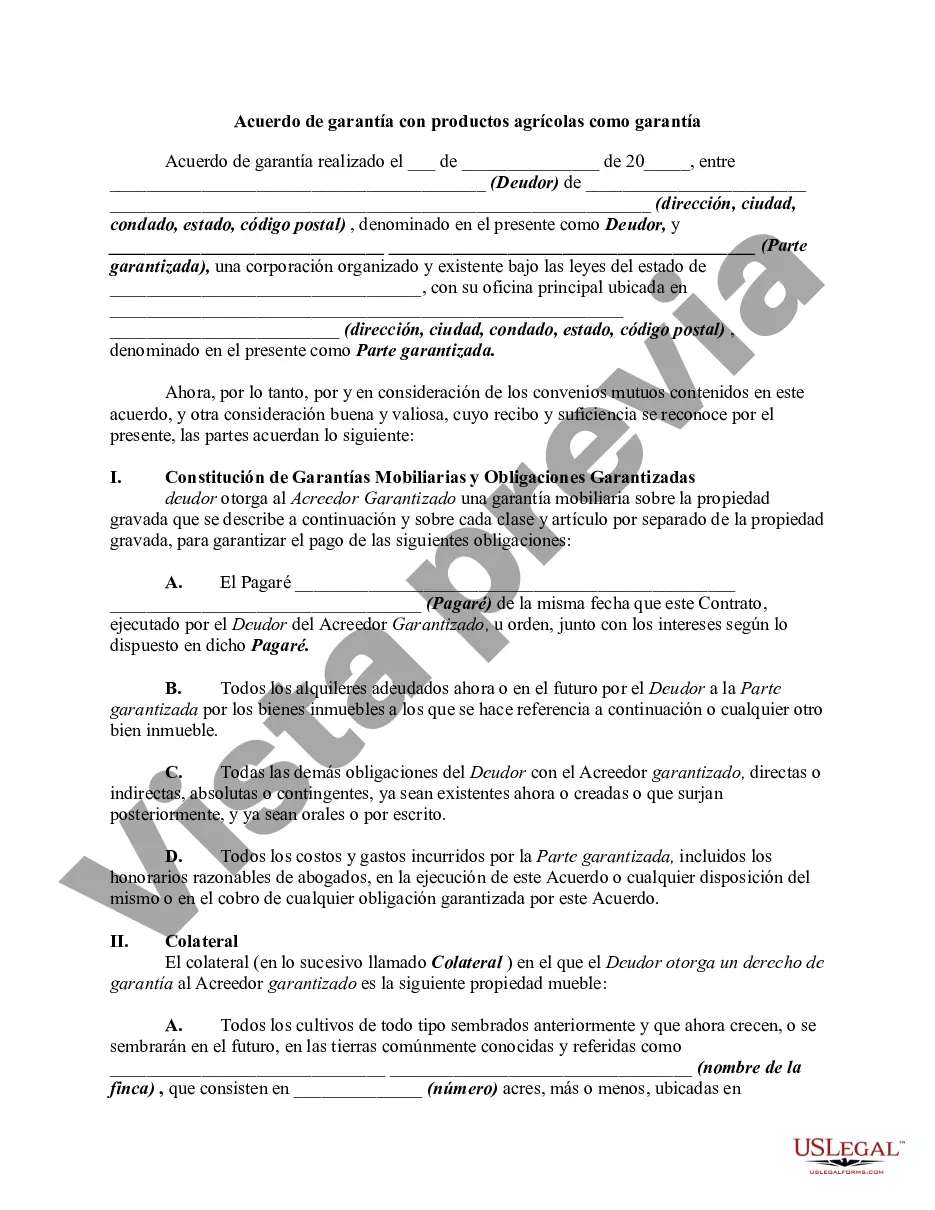

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Mecklenburg North Carolina Security Agreement with Farm Products as Collateral is a legally binding contract that establishes a security interest on farm products to secure the repayment of a debt. This agreement is commonly used in the agricultural sector, especially in Mecklenburg County, North Carolina, where agriculture plays a vital role in the economy. The primary purpose of the Mecklenburg North Carolina Security Agreement with Farm Products as Collateral is to protect the lender's rights in case the borrower defaults on the loan. By granting the lender a security interest in farm products, the borrower agrees to use these assets as collateral until the debt is repaid. This type of agreement provides a detailed description of the terms and conditions of the loan, including the amount borrowed, interest rates, repayment schedule, and the consequences of defaulting on the loan. It also outlines the specific farm products that are considered collateral, such as crops, livestock, and equipment. The Mecklenburg County Security Agreement with Farm Products as Collateral may have different variations depending on the specific needs and agreements between the lender and borrower. Some common variations include: 1. Crop-specific Security Agreement: This type of agreement focuses on using crops as collateral. It may include provisions related to planting, harvesting, and selling the crops, emphasizing how the proceeds will be used to repay the debt. 2. Livestock-specific Security Agreement: When livestock is the primary asset used as collateral, this agreement variant is employed. It includes details about the care, feeding, and sale of the livestock, as well as how the proceeds will be utilized. 3. Equipment-specific Security Agreement: If the borrower uses farm equipment as collateral, this specific agreement variant is used. It covers the maintenance, storage, and eventual disposal of the equipment, as well as how it contributes to the repayment of the loan. These variations aim to address the specific characteristics and risks associated with different types of farm products. The Mecklenburg North Carolina Security Agreement with Farm Products as Collateral serves as a crucial legal document that ensures both the lender and borrower are protected and have a clear understanding of their rights and obligations throughout the loan term. In conclusion, the Mecklenburg North Carolina Security Agreement with Farm Products as Collateral is an essential contract that safeguards the interests of both lenders and borrowers in the agricultural sector. By utilizing farm products as collateral, this agreement provides security for the repayment of loans, allowing farmers to access essential funding while lenders are protected