offering a form of guarantee in the event of default, while allowing farmers to obtain necessary financing for their agricultural operations. This type of security agreement involves the use of farm products as collateral. Farm products refer to various goods produced or derived from farming activities, including crops, livestock, poultry, and agricultural equipment. These products serve as a valuable asset to secure a loan or debt, giving lenders a means of recourse if the borrower fails to repay. There are a few different types of Alameda California Security Agreements with Farm Products as Collateral available to cater to specific circumstances and needs: 1. Crop-specific security agreement: This type of agreement focuses on using a particular crop, such as almonds, strawberries, or wine grapes, as collateral. It ensures that lenders have a legal claim to the specific crop in case of default. 2. Livestock-specific security agreement: In this agreement, the livestock raised on the farm, such as cattle, pigs, or chickens, are used as collateral to secure the loan. 3. General farm products' security agreement: This agreement encompasses a broader array of farm products, including crops, livestock, and other goods derived from agricultural activities. It provides lenders with a claim to any farm products produced, allowing them to recover their investment if necessary. It is vital for both lenders and borrowers to carefully draft and execute the Alameda California Security Agreement with Farm Products as Collateral, ensuring all legal requirements are met. This agreement typically outlines the rights and responsibilities of both parties, the terms of the loan, the specific collateral being used, and remedies in the event of default. In conclusion, the Alameda California Security Agreement with Farm Products as Collateral is a crucial tool for farmers and agricultural businesses in obtaining financing while protecting lenders' interests. With various types of agreements available, farmers can tailor the collateral to suit their specific agricultural operations, providing lenders with a means of recourse in case of default.Alameda, California Security Agreement with Farm Products as Collateral: A security agreement is a legal contract established between a borrower and a lender to secure collateral against a loan or debt. In the case of Alameda, California, farmers and agricultural businesses can enter into a specific type of security agreement known as the Alameda California Security Agreement with Farm Products as Collateral. This agreement provides protection to lenders by offering a form of guarantee in the event of default, while allowing farmers to obtain necessary financing for their agricultural operations. This type of security agreement involves the use of farm products as collateral. Farm products refer to various goods produced or derived from farming activities, including crops, livestock, poultry, and agricultural equipment. These products serve as a valuable asset to secure a loan or debt, giving lenders a means of recourse if the borrower fails to repay. There are a few different types of Alameda California Security Agreements with Farm Products as Collateral available to cater to specific circumstances and needs: 1. Crop-specific security agreement: This type of agreement focuses on using a particular crop, such as almonds, strawberries, or wine grapes, as collateral. It ensures that lenders have a legal claim to the specific crop in case of default. 2. Livestock-specific security agreement: In this agreement, the livestock raised on the farm, such as cattle, pigs, or chickens, are used as collateral to secure the loan. 3. General farm products' security agreement: This agreement encompasses a broader array of farm products, including crops, livestock, and other goods derived from agricultural activities. It provides lenders with a claim to any farm products produced, allowing them to recover their investment if necessary. It is vital for both lenders and borrowers to carefully draft and execute the Alameda California Security Agreement with Farm Products as Collateral, ensuring all legal requirements are met. This agreement typically outlines the rights and responsibilities of both parties, the terms of the loan, the specific collateral being used, and remedies in the event of default. In conclusion, the Alameda California Security Agreement with Farm Products as Collateral is a crucial tool for farmers and agricultural businesses in obtaining financing while protecting lenders' interests. With various types of agreements available, farmers can tailor the collateral to suit their specific agricultural operations, providing lenders with a means of recourse in case of default.

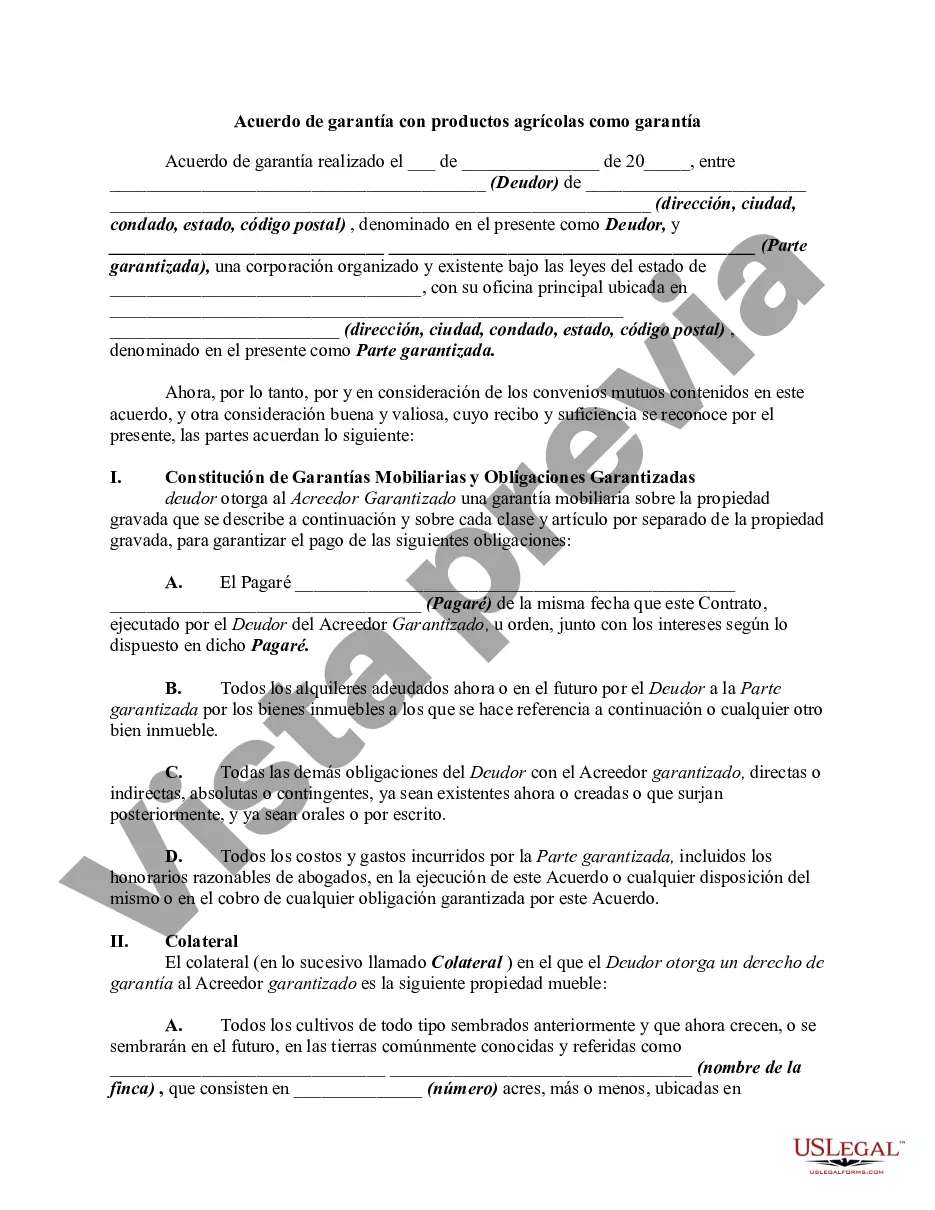

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.