Riverside California Transfer under the Uniform Transfers to Minors Act — Multistate Form is a legal document used for transferring assets or property to minors in the state of Riverside, California. This form is governed by the Uniform Transfers to Minors Act (TMA), which is a statute that allows individuals to make gifts or transfers to minors without the need for a formal trust. The Riverside California Transfer under the Uniform Transfers to Minors Act — Multistate Form serves as an efficient and convenient way to transfer assets to minors while ensuring supervision and control until they reach the age of majority. It provides a framework for managing the minor's assets and protects their interests until they are old enough to take control of the property themselves. This multistate form is specifically designed to be used in Riverside, California, and adheres to the laws and regulations specific to that jurisdiction. It may also include additional clauses or provisions that are relevant to Riverside County. Different types of Riverside California Transfer under the Uniform Transfers to Minors Act — Multistate Forms may vary based on the nature of the assets being transferred and the specific terms and conditions set by the transferor. Some common variations include: 1. Financial Asset Transfer: This form is used when transferring financial assets such as cash, stocks, bonds, or mutual funds to a minor beneficiary. 2. Real Estate Transfer: This form is utilized when transferring ownership or interest in real estate properties, including residential or commercial properties, to a minor. 3. Intellectual Property Transfer: This form applies to the transfer of copyrights, patents, trademarks, or other intellectual property rights to a minor. Each type of Riverside California Transfer under the Uniform Transfers to Minors Act — Multistate Form serves a specific purpose and may have varying requirements and considerations. It is crucial to consult with an attorney or legal professional to ensure that the form is properly completed and tailored to meet the specific needs of the transferor and the minor beneficiary.

Riverside California Transfer under the Uniform Transfers to Minors Act - Multistate Form

