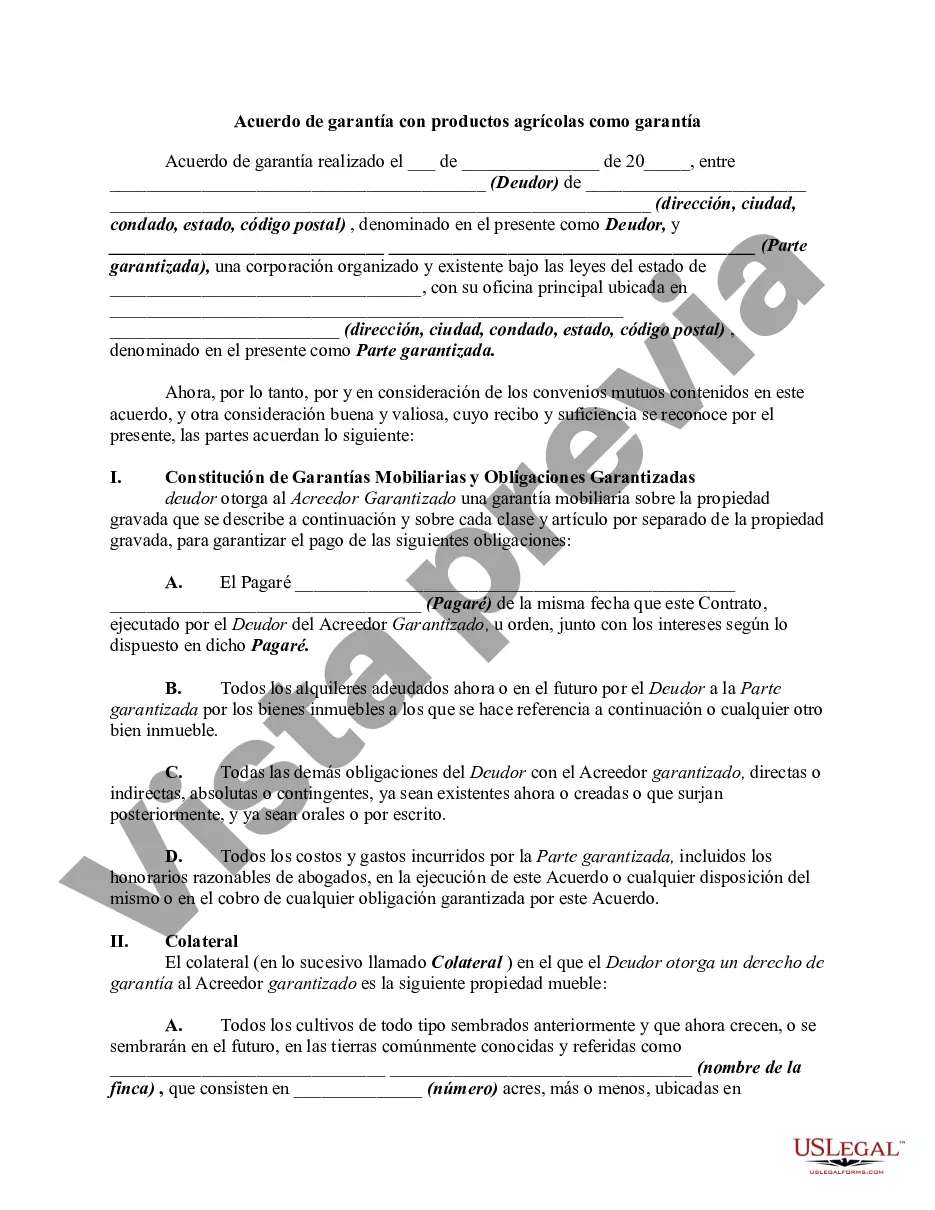

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Tarrant Texas Security Agreement with Farm Products as Collateral is a legal document that ensures the protection of lenders' interests when they provide loans to farmers or agricultural businesses in Tarrant County, Texas. This agreement aims to secure the loan by allowing the lender to claim and sell the farm products if the borrower fails to repay the debt. Typically, these agreements enable lenders to have a first priority interest in the agricultural products or crops grown on the farm or the proceeds from their sale. There are different types of Tarrant Texas Security Agreements with Farm Products as Collateral that cater to various situations and parties involved: 1. Tarrant Texas Security Agreement for Agricultural Loans: This type of agreement is specifically designed for financial institutions or lenders offering loans to farmers or agricultural businesses. It lists all the necessary terms and conditions, including the types of farm products that can serve as collateral, the loan repayment schedule, interest rate, and enforcement mechanisms in case of default. 2. Tarrant Texas Security Agreement for Farm Equipment Financing: This agreement pertains specifically to loans granted for purchasing or leasing agricultural equipment and machinery. The farm products produced using the financed equipment are often used as collateral to secure the loan. 3. Tarrant Texas Security Agreement for Livestock Loans: Livestock farmers seeking financial support can enter into this agreement to secure loans by using their animals as collateral. The agreement specifies the number, breed, and value of the livestock serving as collateral, along with the penalties for default. 4. Tarrant Texas Security Agreement for Crop Production Loans: This type of security agreement is crucial for crop farmers who require funds for purchasing seeds, fertilizers, and other inputs. The agreement outlines the crop types, quantities, and expected yields that will act as collateral to secure the loan. In conclusion, Tarrant Texas Security Agreement with Farm Products as Collateral is a legal framework to protect lenders' interests when providing loans to farmers in Tarrant County, Texas. The various types of agreements mentioned above ensure that both lenders and borrowers have a clear understanding of the terms and conditions, ultimately fostering financial stability and growth in the agricultural sector.Tarrant Texas Security Agreement with Farm Products as Collateral is a legal document that ensures the protection of lenders' interests when they provide loans to farmers or agricultural businesses in Tarrant County, Texas. This agreement aims to secure the loan by allowing the lender to claim and sell the farm products if the borrower fails to repay the debt. Typically, these agreements enable lenders to have a first priority interest in the agricultural products or crops grown on the farm or the proceeds from their sale. There are different types of Tarrant Texas Security Agreements with Farm Products as Collateral that cater to various situations and parties involved: 1. Tarrant Texas Security Agreement for Agricultural Loans: This type of agreement is specifically designed for financial institutions or lenders offering loans to farmers or agricultural businesses. It lists all the necessary terms and conditions, including the types of farm products that can serve as collateral, the loan repayment schedule, interest rate, and enforcement mechanisms in case of default. 2. Tarrant Texas Security Agreement for Farm Equipment Financing: This agreement pertains specifically to loans granted for purchasing or leasing agricultural equipment and machinery. The farm products produced using the financed equipment are often used as collateral to secure the loan. 3. Tarrant Texas Security Agreement for Livestock Loans: Livestock farmers seeking financial support can enter into this agreement to secure loans by using their animals as collateral. The agreement specifies the number, breed, and value of the livestock serving as collateral, along with the penalties for default. 4. Tarrant Texas Security Agreement for Crop Production Loans: This type of security agreement is crucial for crop farmers who require funds for purchasing seeds, fertilizers, and other inputs. The agreement outlines the crop types, quantities, and expected yields that will act as collateral to secure the loan. In conclusion, Tarrant Texas Security Agreement with Farm Products as Collateral is a legal framework to protect lenders' interests when providing loans to farmers in Tarrant County, Texas. The various types of agreements mentioned above ensure that both lenders and borrowers have a clear understanding of the terms and conditions, ultimately fostering financial stability and growth in the agricultural sector.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.