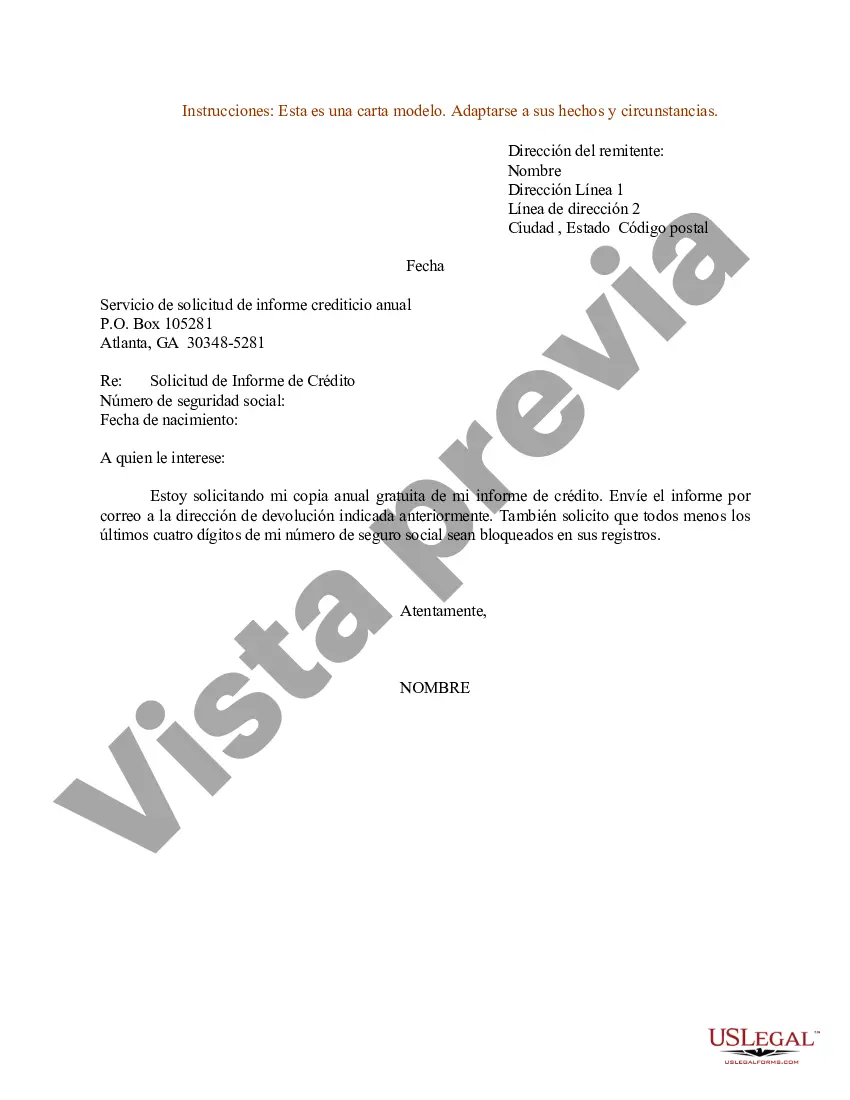

Subject: Request for Free Credit Report — Your Right Protected under Federal Law! Dear [Credit Bureau Name], I hope this letter finds you well. I am writing to you today to exercise my right as a consumer, as allowed by the Fair Credit Reporting Act (FCRA), to request a free credit report. As a resident of San Antonio, Texas, I want to ensure that my financial reputation is accurately reflected and that everything is in order. San Antonio, the seventh-most populous city in the United States, is a vibrant and bustling city known for its rich history, diverse culture, and friendly community. Located in the heart of Texas, San Antonio offers a unique blend of tradition and modernity, attracting millions of visitors each year. It is under the purview of this federal law that I kindly ask you to provide me with detailed information about my credit history and standing. As a diligent consumer, I believe that regularly reviewing my credit report is essential in maintaining financial health and addressing any potential discrepancies or inaccuracies that may adversely affect my creditworthiness. By obtaining my credit report, I will be able to examine various important factors, such as my credit utilization, payment history, existing loans, and any potentially negative marks. Understanding this information will empower me to take control of my financial well-being and make informed decisions regarding my future financial endeavors. I kindly request that you provide me with a comprehensive credit report from all three credit bureaus, namely Equifax, Experian, and TransUnion, as mandated by federal law. This comprehensive report will enable me to conduct a thorough review and address any inconsistencies or incorrect information, if present. I understand that, according to the FCRA, I am entitled to receive one free credit report from each of the three major credit bureaus every twelve months. Therefore, please provide corresponding credit reports from each bureau named above, ensuring that the reports are accurate, up-to-date, and inclusive of all necessary details. In order to facilitate this request, I have provided the required information below: Full Name: [Your Full Name] Social Security Number: [Your Social Security Number] Date of Birth: [Your Date of Birth] Current Address: [Your Current Address] Previous Address (if applicable): [Your Previous Address] I sincerely appreciate your cooperation in this matter, and thank you for promptly addressing my request. As an active citizen of San Antonio, I believe in my right to access and review my credit information, as ensured by the FCRA. Please reply to this letter at your earliest convenience, confirming the receipt of my request and providing an estimated timeframe within which I may expect to receive the requested credit reports. Alternatively, if any additional information is needed, kindly let me know so that I can promptly provide it. Thank you for understanding the significance of this request and assisting me in obtaining the necessary information to make informed financial decisions. I trust that you will handle this matter with the utmost professionalism and diligence. Sincerely, [Your Full Name] [Your Contact Information]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Ejemplo de carta de solicitud de informe de crédito gratuito permitido por la ley federal - Sample Letter for Request for Free Credit Report Allowed by Federal Law

