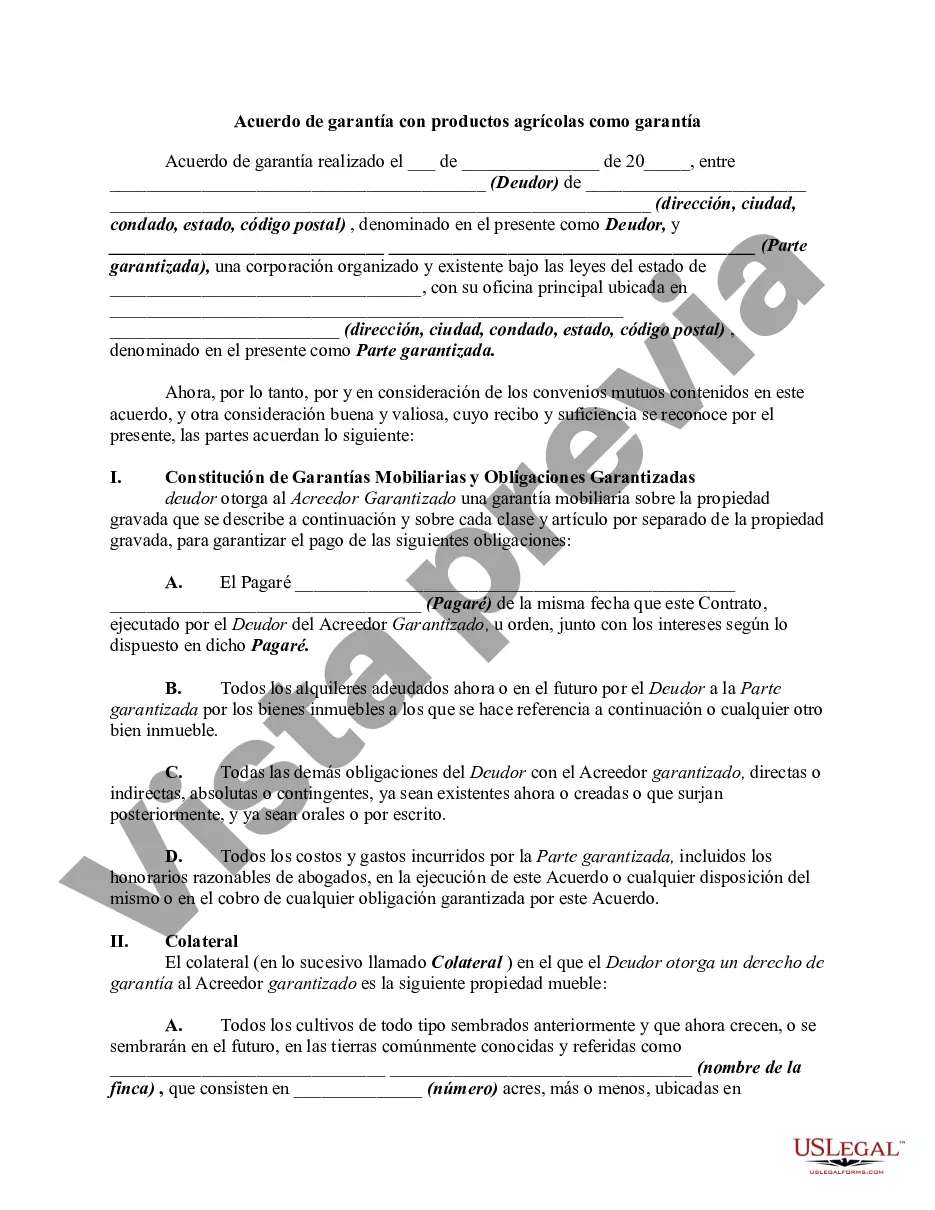

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Fairfax Virginia Security Agreement with Farm Products as Collateral is a legal document that outlines the terms and conditions between a lender and a borrower when farm products are put up as collateral for a loan in Fairfax, Virginia. This agreement is designed to provide protection to the lender in case the borrower defaults on the repayment of the loan. In such agreements, the borrower agrees to pledge or use their farm products, such as crops, livestock, or agricultural machinery, as collateral to secure the loan. This collateral ensures that the lender has a legal claim to those assets in case the borrower fails to meet their repayment obligations. There are different types of Fairfax Virginia Security Agreements with Farm Products as Collateral, which may include: 1. Crop Security Agreement: This type of agreement specifically pertains to crops grown on the farm. The borrower pledges the crops as collateral, offering them as security for the loan. 2. Livestock Security Agreement: In this agreement, the borrower uses livestock, such as cattle, poultry, or horses, as collateral to support the loan. It grants the lender a security interest in the livestock until the loan is repaid. 3. Agricultural Machinery and Equipment Security Agreement: This type of agreement involves using farm machinery, equipment, or vehicles as collateral for the loan. The borrower grants the lender a security interest in these assets until the loan is fully paid off. 4. Combined Security Agreement: In certain cases, borrowers may offer a combination of farm products, such as crops, livestock, and machinery, as collateral to secure the loan. This provides the lender with a more comprehensive security interest in case of default. Fairfax Virginia Security Agreements with Farm Products as Collateral play a crucial role in the agricultural sector by enabling farmers to obtain financing for their farming operations while providing lenders with a level of assurance. These agreements ensure that lenders have legal protection and recourse if a borrower is unable to repay their loan, reducing the risk associated with lending in the agricultural industry.Fairfax Virginia Security Agreement with Farm Products as Collateral is a legal document that outlines the terms and conditions between a lender and a borrower when farm products are put up as collateral for a loan in Fairfax, Virginia. This agreement is designed to provide protection to the lender in case the borrower defaults on the repayment of the loan. In such agreements, the borrower agrees to pledge or use their farm products, such as crops, livestock, or agricultural machinery, as collateral to secure the loan. This collateral ensures that the lender has a legal claim to those assets in case the borrower fails to meet their repayment obligations. There are different types of Fairfax Virginia Security Agreements with Farm Products as Collateral, which may include: 1. Crop Security Agreement: This type of agreement specifically pertains to crops grown on the farm. The borrower pledges the crops as collateral, offering them as security for the loan. 2. Livestock Security Agreement: In this agreement, the borrower uses livestock, such as cattle, poultry, or horses, as collateral to support the loan. It grants the lender a security interest in the livestock until the loan is repaid. 3. Agricultural Machinery and Equipment Security Agreement: This type of agreement involves using farm machinery, equipment, or vehicles as collateral for the loan. The borrower grants the lender a security interest in these assets until the loan is fully paid off. 4. Combined Security Agreement: In certain cases, borrowers may offer a combination of farm products, such as crops, livestock, and machinery, as collateral to secure the loan. This provides the lender with a more comprehensive security interest in case of default. Fairfax Virginia Security Agreements with Farm Products as Collateral play a crucial role in the agricultural sector by enabling farmers to obtain financing for their farming operations while providing lenders with a level of assurance. These agreements ensure that lenders have legal protection and recourse if a borrower is unable to repay their loan, reducing the risk associated with lending in the agricultural industry.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.