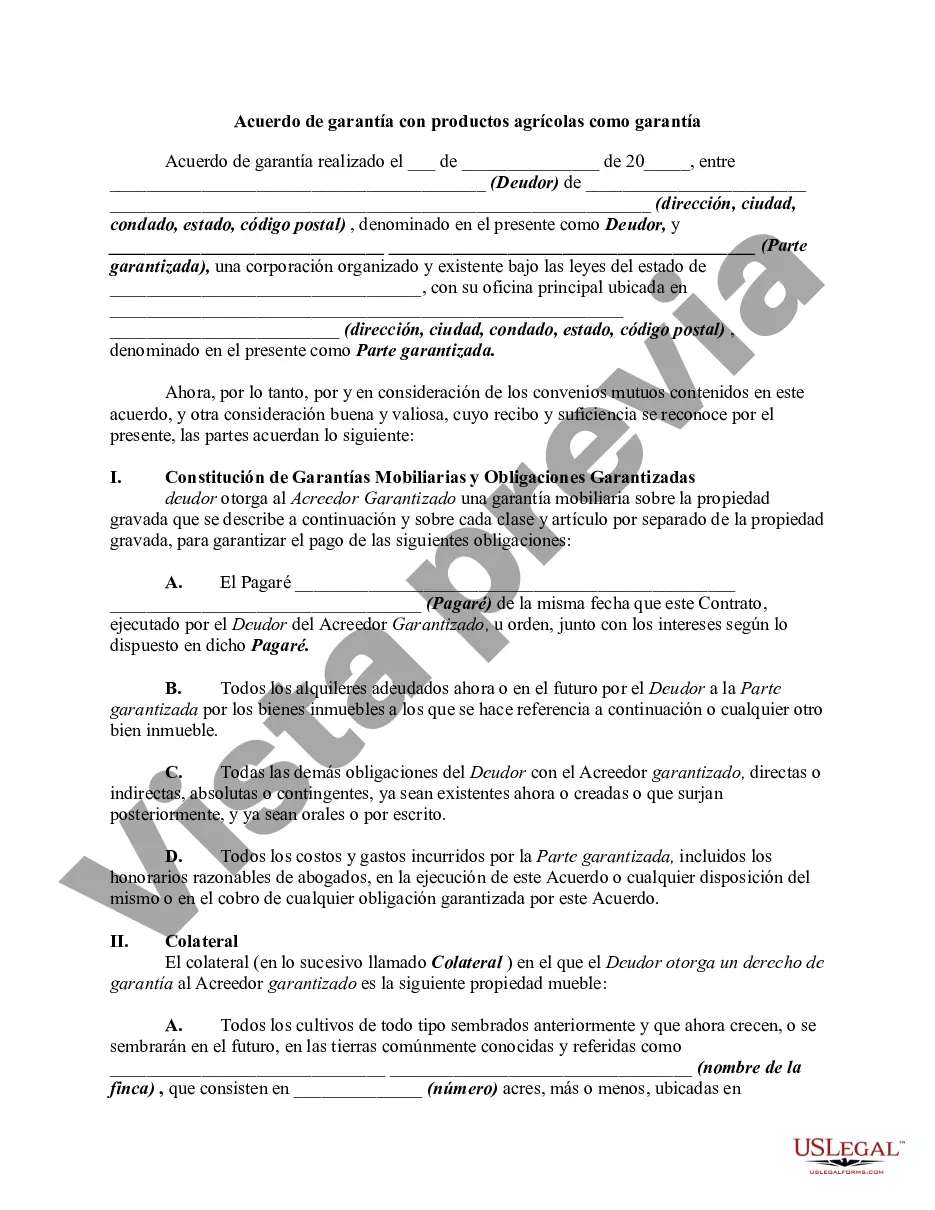

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Allegheny Pennsylvania Security Agreement with Farm Products as Collateral is a legal document that provides security to lenders or creditors who provide loans or credit to farmers in Allegheny County, Pennsylvania. This agreement is designed to protect the lenders' interests by securing the farm products as collateral in case the farmer defaults on their loan or credit obligations. The Allegheny Pennsylvania Security Agreement with Farm Products as Collateral ensures that if the farmer fails to repay the loan or credit, the lender has the right to seize and sell the farm products to recover the outstanding debt. This agreement also defines the terms and conditions of the loan, including the interest rates, repayment schedule, and obligations of both parties involved, ensuring clarity and fairness. There are various types of Allegheny Pennsylvania Security Agreement with Farm Products as Collateral, which may differ based on certain factors. Some common types include: 1. Crop Financing Agreement: This type of security agreement specifically deals with farm products related to crops grown on the farm, such as corn, wheat, soybeans, or vegetables. The lender will provide financing based on the anticipated value of the crop, and the agreement will secure the lender's interest in the harvested crop. 2. Livestock Financing Agreement: This type of agreement focuses on farm products related to livestock, such as cattle, pigs, poultry, or dairy products. The lender may provide financing to support the farmer's livestock operations, and the agreement will ensure the lender's rights in the livestock and other related products. 3. Equipment Financing Agreement: This type of security agreement relates to farm equipment, machinery, or vehicles that are used in the farming operations. The lender may provide financial support to purchase or maintain the necessary equipment, and the agreement secures the lender's interest in the equipment. 4. Commodity Financing Agreement: This type of agreement deals with farm products that are considered commodities, like grains, oil seeds, or other raw agricultural products. The lender may offer financial assistance to help farmers store, transport, or sell their commodities, and the agreement secures the lender's rights in the products. Overall, the Allegheny Pennsylvania Security Agreement with Farm Products as Collateral acts as a protective measure for lenders, ensuring that they have a legal claim to the farm products in the event of borrower default. This agreement emphasizes the importance of collateral in securing loans for agricultural purposes, promoting financial stability and facilitating farming operations in Allegheny