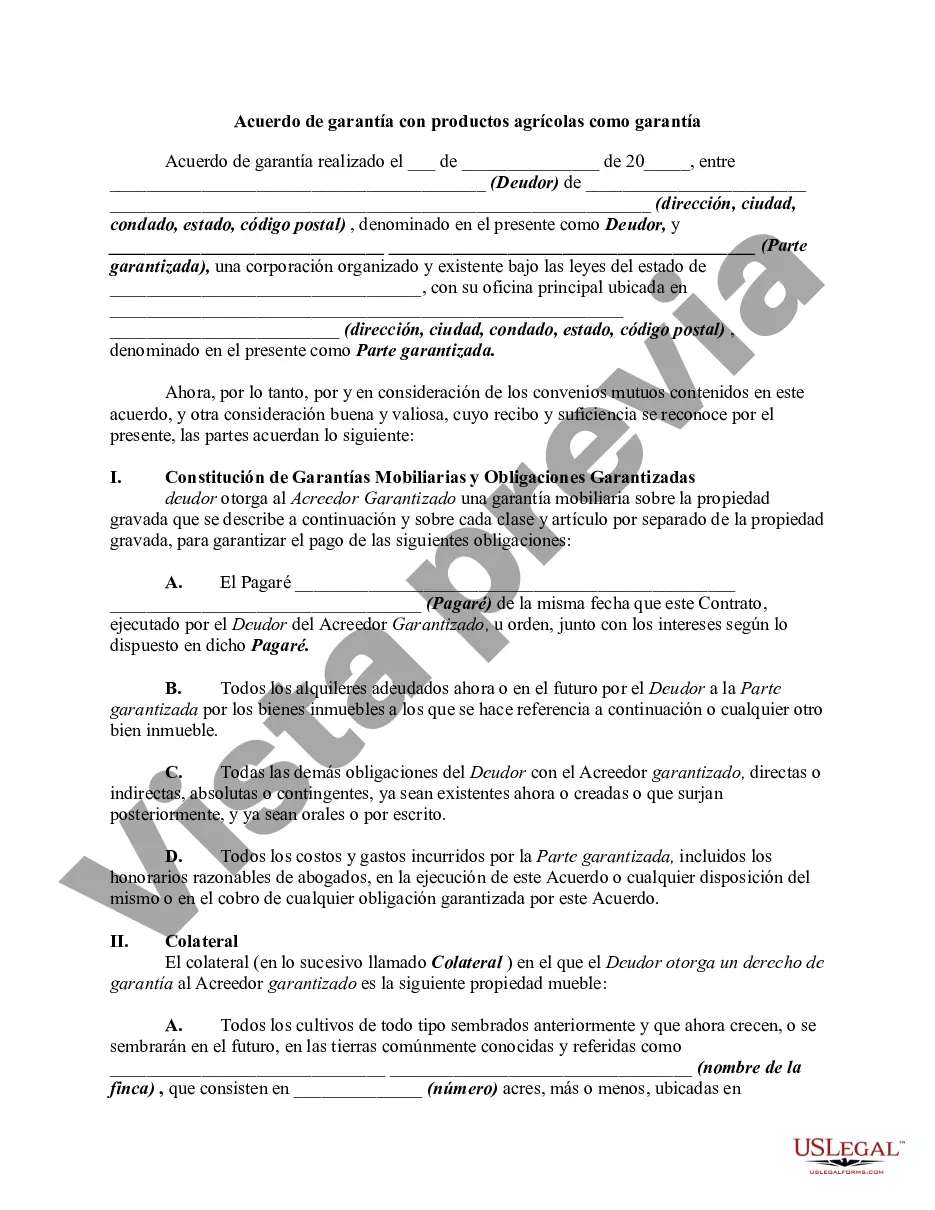

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

San Jose, California Security Agreement with Farm Products as Collateral: Explained A security agreement is a legal contract that establishes the rights and obligations between a borrower and a lender. In San Jose, California, a Security Agreement with Farm Products as Collateral is specifically designed to provide protection to lenders when granting loans to farmers or agricultural businesses. Key Components of the Security Agreement: 1. Lender and Borrower: The agreement identifies the lender, who may be a financial institution or an individual, and the borrower, who is the farmer or agricultural business seeking funds. 2. Collateral: In this specific agreement, farm products serve as collateral. These assets include crops, livestock, produce, equipment, machinery, and other agricultural commodities owned by the borrower. By pledging these assets, the borrower provides a form of security for the lender in case of default. 3. Terms and Conditions: The agreement outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any specific provisions or restrictions pertaining to the farm products used as collateral. It also covers the method of sale or disposal of the collateral in case of default. 4. Default and Remedies: The agreement establishes the events that may lead to default, such as non-payment of the loan, failure to maintain the collateral's value, or breach of other terms. It also enumerates the remedies available to the lender in case of default, such as the right to take possession of the collateral, sell it, and apply the proceeds toward the loan balance. Different Types of San Jose, California Security Agreements with Farm Products as Collateral: 1. Crop Security Agreement: This agreement specifically focuses on pledging crops as collateral. It addresses the risks associated with crop production, allowing farmers to secure financing for their planting and harvesting activities. 2. Livestock Security Agreement: This type of agreement is tailored for farmers or ranchers who primarily rely on livestock production. It provides a mechanism for using livestock inventory as collateral, ensuring lenders have a means to recover funds if the borrower defaults. 3. Equipment Security Agreement: Farmers often require equipment for agricultural operations. In this type of agreement, various types of machinery, vehicles, or other equipment used in farming can be pledged as collateral, thereby enabling lenders to provide loans specifically for equipment acquisition or maintenance. 4. General Farm Products Security Agreement: This comprehensive agreement covers a wide range of farm products, including crops, livestock, machinery, and other items pertinent to agricultural activities. It offers flexibility and convenience to borrowers and lenders by consolidating multiple types of collateral into a single agreement. In San Jose, California, the Security Agreement with Farm Products as Collateral plays a vital role in supporting agricultural businesses. It safeguards the interests of lenders while enabling farmers to access capital for their farming operations and stimulates economic growth in the