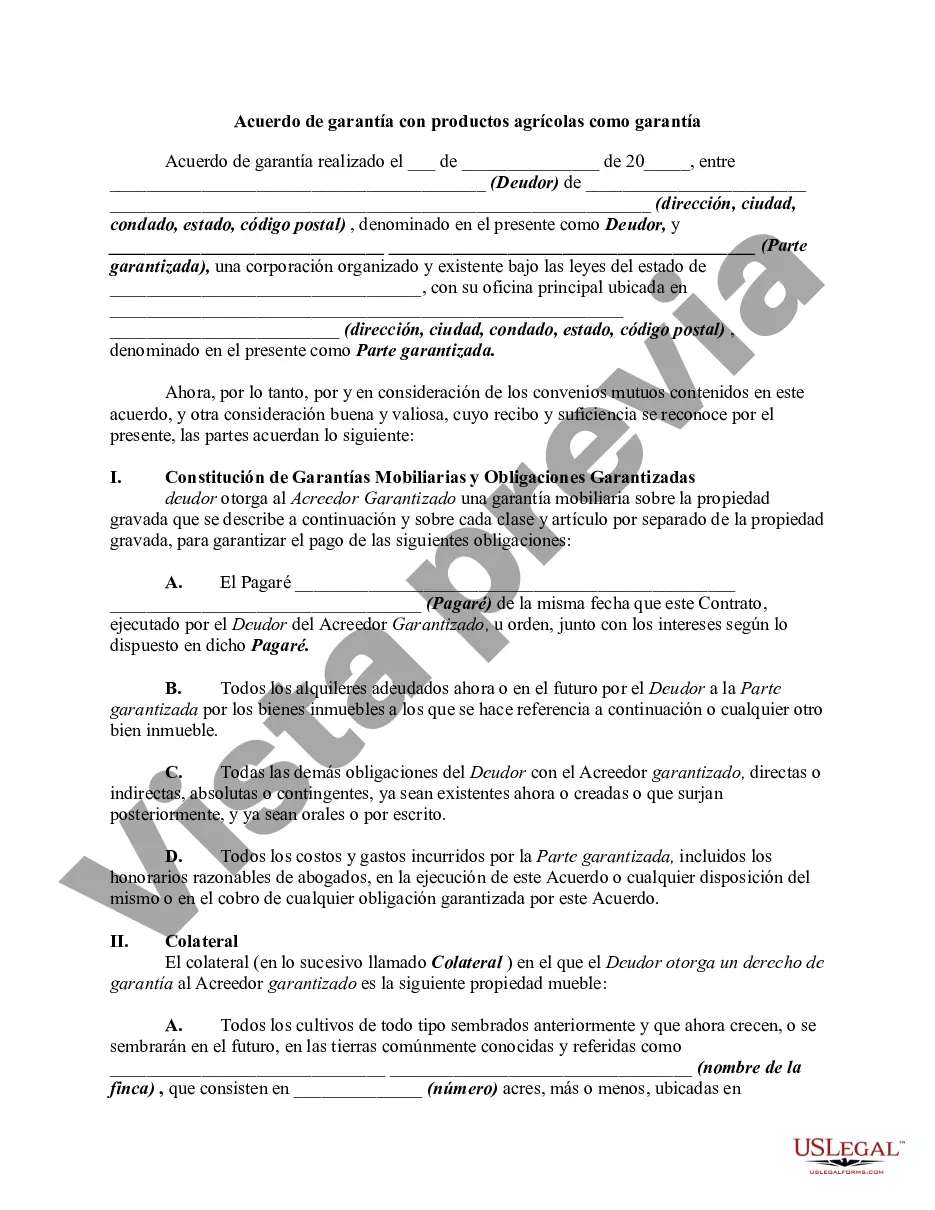

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

A Wake North Carolina Security Agreement with Farm Products as Collateral is a contractual agreement between a borrower (often a farmer or agricultural business) and a lender, typically a financial institution or creditor. This agreement acts as a legal document, outlining the terms and conditions under which the borrower pledges their farm products, such as crops, livestock, or equipment, as collateral to secure a loan. In this type of security agreement, the farmer agrees to provide the lender with a lien or security interest on their farm products. This means that the lender has the right to seize or sell the collateralized farm products if the borrower fails to repay the loan or fulfill other obligations stated in the agreement. The agreement also specifies the duration of the security interest, repayment schedule, interest rates, and any additional conditions that the borrower must adhere to. The Wake North Carolina Security Agreement with Farm Products as Collateral is important for both borrowers and lenders. For borrowers, it provides access to much-needed capital for various purposes, such as purchasing or upgrading farming equipment, buying seeds or fertilizers, or managing day-to-day operations. Meanwhile, lenders benefit from the security provided by the collateral, ensuring a reduced level of risk in case of default or non-payment. There may be different types of Wake North Carolina Security Agreements with Farm Products as Collateral, depending on the specific circumstances and parties involved. Some variations could include: 1. Crop-specific Security Agreement: This type of agreement may focus solely on crops as collateral. It would outline the lender's rights and the borrower's obligations concerning the handling, sale, or storage of the crops until the loan is repaid. 2. Livestock-specific Security Agreement: Similar to the crop-specific agreement, this variation focuses on livestock, such as cattle, poultry, or swine, as the pledged collateral. It would detail the lender's rights and the borrower's responsibilities regarding the management and sale of the livestock. 3. Equipment-specific Security Agreement: In some cases, the agreement may encompass only farm machinery, tractors, or other equipment used in farming operations. This type of agreement would describe how the lender can exercise their rights in the event of default, including the possibility of repossessing or selling the equipment to recover the debt. Overall, a Wake North Carolina Security Agreement with Farm Products as Collateral serves to protect the interests of both borrowers and lenders involved in agricultural transactions. By clearly outlining the rights and obligations of each party, it helps maintain a fair and transparent relationship, encourages responsible lending practices, and provides a legal framework for disputes or conflicts that may arise