In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Oakland Michigan Security Agreement with Farm Products as Collateral refers to a legal document used in the state of Michigan that establishes a security interest in farm products as collateral for a loan or other financial transaction. This agreement offers protection to lenders by securing their interest in the borrower's farm products, ensuring repayment in the event of default or non-payment. The Oakland County government in Michigan recognizes the importance of the agriculture industry and has specific regulations in place to protect lenders and provide a framework for securing loans with farm products. There are several types of Oakland Michigan security agreements that involve farm products as collateral: 1. Crop Security Agreement: This type of agreement is commonly used when a farmer wishes to obtain financing by using their crops as collateral. The lender will have a security interest in the farmer's crops, which means that if the loan is not repaid, the lender can claim the crops to recover their investment. 2. Livestock Security Agreement: This agreement is used when a farmer wishes to use their livestock as collateral for a loan. It gives the lender a security interest in the borrower's livestock, allowing them to repossess and sell the livestock if the borrower fails to repay the loan. 3. Equipment Security Agreement: In some cases, farmers may seek a loan using their farming equipment (such as tractors, harvesters, or machinery) as collateral. This agreement grants the lender a security interest in the equipment, enabling them to seize and sell it to recoup their losses if the borrower defaults. 4. Warehouse Receipts Security Agreement: Farmers who store their agricultural products in warehouses can use these receipts as collateral for loans. The agreement allows the lender to claim the stored farm products if the loan is not repaid. It is important for both lenders and borrowers to understand the terms and conditions outlined in an Oakland Michigan Security Agreement with Farm Products as Collateral. Compliance with these agreements ensures a smooth and legally binding transaction, minimizing the risk for all parties involved.Oakland Michigan Security Agreement with Farm Products as Collateral refers to a legal document used in the state of Michigan that establishes a security interest in farm products as collateral for a loan or other financial transaction. This agreement offers protection to lenders by securing their interest in the borrower's farm products, ensuring repayment in the event of default or non-payment. The Oakland County government in Michigan recognizes the importance of the agriculture industry and has specific regulations in place to protect lenders and provide a framework for securing loans with farm products. There are several types of Oakland Michigan security agreements that involve farm products as collateral: 1. Crop Security Agreement: This type of agreement is commonly used when a farmer wishes to obtain financing by using their crops as collateral. The lender will have a security interest in the farmer's crops, which means that if the loan is not repaid, the lender can claim the crops to recover their investment. 2. Livestock Security Agreement: This agreement is used when a farmer wishes to use their livestock as collateral for a loan. It gives the lender a security interest in the borrower's livestock, allowing them to repossess and sell the livestock if the borrower fails to repay the loan. 3. Equipment Security Agreement: In some cases, farmers may seek a loan using their farming equipment (such as tractors, harvesters, or machinery) as collateral. This agreement grants the lender a security interest in the equipment, enabling them to seize and sell it to recoup their losses if the borrower defaults. 4. Warehouse Receipts Security Agreement: Farmers who store their agricultural products in warehouses can use these receipts as collateral for loans. The agreement allows the lender to claim the stored farm products if the loan is not repaid. It is important for both lenders and borrowers to understand the terms and conditions outlined in an Oakland Michigan Security Agreement with Farm Products as Collateral. Compliance with these agreements ensures a smooth and legally binding transaction, minimizing the risk for all parties involved.

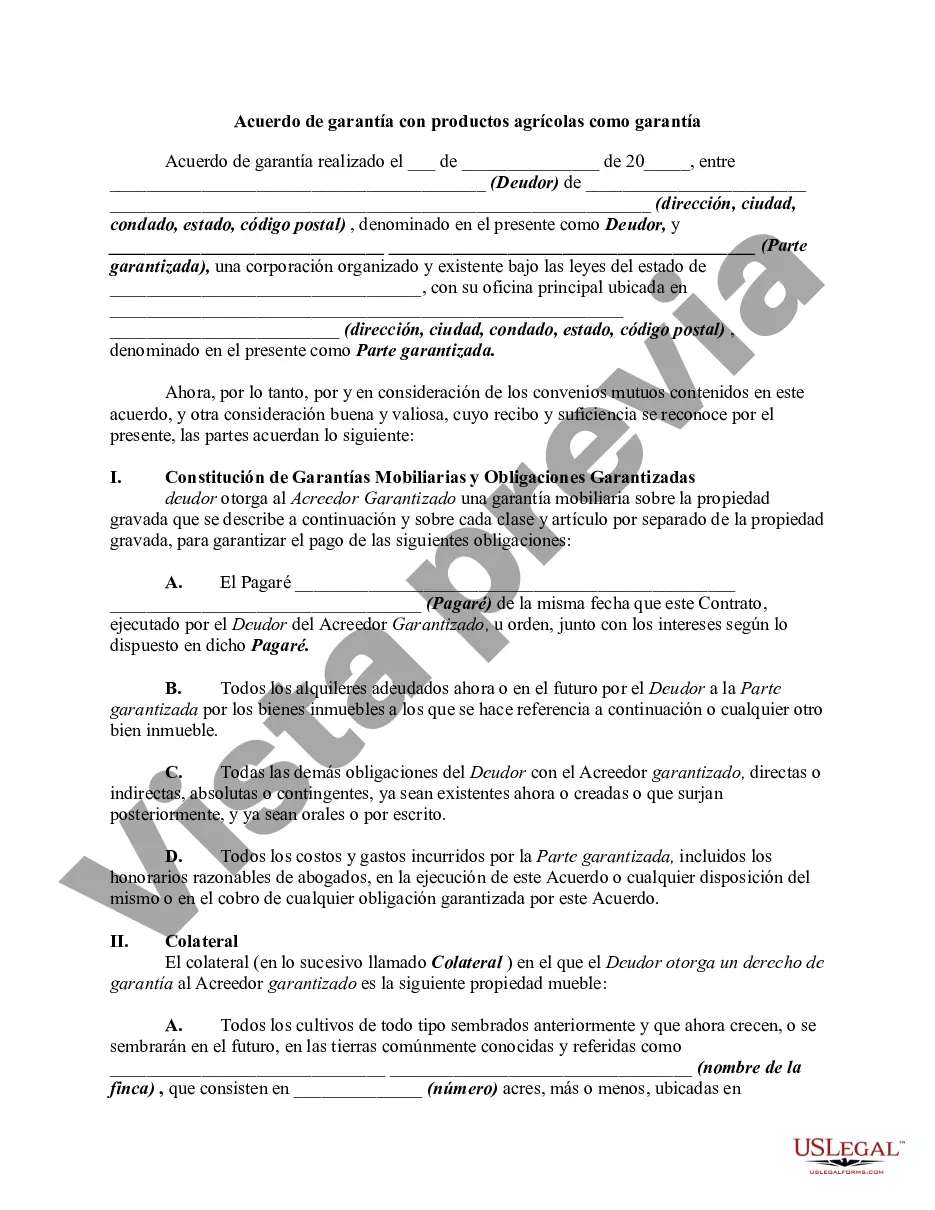

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.