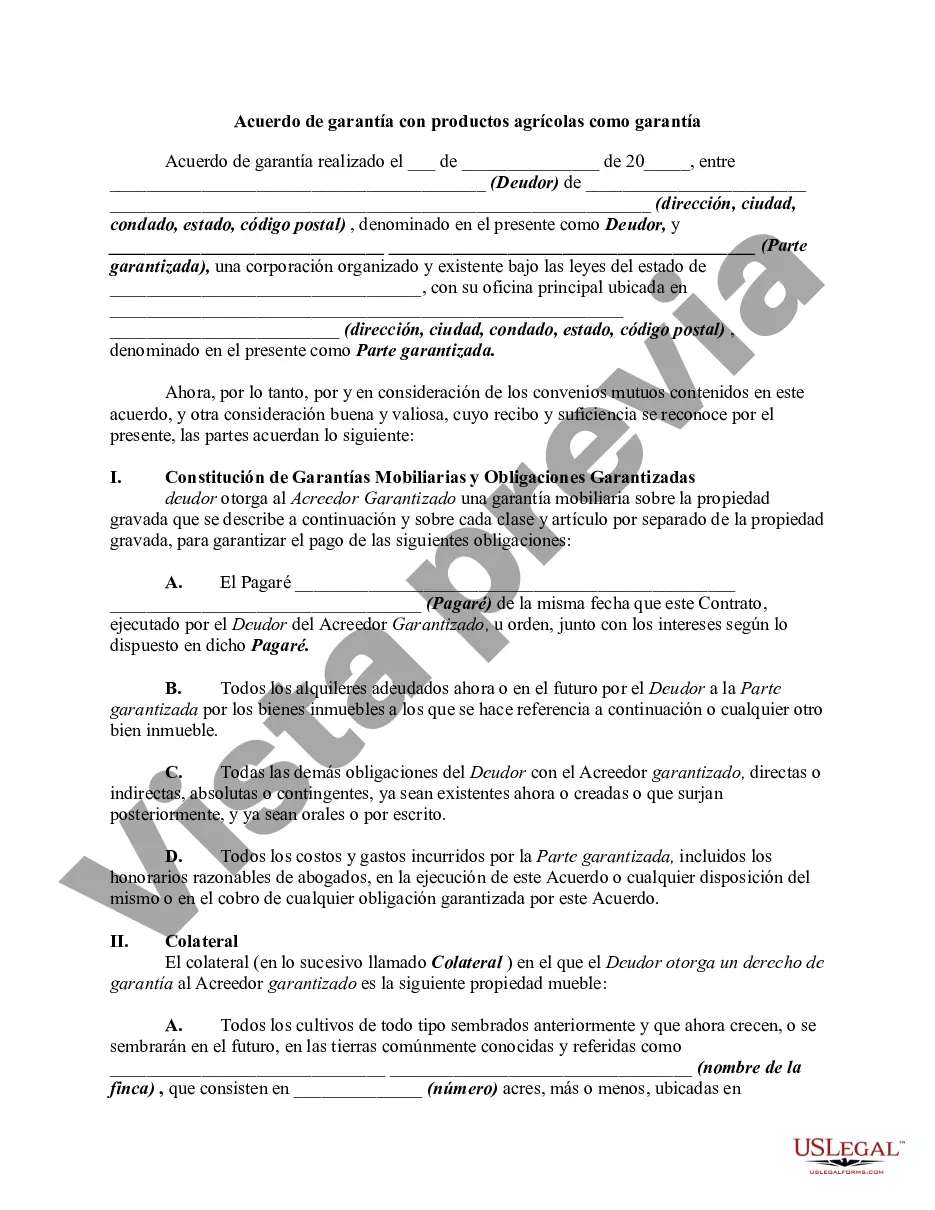

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Riverside California Security Agreement with Farm Products as Collateral, also known as an agricultural security agreement, is a legal contract designed to protect the interests of lenders providing financing to farmers or agricultural businesses. This agreement establishes the rights and obligations of both parties involved and ensures the repayment of loans by holding farm products as collateral. The primary purpose of the Riverside California Security Agreement with Farm Products as Collateral is to provide lenders with a source of repayment or recourse in case of default by the borrower. By accepting farm products as collateral, lenders mitigate their risk and secure their investment. This type of agreement is essential for both parties to establish trust and maintain a mutually beneficial business relationship. Key aspects of the Riverside California Security Agreement with Farm Products as Collateral include the identification of the parties involved, a detailed description of the farm products accepted as collateral, and the terms and conditions for loan repayment. This agreement also outlines the rights and responsibilities of both the lender and the borrower. Different types of Riverside California Security Agreement with Farm Products as Collateral may include: 1. Crop-specific Security Agreement: This type of agreement focuses on a specific type of farm product, such as corn, wheat, soybeans, or fruits. The agreement details the quantity and quality of the crop, along with its market value. 2. Livestock Security Agreement: Livestock, including cattle, pigs, or poultry, can serve as collateral in this type of security agreement. The document specifies the number of animals, breed, health conditions, and any necessary insurance requirements. 3. Machinery and Equipment Security Agreement: In this case, farm equipment and machinery, like tractors, combines, or irrigation systems, are used as collateral. The agreement describes the condition and value of the equipment, along with maintenance responsibilities. 4. Farm Equity Security Agreement: This type of agreement allows farmers to use their overall farm equity, including land, buildings, and other assets, as collateral. It outlines the valuation of the equity and the rights of the lender to seize the assets in case of default. In conclusion, the Riverside California Security Agreement with Farm Products as Collateral is a critical legal document that facilitates lending to farmers and agricultural businesses. It provides lenders with reassurance by offering farm products or other assets as collateral, ensuring repayment of loans. Different types of security agreements can be tailored to various agricultural sectors, including crop-specific, livestock, machinery and equipment, or farm equity collateral. These agreements play a crucial role in supporting the agricultural industry's financial