during the loan term.A Wake North Carolina Security Agreement with Farm Products as Collateral is a contractual agreement between a borrower (often a farmer or agricultural business) and a lender, typically a financial institution or creditor. This agreement acts as a legal document, outlining the terms and conditions under which the borrower pledges their farm products, such as crops, livestock, or equipment, as collateral to secure a loan. In this type of security agreement, the farmer agrees to provide the lender with a lien or security interest on their farm products. This means that the lender has the right to seize or sell the collateralized farm products if the borrower fails to repay the loan or fulfill other obligations stated in the agreement. The agreement also specifies the duration of the security interest, repayment schedule, interest rates, and any additional conditions that the borrower must adhere to. The Wake North Carolina Security Agreement with Farm Products as Collateral is important for both borrowers and lenders. For borrowers, it provides access to much-needed capital for various purposes, such as purchasing or upgrading farming equipment, buying seeds or fertilizers, or managing day-to-day operations. Meanwhile, lenders benefit from the security provided by the collateral, ensuring a reduced level of risk in case of default or non-payment. There may be different types of Wake North Carolina Security Agreements with Farm Products as Collateral, depending on the specific circumstances and parties involved. Some variations could include: 1. Crop-specific Security Agreement: This type of agreement may focus solely on crops as collateral. It would outline the lender's rights and the borrower's obligations concerning the handling, sale, or storage of the crops until the loan is repaid. 2. Livestock-specific Security Agreement: Similar to the crop-specific agreement, this variation focuses on livestock, such as cattle, poultry, or swine, as the pledged collateral. It would detail the lender's rights and the borrower's responsibilities regarding the management and sale of the livestock. 3. Equipment-specific Security Agreement: In some cases, the agreement may encompass only farm machinery, tractors, or other equipment used in farming operations. This type of agreement would describe how the lender can exercise their rights in the event of default, including the possibility of repossessing or selling the equipment to recover the debt. Overall, a Wake North Carolina Security Agreement with Farm Products as Collateral serves to protect the interests of both borrowers and lenders involved in agricultural transactions. By clearly outlining the rights and obligations of each party, it helps maintain a fair and transparent relationship, encourages responsible lending practices, and provides a legal framework for disputes or conflicts that may arise during the loan term.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.