Description

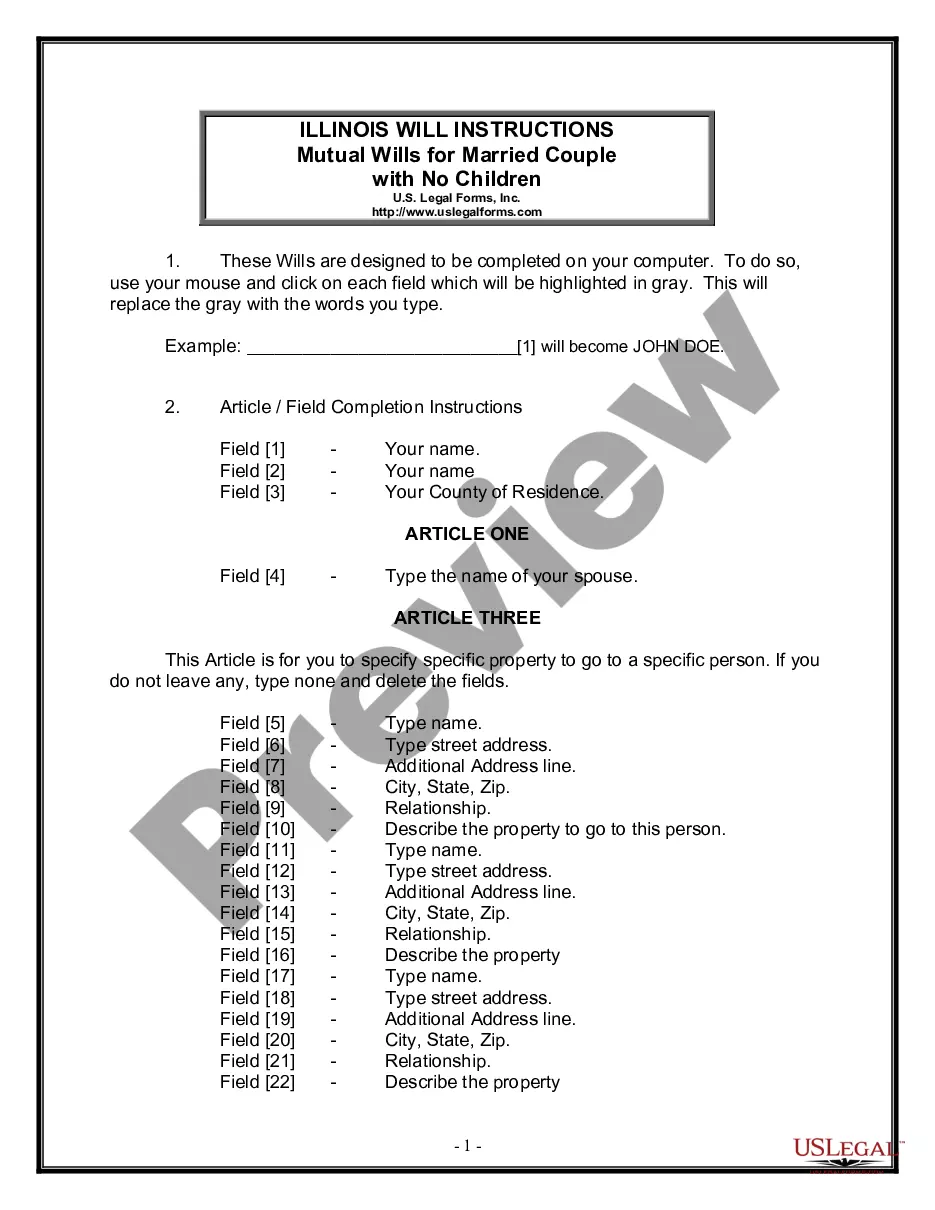

How to fill out Riverside California Transfer Under The Uniform Transfers To Minors Act - Multistate Form?

How much time does it typically take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, finding a Riverside Transfer under the Uniform Transfers to Minors Act - Multistate Form meeting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. In addition to the Riverside Transfer under the Uniform Transfers to Minors Act - Multistate Form, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Riverside Transfer under the Uniform Transfers to Minors Act - Multistate Form:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Riverside Transfer under the Uniform Transfers to Minors Act - Multistate Form.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

The California Uniform Transfers to Minors Act (CUTMA) is a modernization of the Uniform Gift to Minors Act, and became effective in 1985. A gift made pursuant to CUTMA is held in custodianship until age 18 unless the gift specifies a termination age beyond 18, but not over 25 years of age.

The Uniform Transfers to Minors Act (UTMA) allows a minor to receive gifts without the aid of a guardian or trustee. The law is an extension of the Uniform Gift to Minors Act. The minor named in the UTMA can avoid tax consequences until they attain legal age for the state in which the account is set up.

The Uniform Transfers to Minors Act (UTMA) allows an adult to transfer assets to a minor by opening a custodial account for them. This type of account is managed by an adult the custodian who holds onto the assets until the minor reaches a certain age, usually 18 or 21.

When children reach the age of majority, the account can be transferred into their name only with custodian consent. Otherwise, they can remove the custodian from the account at the age of termination. Ask your brokerage firm what ages apply to your son's accounts and the steps you need to take at each point.

Key Takeaways. Under the Uniform Transfers to Minors Act (UMTA), money deposited into a UTMA account typically can't be withdrawn except by the child at the appropriate age. A UTMA custodian may be able to use some custodial assets for the "use and benefit of the minor."

When the child reaches a certain age (generally between 18 and 25, varying by state), assets and control of the account must be transferred to them.

Finally, the age of majority for an UGMA is normally lower than that of an UTMA. In most states, the custodianship of an UGMA account will end when the beneficiary reaches either 18 or 21. With an UTMA, it's more common for the custodianship to last until age 21 if not longer.

The Uniform Transfers to Minors Act (UTMA) allows gift givers to transfer money or other gifts like real estate or fine art to a minor child without the need for a guardian or trustee.

Age of Majority and Trust Termination StateUGMAUTMAArkansas2121California1818Colorado2121Connecticut212149 more rows

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child'susually lowertax rate, rather than the parent's rate. For some families, this savings can be significant. Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate.

Interesting Questions

More info

In 1977, an employer was prosecuted in a human rights class action involving allegations of unlawful termination of employment and harassment resulting from the failure of an employer to provide accommodation for a psychiatric disability. The employer appealed, and the Supreme Court of Canada dismissed the appeal for the reasons that (1) the complaint failed to plead a “plain claim” under the Canadian Charter of Rights and Freedoms, (2) the complaint did not contain proper affidavits of two witnesses, and (3) the complaint failed because it failed to state facts upon which relief could be granted. The Court found that: [s]such an action had no genuine possibility of success because it failed to plead a claim that the plaintiff suffered an act of discrimination, and that discrimination was a prohibited ground of discrimination under Section 10(a).

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.