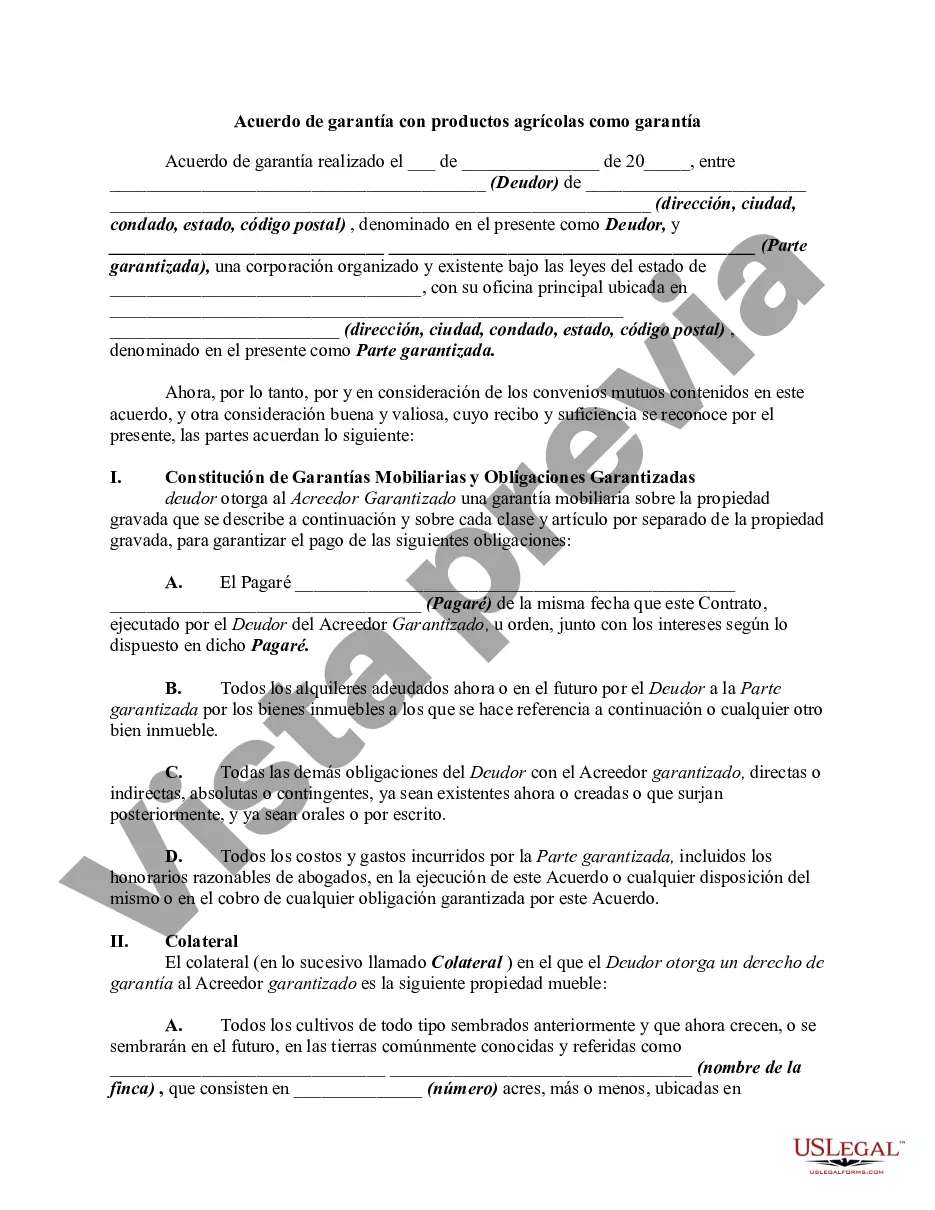

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

The Harris Texas Security Agreement with Farm Products as Collateral is a legal document that outlines the terms and conditions between a lender and a borrower in Harris County, Texas. This agreement is specifically designed for agricultural borrowers who offer their farm products as collateral to secure a loan. Under the Harris Texas Security Agreement, the borrower grants a security interest in their farm products to the lender as collateral, enabling the lender to recover the loaned funds in case of default. The agreement establishes the rights and obligations of both parties, ensuring a fair and transparent lending process. The primary purpose of the Harris Texas Security Agreement is to protect the lender's investment by providing a legal framework for the borrower's repayment responsibilities. By offering farm products as collateral, the borrower offers a tangible asset that holds value and can be sold to recover the loan amount if necessary. This agreement typically includes detailed information about the borrower, such as their name, address, and contact details. It also outlines the specifics of the loan, including the principal amount, interest rate, and repayment terms. Additionally, the agreement details the list of farm products being used as collateral, which may include crops, livestock, machinery, or any other products generated by the farm operation. It is important to note that there may be different types of Harris Texas Security Agreement with Farm Products as Collateral, depending on the specific needs and circumstances of the borrower and lender. Some variations may include additional clauses or terms that tailor the agreement to certain agricultural sectors, farm sizes, or loan amounts. Examples of specific types of Harris Texas Security Agreement with Farm Products as Collateral could include: 1. Crop Lien Agreement: This type of agreement focuses solely on crops as collateral. It may include specific clauses related to the growing, harvesting, and storing of the crops, as well as how the sale proceeds will be used to repay the loan. 2. Livestock Security Agreement: This variation is designed for borrowers who primarily rely on livestock farming. It includes provisions for the identification, management, and potential sale of the livestock in case of default. 3. Equipment and Machinery Security Agreement: This type of agreement is tailored to borrowers who require financing for farm equipment and machinery. It outlines the types and models of equipment being used as collateral, including serial numbers and other identifying information. In conclusion, the Harris Texas Security Agreement with Farm Products as Collateral is a crucial legal document that protects both lenders and borrowers in agricultural lending transactions. It establishes the rights and responsibilities of both parties, ensuring a fair and transparent lending process. The varying types of these agreements allow for customization to specific agricultural