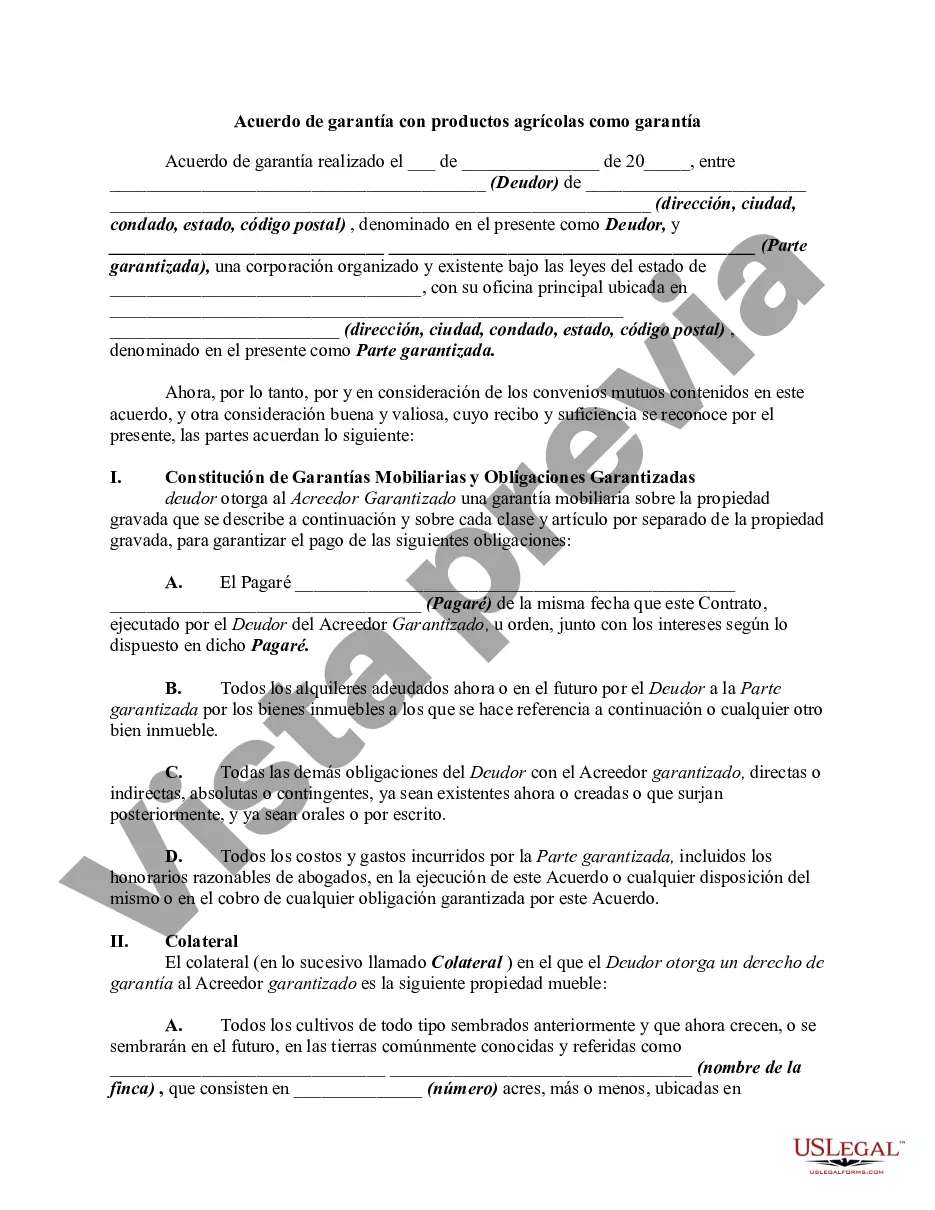

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Houston, Texas Security Agreement with Farm Products as Collateral is a legal document that establishes a lien on the farm products owned by the borrower in order to secure a debt or obligation owed to the lender. This agreement is a crucial component in protecting the interests of both parties involved in a credit transaction related to farm products. It provides the lender with a sense of security by allowing them to use the farm products as collateral in case of default or non-payment by the borrower. The Houston, Texas Security Agreement with Farm Products as Collateral is governed by the laws of the state and must adhere to specific requirements outlined in the Uniform Commercial Code (UCC). This agreement outlines the details of the loan, including the amount borrowed, interest rates, repayment terms, and the description of the collateral — in this case, the farm products. There are several types of Houston, Texas Security Agreements with Farm Products as Collateral: 1. Agricultural Lien: This type of security agreement allows lenders to secure their interest in crops, livestock, and other agricultural products produced by the borrower. It covers a wide range of farm products, including commodities, fruits, vegetables, grains, plants, and animals. 2. Equipment and Machinery Lien: Some Houston, Texas Security Agreements cover farm equipment and machinery, such as tractors, harvesters, irrigation systems, and other tools necessary for agricultural operations. These agreements enable lenders to seize and sell the equipment to recover their investment if the borrower defaults. 3. Livestock Lien: This type of security agreement specifically focuses on farm animals, such as cattle, horses, sheep, and poultry. Lenders can place a lien on the livestock, allowing them to take possession of and sell the animals if the borrower fails to meet their payment obligations. 4. Crop Lien: This agreement secures debts using the borrower's crops as collateral. It covers various types of crops grown on the farm, such as grains, vegetables, fruits, and other agricultural produce. Lenders can seize and sell the crops if the borrower defaults on their loan. Houston, Texas Security Agreement with Farm Products as Collateral is an essential tool in ensuring the successful lending and borrowing of funds for agricultural purposes. It protects the lender's investment while allowing the borrower to leverage their farm products as a form of collateral. Understanding the different types of agreements within this category is crucial for both parties involved to make informed decisions and