County, Pennsylvania.Allegheny Pennsylvania Security Agreement with Farm Products as Collateral is a legal document that provides security to lenders or creditors who provide loans or credit to farmers in Allegheny County, Pennsylvania. This agreement is designed to protect the lenders' interests by securing the farm products as collateral in case the farmer defaults on their loan or credit obligations. The Allegheny Pennsylvania Security Agreement with Farm Products as Collateral ensures that if the farmer fails to repay the loan or credit, the lender has the right to seize and sell the farm products to recover the outstanding debt. This agreement also defines the terms and conditions of the loan, including the interest rates, repayment schedule, and obligations of both parties involved, ensuring clarity and fairness. There are various types of Allegheny Pennsylvania Security Agreement with Farm Products as Collateral, which may differ based on certain factors. Some common types include: 1. Crop Financing Agreement: This type of security agreement specifically deals with farm products related to crops grown on the farm, such as corn, wheat, soybeans, or vegetables. The lender will provide financing based on the anticipated value of the crop, and the agreement will secure the lender's interest in the harvested crop. 2. Livestock Financing Agreement: This type of agreement focuses on farm products related to livestock, such as cattle, pigs, poultry, or dairy products. The lender may provide financing to support the farmer's livestock operations, and the agreement will ensure the lender's rights in the livestock and other related products. 3. Equipment Financing Agreement: This type of security agreement relates to farm equipment, machinery, or vehicles that are used in the farming operations. The lender may provide financial support to purchase or maintain the necessary equipment, and the agreement secures the lender's interest in the equipment. 4. Commodity Financing Agreement: This type of agreement deals with farm products that are considered commodities, like grains, oil seeds, or other raw agricultural products. The lender may offer financial assistance to help farmers store, transport, or sell their commodities, and the agreement secures the lender's rights in the products. Overall, the Allegheny Pennsylvania Security Agreement with Farm Products as Collateral acts as a protective measure for lenders, ensuring that they have a legal claim to the farm products in the event of borrower default. This agreement emphasizes the importance of collateral in securing loans for agricultural purposes, promoting financial stability and facilitating farming operations in Allegheny County, Pennsylvania.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.