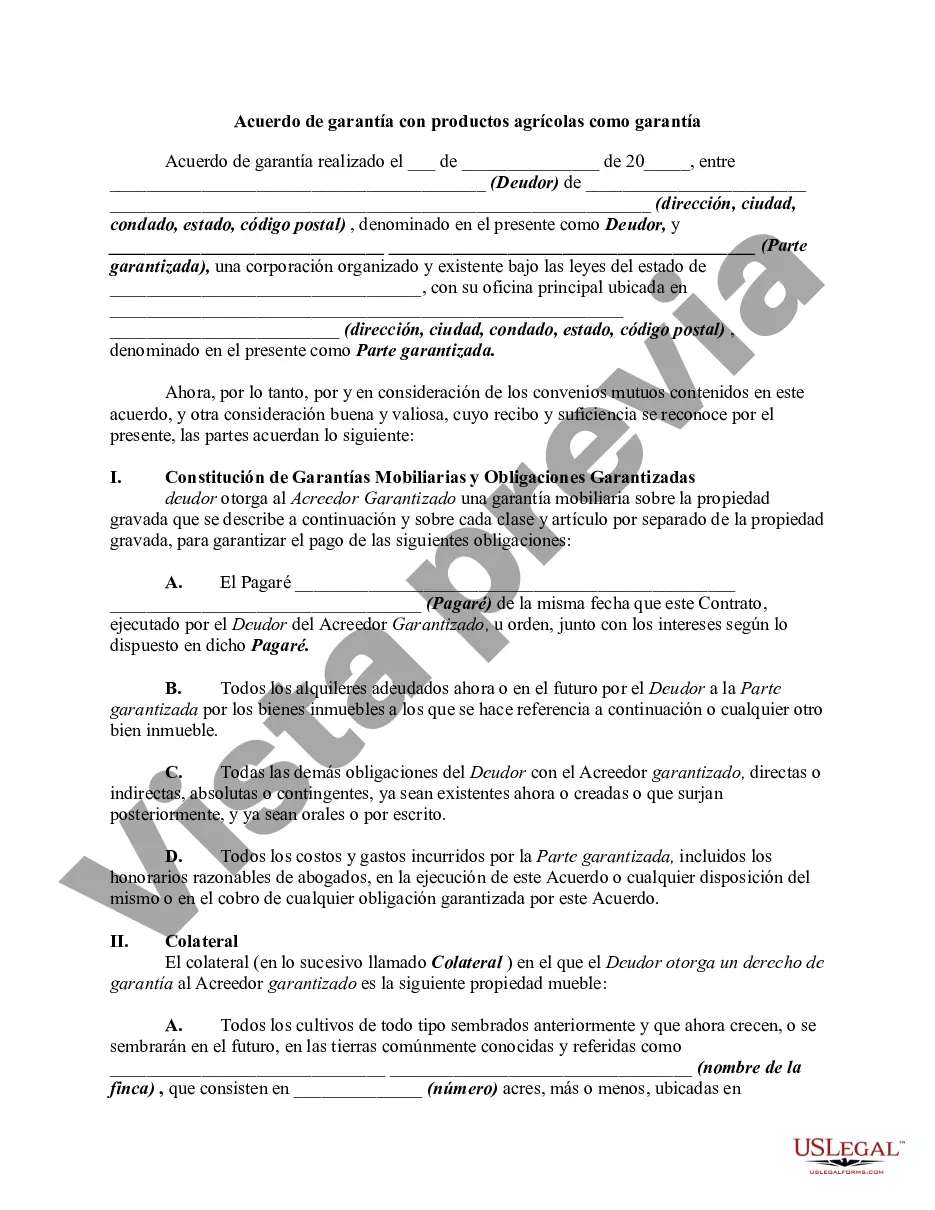

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Contra Costa California Security Agreement with Farm Products as Collateral is a legal contract that aims to provide security for lenders or creditors when extending loans or credit to farmers or agricultural businesses in Contra Costa County, California. This type of agreement helps mitigate the risks associated with lending money or granting credit in the agriculture industry. The Security Agreement ensures that lenders have a claim on the borrower's farm products, such as crops, livestock, or related inventory, which will act as collateral if the borrower defaults on their loan or credit obligations. By utilizing the farm products as collateral, lenders can recover their funds by selling or liquidating the pledged assets in the event of non-payment. There are different types of Contra Costa California Security Agreements with Farm Products as Collateral. Some common variations include: 1. Crop-specific Security Agreement: This type of agreement focuses solely on farm products that are in the form of crops, such as grains, fruits, vegetables, or any other cultivated product grown on the borrower's farm. The agreement will specify the types of crops pledged as collateral, the quantity, and other relevant details. 2. Livestock-specific Security Agreement: This type of agreement is specific to livestock as collateral, including animals such as cows, sheep, pigs, or poultry. Lenders will have a security interest in the borrower's livestock, ensuring repayment in the event of default. 3. Inventory-specific Security Agreement: This agreement extends the scope beyond crops and livestock, encompassing all inventory related to agricultural operations. It may include agricultural supplies, machinery, equipment, fertilizers, pesticides, or any other items used in the farming business. 4. All-encompassing Security Agreement: This type of agreement includes a combination of the above types, pledging various farm products as collateral, spanning crops, livestock, and agricultural inventory. It provides lenders with a comprehensive security interest in all aspects of the borrower's agricultural operation, maximizing protection for the loaned funds. Contra Costa California Security Agreement with Farm Products as Collateral plays a crucial role in ensuring financial stability for both lenders and borrowers in the agricultural sector. It establishes a clear understanding of the assets being used as collateral, the rights and responsibilities of both parties, and provides a legal framework for dispute resolution in case of disagreements or default.Contra Costa California Security Agreement with Farm Products as Collateral is a legal contract that aims to provide security for lenders or creditors when extending loans or credit to farmers or agricultural businesses in Contra Costa County, California. This type of agreement helps mitigate the risks associated with lending money or granting credit in the agriculture industry. The Security Agreement ensures that lenders have a claim on the borrower's farm products, such as crops, livestock, or related inventory, which will act as collateral if the borrower defaults on their loan or credit obligations. By utilizing the farm products as collateral, lenders can recover their funds by selling or liquidating the pledged assets in the event of non-payment. There are different types of Contra Costa California Security Agreements with Farm Products as Collateral. Some common variations include: 1. Crop-specific Security Agreement: This type of agreement focuses solely on farm products that are in the form of crops, such as grains, fruits, vegetables, or any other cultivated product grown on the borrower's farm. The agreement will specify the types of crops pledged as collateral, the quantity, and other relevant details. 2. Livestock-specific Security Agreement: This type of agreement is specific to livestock as collateral, including animals such as cows, sheep, pigs, or poultry. Lenders will have a security interest in the borrower's livestock, ensuring repayment in the event of default. 3. Inventory-specific Security Agreement: This agreement extends the scope beyond crops and livestock, encompassing all inventory related to agricultural operations. It may include agricultural supplies, machinery, equipment, fertilizers, pesticides, or any other items used in the farming business. 4. All-encompassing Security Agreement: This type of agreement includes a combination of the above types, pledging various farm products as collateral, spanning crops, livestock, and agricultural inventory. It provides lenders with a comprehensive security interest in all aspects of the borrower's agricultural operation, maximizing protection for the loaned funds. Contra Costa California Security Agreement with Farm Products as Collateral plays a crucial role in ensuring financial stability for both lenders and borrowers in the agricultural sector. It establishes a clear understanding of the assets being used as collateral, the rights and responsibilities of both parties, and provides a legal framework for dispute resolution in case of disagreements or default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.