stability and growth.Riverside California Security Agreement with Farm Products as Collateral, also known as an agricultural security agreement, is a legal contract designed to protect the interests of lenders providing financing to farmers or agricultural businesses. This agreement establishes the rights and obligations of both parties involved and ensures the repayment of loans by holding farm products as collateral. The primary purpose of the Riverside California Security Agreement with Farm Products as Collateral is to provide lenders with a source of repayment or recourse in case of default by the borrower. By accepting farm products as collateral, lenders mitigate their risk and secure their investment. This type of agreement is essential for both parties to establish trust and maintain a mutually beneficial business relationship. Key aspects of the Riverside California Security Agreement with Farm Products as Collateral include the identification of the parties involved, a detailed description of the farm products accepted as collateral, and the terms and conditions for loan repayment. This agreement also outlines the rights and responsibilities of both the lender and the borrower. Different types of Riverside California Security Agreement with Farm Products as Collateral may include: 1. Crop-specific Security Agreement: This type of agreement focuses on a specific type of farm product, such as corn, wheat, soybeans, or fruits. The agreement details the quantity and quality of the crop, along with its market value. 2. Livestock Security Agreement: Livestock, including cattle, pigs, or poultry, can serve as collateral in this type of security agreement. The document specifies the number of animals, breed, health conditions, and any necessary insurance requirements. 3. Machinery and Equipment Security Agreement: In this case, farm equipment and machinery, like tractors, combines, or irrigation systems, are used as collateral. The agreement describes the condition and value of the equipment, along with maintenance responsibilities. 4. Farm Equity Security Agreement: This type of agreement allows farmers to use their overall farm equity, including land, buildings, and other assets, as collateral. It outlines the valuation of the equity and the rights of the lender to seize the assets in case of default. In conclusion, the Riverside California Security Agreement with Farm Products as Collateral is a critical legal document that facilitates lending to farmers and agricultural businesses. It provides lenders with reassurance by offering farm products or other assets as collateral, ensuring repayment of loans. Different types of security agreements can be tailored to various agricultural sectors, including crop-specific, livestock, machinery and equipment, or farm equity collateral. These agreements play a crucial role in supporting the agricultural industry's financial stability and growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.