protect their interests.Houston, Texas Security Agreement with Farm Products as Collateral is a legal document that establishes a lien on the farm products owned by the borrower in order to secure a debt or obligation owed to the lender. This agreement is a crucial component in protecting the interests of both parties involved in a credit transaction related to farm products. It provides the lender with a sense of security by allowing them to use the farm products as collateral in case of default or non-payment by the borrower. The Houston, Texas Security Agreement with Farm Products as Collateral is governed by the laws of the state and must adhere to specific requirements outlined in the Uniform Commercial Code (UCC). This agreement outlines the details of the loan, including the amount borrowed, interest rates, repayment terms, and the description of the collateral — in this case, the farm products. There are several types of Houston, Texas Security Agreements with Farm Products as Collateral: 1. Agricultural Lien: This type of security agreement allows lenders to secure their interest in crops, livestock, and other agricultural products produced by the borrower. It covers a wide range of farm products, including commodities, fruits, vegetables, grains, plants, and animals. 2. Equipment and Machinery Lien: Some Houston, Texas Security Agreements cover farm equipment and machinery, such as tractors, harvesters, irrigation systems, and other tools necessary for agricultural operations. These agreements enable lenders to seize and sell the equipment to recover their investment if the borrower defaults. 3. Livestock Lien: This type of security agreement specifically focuses on farm animals, such as cattle, horses, sheep, and poultry. Lenders can place a lien on the livestock, allowing them to take possession of and sell the animals if the borrower fails to meet their payment obligations. 4. Crop Lien: This agreement secures debts using the borrower's crops as collateral. It covers various types of crops grown on the farm, such as grains, vegetables, fruits, and other agricultural produce. Lenders can seize and sell the crops if the borrower defaults on their loan. Houston, Texas Security Agreement with Farm Products as Collateral is an essential tool in ensuring the successful lending and borrowing of funds for agricultural purposes. It protects the lender's investment while allowing the borrower to leverage their farm products as a form of collateral. Understanding the different types of agreements within this category is crucial for both parties involved to make informed decisions and protect their interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.