Description

How to fill out San Antonio Texas Ejemplo De Carta De Solicitud De Informe De Crédito Gratuito Permitido Por La Ley Federal?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the San Antonio Sample Letter for Request for Free Credit Report Allowed by Federal Law, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the recent version of the San Antonio Sample Letter for Request for Free Credit Report Allowed by Federal Law, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Sample Letter for Request for Free Credit Report Allowed by Federal Law:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your San Antonio Sample Letter for Request for Free Credit Report Allowed by Federal Law and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Como mejorar tu calificacion crediticia Paga tu tarjeta de credito y otras facturas a tiempo.Revisa tus informes de credito.No solicites muchas tarjetas de credito a la vez.No abras demasiadas cuentas de credito nuevas a la vez.No canceles las tarjetas no utilizadas (a menos que debas pagar una tarifa anual).

5 formas para mejorar tu score de credito Crea tu historial crediticio. Paga tus deudas a tiempo. Si tienes obligaciones vencidas ponte al dia. Manten bajos los balances de tu tarjeta de credito. Altos niveles de deuda pueden lesionar tu score. Aplica a nuevas lineas de credito solo cuando las necesitas.

¿Que debo incluir en mi carta de disputa crediticia? La fecha actual. Su informacion (nombre, informacion de contacto, fecha de nacimiento y numero de cuenta) La informacion de contacto de la agencia de credito. Una breve descripcion del error (no es necesario contarles una historia larga y complicada)

Ocho pasos para eliminar deudas antiguas de tu reporte crediticio Verifica la antiguedad.Confirma la antiguedad de la deuda saldada.Obten los tres reportes de credito.Envia cartas a las agencias de credito.Envia una carta al acreedor informante.Consigue una atencion especial.

5 maneras de mejorar su puntaje de credito Su historial de pago juega un papel importante al determinar su puntaje de credito. Trate de mantener sus saldos por debajo del 30% de su credito total disponible. Mantener abiertas las cuentas de tarjetas de credito antiguas puede mejorar su salud crediticia.

6 maneras de llegar a un puntaje de credito de 800 rapidamente.Revise su reporte de credito.Dispute los errores de su reporte de credito.Pague las deudas de las tarjetas de credito.Haga todos los pagos a tiempo.No cierre las cuentas antiguas.No se exceda con las nuevas solicitudes de credito.

Asegurese de incluir los siguientes datos en su carta: Su nombre y numero de cuenta. El monto en dolares del cargo en disputa. La fecha del cargo en disputa. Una explicacion de los motivos por los que piensa que ese cargo es incorrecto.

Una carta de disputa de credito es un documento que puede enviar a las agencias de credito para senalar inexactitudes en sus informes de credito y solicitar la eliminacion de los errores (en ingles). En la carta, puede explicar por que cree que las informaciones son inexactas y proveer los documentos de respaldo.

Rangos de puntajes de credito Rango de puntaje de creditoVantageScore 3.0FICOMuy buenoN/A740799Bueno661780670739Regular601660580669Deficiente500600< 5802 more rows ?

Como conseguir sus informes de credito gratis Una vez al ano usted puede solicitar una copia de cada compania a traves de Annualcreditreport.com (en ingles) o llamando al 1-877-322-8228. La Comision Federal de Comercio ofrece mas informacion sobre estos informes de credito gratis.

Interesting Questions

More info

Get Legal Help with your Business: Contact us for a free quote. Contact us for a free quote. Legal Aid: Get free consultation. Get free consultation. Small Claims Courts: Check your local courthouse for available services. Check your local courthouse for available services. Free Legal Counsel: Call for no-cost access to free legal advice from lawyers in your community. Call for no-cost access to free legal advice from lawyers in your community. Free Legal Services: Get started with Legal Aid Southern California or visit sclc.org/legalhelp. Get started with Legal Aid Southern California or visit sclc.org/legalhelp.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.