agricultural sector.San Jose, California Security Agreement with Farm Products as Collateral: Explained A security agreement is a legal contract that establishes the rights and obligations between a borrower and a lender. In San Jose, California, a Security Agreement with Farm Products as Collateral is specifically designed to provide protection to lenders when granting loans to farmers or agricultural businesses. Key Components of the Security Agreement: 1. Lender and Borrower: The agreement identifies the lender, who may be a financial institution or an individual, and the borrower, who is the farmer or agricultural business seeking funds. 2. Collateral: In this specific agreement, farm products serve as collateral. These assets include crops, livestock, produce, equipment, machinery, and other agricultural commodities owned by the borrower. By pledging these assets, the borrower provides a form of security for the lender in case of default. 3. Terms and Conditions: The agreement outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any specific provisions or restrictions pertaining to the farm products used as collateral. It also covers the method of sale or disposal of the collateral in case of default. 4. Default and Remedies: The agreement establishes the events that may lead to default, such as non-payment of the loan, failure to maintain the collateral's value, or breach of other terms. It also enumerates the remedies available to the lender in case of default, such as the right to take possession of the collateral, sell it, and apply the proceeds toward the loan balance. Different Types of San Jose, California Security Agreements with Farm Products as Collateral: 1. Crop Security Agreement: This agreement specifically focuses on pledging crops as collateral. It addresses the risks associated with crop production, allowing farmers to secure financing for their planting and harvesting activities. 2. Livestock Security Agreement: This type of agreement is tailored for farmers or ranchers who primarily rely on livestock production. It provides a mechanism for using livestock inventory as collateral, ensuring lenders have a means to recover funds if the borrower defaults. 3. Equipment Security Agreement: Farmers often require equipment for agricultural operations. In this type of agreement, various types of machinery, vehicles, or other equipment used in farming can be pledged as collateral, thereby enabling lenders to provide loans specifically for equipment acquisition or maintenance. 4. General Farm Products Security Agreement: This comprehensive agreement covers a wide range of farm products, including crops, livestock, machinery, and other items pertinent to agricultural activities. It offers flexibility and convenience to borrowers and lenders by consolidating multiple types of collateral into a single agreement. In San Jose, California, the Security Agreement with Farm Products as Collateral plays a vital role in supporting agricultural businesses. It safeguards the interests of lenders while enabling farmers to access capital for their farming operations and stimulates economic growth in the agricultural sector.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.