in case of default.Mecklenburg North Carolina Security Agreement with Farm Products as Collateral is a legally binding contract that establishes a security interest on farm products to secure the repayment of a debt. This agreement is commonly used in the agricultural sector, especially in Mecklenburg County, North Carolina, where agriculture plays a vital role in the economy. The primary purpose of the Mecklenburg North Carolina Security Agreement with Farm Products as Collateral is to protect the lender's rights in case the borrower defaults on the loan. By granting the lender a security interest in farm products, the borrower agrees to use these assets as collateral until the debt is repaid. This type of agreement provides a detailed description of the terms and conditions of the loan, including the amount borrowed, interest rates, repayment schedule, and the consequences of defaulting on the loan. It also outlines the specific farm products that are considered collateral, such as crops, livestock, and equipment. The Mecklenburg County Security Agreement with Farm Products as Collateral may have different variations depending on the specific needs and agreements between the lender and borrower. Some common variations include: 1. Crop-specific Security Agreement: This type of agreement focuses on using crops as collateral. It may include provisions related to planting, harvesting, and selling the crops, emphasizing how the proceeds will be used to repay the debt. 2. Livestock-specific Security Agreement: When livestock is the primary asset used as collateral, this agreement variant is employed. It includes details about the care, feeding, and sale of the livestock, as well as how the proceeds will be utilized. 3. Equipment-specific Security Agreement: If the borrower uses farm equipment as collateral, this specific agreement variant is used. It covers the maintenance, storage, and eventual disposal of the equipment, as well as how it contributes to the repayment of the loan. These variations aim to address the specific characteristics and risks associated with different types of farm products. The Mecklenburg North Carolina Security Agreement with Farm Products as Collateral serves as a crucial legal document that ensures both the lender and borrower are protected and have a clear understanding of their rights and obligations throughout the loan term. In conclusion, the Mecklenburg North Carolina Security Agreement with Farm Products as Collateral is an essential contract that safeguards the interests of both lenders and borrowers in the agricultural sector. By utilizing farm products as collateral, this agreement provides security for the repayment of loans, allowing farmers to access essential funding while lenders are protected in case of default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.