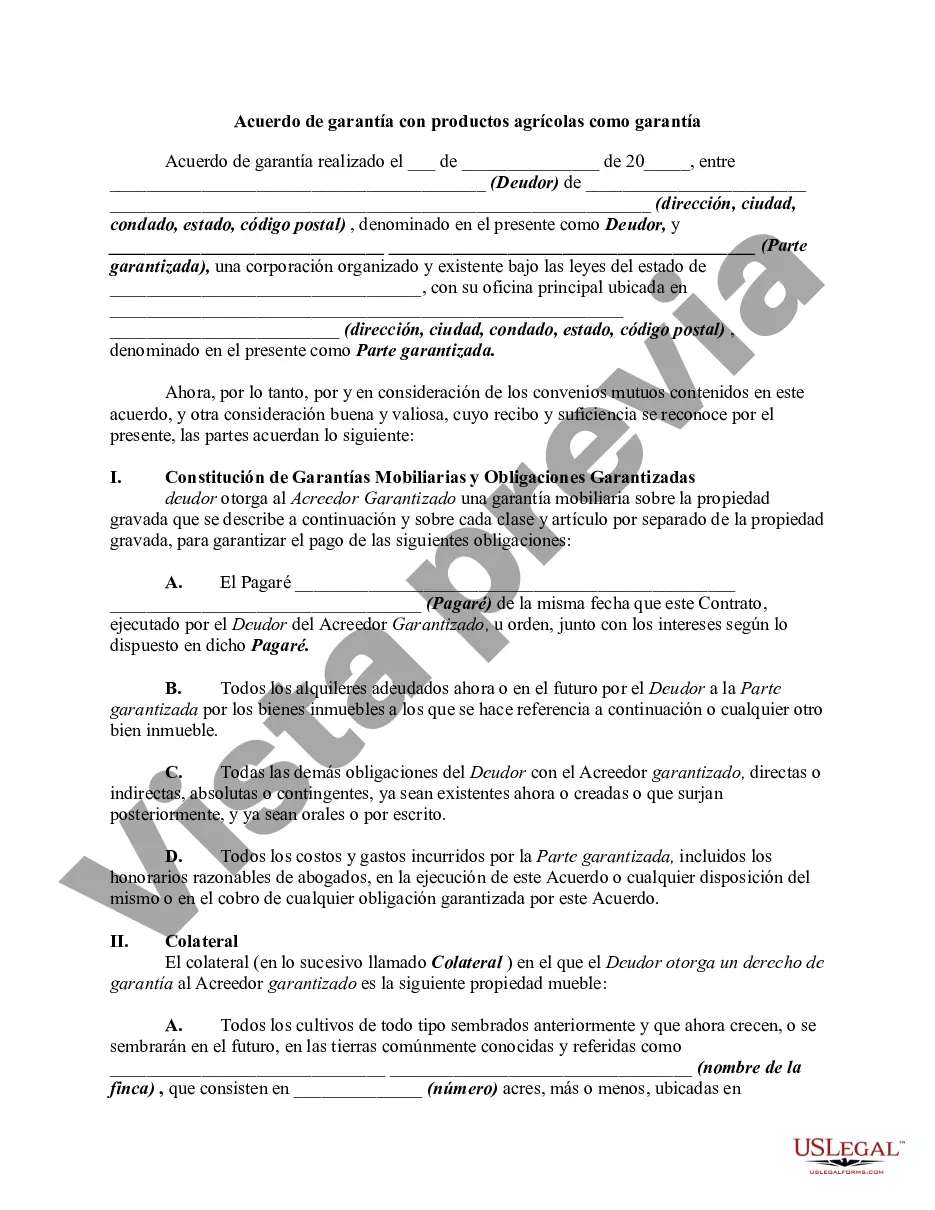

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Fulton Georgia Security Agreement with Farm Products as Collateral is a legally binding contract that serves as a means of providing security for a loan in the agriculture industry. This agreement is designed to protect the lender's interests by ensuring that if the borrower defaults on their loan, the lender can seize and sell the farm products used as collateral to recover the outstanding debt. A Fulton Georgia Security Agreement with Farm Products as Collateral typically includes the following key components: 1. Parties involved: The agreement will clearly identify the borrower and the lender. It may also include any other relevant parties such as guarantors or co-signers. 2. Description of the loan: The agreement will outline the details of the loan, including the principal amount, interest rate, repayment terms, and any applicable fees or penalties. 3. Identification of the collateral: The agreement will specify the farm products that are being used as collateral, such as crops, livestock, equipment, or harvest yields. These assets will be listed with sufficient detail to ensure accurate identification. 4. Perfection of security interest: The agreement will ensure that the lender's security interest in the specified collateral is properly perfected. This may involve filing a UCC-1 financing statement with the relevant authorities, ensuring the lender's priority in case of competing claims on the collateral. 5. Covenants and obligations: The agreement will outline the borrower's responsibilities, including maintaining the collateral's value, insuring the collateral, and promptly notifying the lender of any conflicts or losses regarding the farm products. 6. Default and remedies: The agreement will define what constitutes a default, such as missed payments or violation of the covenants. It will outline the actions the lender can take in the event of default, including repossession and sale of the farm products to recover the outstanding debt. 7. Dispute resolution and governing law: The agreement may include provisions for resolving disputes through arbitration or mediation. It will also specify the governing law of the security agreement to ensure consistency and legality. Different types of Fulton Georgia Security Agreement with Farm Products as Collateral may exist, tailored to specific agricultural contexts or variations in collateral types. Some examples include: — Crop-specific Security Agreement: This type of agreement focuses solely on crops as collateral, addressing specific risks and challenges related to crop farming, such as seasonal variations, disease, or weather-related risks. — Livestock-specific Security Agreement: This type of agreement centers around livestock as collateral, considering aspects like herd management, veterinary care, and market fluctuations specific to livestock farming. — Equipment-specific Security Agreement: In cases where farm equipment is used as collateral, this type of agreement may be employed to address proper maintenance, depreciation, and protection of value. — Multi-Collateral Security Agreement: This agreement covers multiple types of farm products as collateral, such as crops, livestock, and equipment. It allows flexibility by encompassing various assets in a single security agreement. In conclusion, a Fulton Georgia Security Agreement with Farm Products as Collateral is a crucial tool in securing loans for agricultural purposes. By offering lenders the safety net of farm products as collateral, this agreement facilitates lending in the agricultural sector while providing a clear framework for dispute resolution and remedies in case of default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.