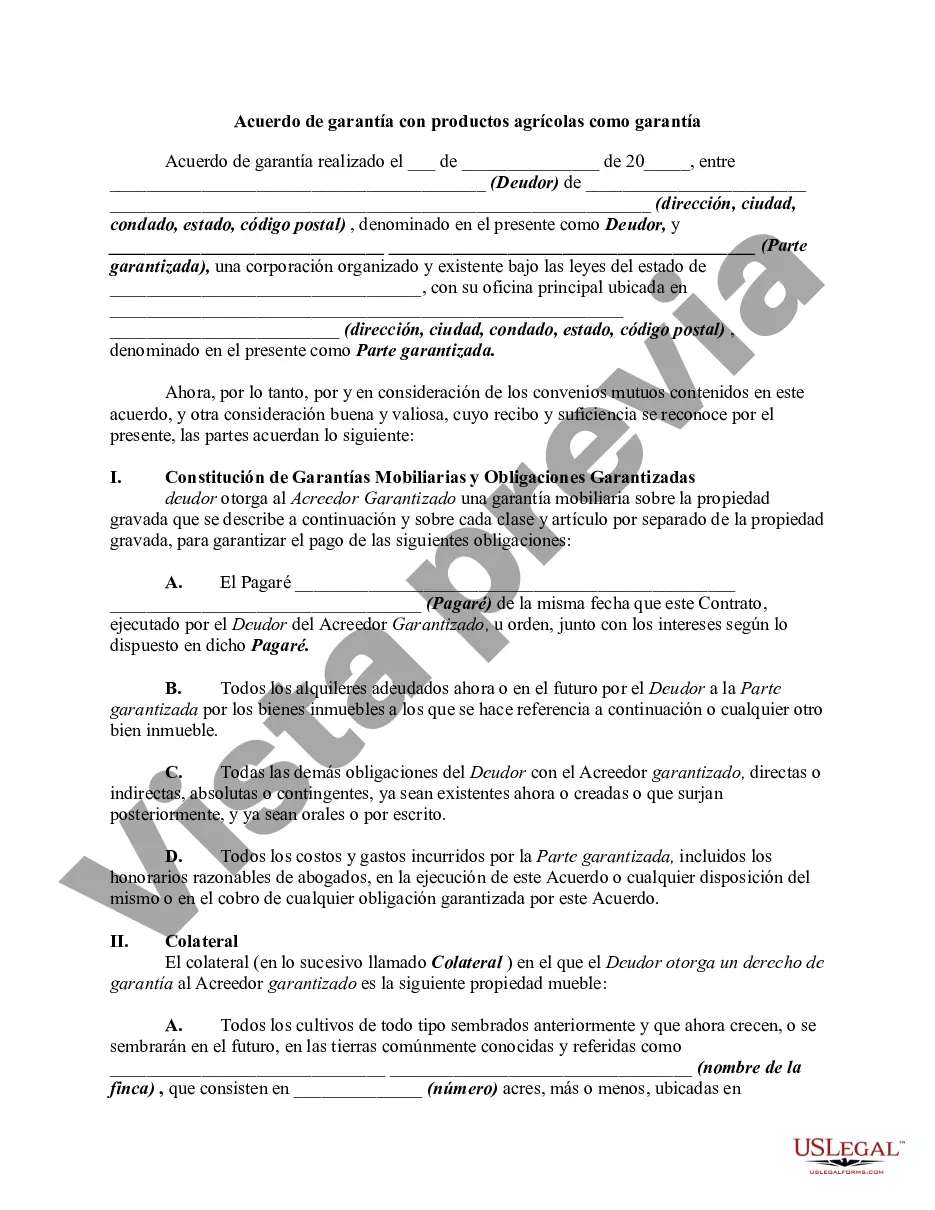

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

A San Diego California Security Agreement with Farm Products as Collateral is a legal document that outlines the understanding and agreement between a lender and a borrower regarding the use of farm products as collateral for a loan or debt. This type of agreement is commonly used in the agricultural industry to secure financing for farmers and ranchers in San Diego, California. The purpose of a Security Agreement is to protect the lender's interest in the event of default by the borrower. By using farm products such as crops, livestock, or equipment as collateral, the lender has the right to claim and sell these assets to recover the unpaid debt if the borrower fails to repay the loan as agreed. This Security Agreement is a crucial aspect of securing agricultural loans in San Diego, California, as it provides assurance to lenders that they have a legal claim on the borrower's farm products. It helps mitigate the risks associated with lending in the agricultural sector and ensures that lenders can recoup their investment should the borrower default. There can be different variations of a San Diego California Security Agreement with Farm Products as Collateral, depending on the specific type of loan or financing arrangement. Some common types of agreements include: 1. Crop and Livestock Security Agreement: This type of agreement covers both crops and livestock as collateral. It outlines the terms and conditions related to the use and sale of these assets in the event of default. 2. Equipment Security Agreement: In this variation, farm equipment and machinery serve as collateral for the loan. The agreement specifies the lender's rights to repossess and sell the equipment to recover the outstanding debt. 3. Warehouse Receipt Security Agreement: This agreement pertains to crops stored in a warehouse. It establishes the lender's rights and processes associated with the sale of these crops if the borrower defaults on the loan. San Diego, California, has a diverse agricultural industry that encompasses crops like avocados, strawberries, lettuce, and many more. Thus, a San Diego California Security Agreement with Farm Products as Collateral is vital to support the financial needs of farmers and ranchers in the region, ensuring a steady flow of capital and investment in the agricultural sector.A San Diego California Security Agreement with Farm Products as Collateral is a legal document that outlines the understanding and agreement between a lender and a borrower regarding the use of farm products as collateral for a loan or debt. This type of agreement is commonly used in the agricultural industry to secure financing for farmers and ranchers in San Diego, California. The purpose of a Security Agreement is to protect the lender's interest in the event of default by the borrower. By using farm products such as crops, livestock, or equipment as collateral, the lender has the right to claim and sell these assets to recover the unpaid debt if the borrower fails to repay the loan as agreed. This Security Agreement is a crucial aspect of securing agricultural loans in San Diego, California, as it provides assurance to lenders that they have a legal claim on the borrower's farm products. It helps mitigate the risks associated with lending in the agricultural sector and ensures that lenders can recoup their investment should the borrower default. There can be different variations of a San Diego California Security Agreement with Farm Products as Collateral, depending on the specific type of loan or financing arrangement. Some common types of agreements include: 1. Crop and Livestock Security Agreement: This type of agreement covers both crops and livestock as collateral. It outlines the terms and conditions related to the use and sale of these assets in the event of default. 2. Equipment Security Agreement: In this variation, farm equipment and machinery serve as collateral for the loan. The agreement specifies the lender's rights to repossess and sell the equipment to recover the outstanding debt. 3. Warehouse Receipt Security Agreement: This agreement pertains to crops stored in a warehouse. It establishes the lender's rights and processes associated with the sale of these crops if the borrower defaults on the loan. San Diego, California, has a diverse agricultural industry that encompasses crops like avocados, strawberries, lettuce, and many more. Thus, a San Diego California Security Agreement with Farm Products as Collateral is vital to support the financial needs of farmers and ranchers in the region, ensuring a steady flow of capital and investment in the agricultural sector.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.