sectors or loan requirements.The Harris Texas Security Agreement with Farm Products as Collateral is a legal document that outlines the terms and conditions between a lender and a borrower in Harris County, Texas. This agreement is specifically designed for agricultural borrowers who offer their farm products as collateral to secure a loan. Under the Harris Texas Security Agreement, the borrower grants a security interest in their farm products to the lender as collateral, enabling the lender to recover the loaned funds in case of default. The agreement establishes the rights and obligations of both parties, ensuring a fair and transparent lending process. The primary purpose of the Harris Texas Security Agreement is to protect the lender's investment by providing a legal framework for the borrower's repayment responsibilities. By offering farm products as collateral, the borrower offers a tangible asset that holds value and can be sold to recover the loan amount if necessary. This agreement typically includes detailed information about the borrower, such as their name, address, and contact details. It also outlines the specifics of the loan, including the principal amount, interest rate, and repayment terms. Additionally, the agreement details the list of farm products being used as collateral, which may include crops, livestock, machinery, or any other products generated by the farm operation. It is important to note that there may be different types of Harris Texas Security Agreement with Farm Products as Collateral, depending on the specific needs and circumstances of the borrower and lender. Some variations may include additional clauses or terms that tailor the agreement to certain agricultural sectors, farm sizes, or loan amounts. Examples of specific types of Harris Texas Security Agreement with Farm Products as Collateral could include: 1. Crop Lien Agreement: This type of agreement focuses solely on crops as collateral. It may include specific clauses related to the growing, harvesting, and storing of the crops, as well as how the sale proceeds will be used to repay the loan. 2. Livestock Security Agreement: This variation is designed for borrowers who primarily rely on livestock farming. It includes provisions for the identification, management, and potential sale of the livestock in case of default. 3. Equipment and Machinery Security Agreement: This type of agreement is tailored to borrowers who require financing for farm equipment and machinery. It outlines the types and models of equipment being used as collateral, including serial numbers and other identifying information. In conclusion, the Harris Texas Security Agreement with Farm Products as Collateral is a crucial legal document that protects both lenders and borrowers in agricultural lending transactions. It establishes the rights and responsibilities of both parties, ensuring a fair and transparent lending process. The varying types of these agreements allow for customization to specific agricultural sectors or loan requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.