Harris Texas Triple Net Lease (NNN Lease) is a type of commercial lease arrangement commonly used in real estate. It involves the leasing of a property where the tenant assumes responsibility for paying not only the base rent but also property taxes, insurance, and maintenance costs. This puts a significant financial burden on the tenant, reducing the landlord's expenses and maximizing their return on investment. In a Harris Texas Triple Net Lease, the tenant is responsible for property taxes, which are assessed by the local government based on the value of the property. This includes real estate taxes, personal property taxes, and any other taxes tied to the property. The tenant handles the paperwork and payments, ensuring compliance with local tax regulations. Insurance costs, another aspect of a triple net lease, are also the responsibility of the tenant. This includes property insurance to protect against damage or loss, liability insurance for any accidents or injuries that may occur on the property, and in some cases, even flood or earthquake insurance. Maintenance expenses are an essential part of a triple net lease. The tenant is generally responsible for all repairs, maintenance, and general upkeep of the property. This includes routine servicing, landscaping, snow removal, HVAC maintenance, and any structural repairs that may be required. The lease terms should clearly outline the tenant's obligations in terms of maintenance and repair, specifying how costs will be handled. Despite the financial responsibilities entailed in a Harris Texas Triple Net Lease, it offers certain advantages for both tenants and landlords. For tenants, a triple net lease allows them to have greater control over the property and tailor it to their specific needs. They often have longer lease terms, providing stability for their business operations. On the other hand, landlords benefit from a steady income stream without the added expenses typically associated with property ownership. In Harris County, Texas, there are several variations of the triple net lease, including: 1. Single-tenant NNN Lease: This lease involves a single tenant who is exclusively responsible for all expenses associated with the property. 2. Multi-tenant NNN Lease: In this type of lease, multiple tenants share the financial responsibilities associated with the property, such as property taxes, insurance, and maintenance costs. Typically, these responsibilities are divided based on the tenant's occupied area or proportional rent. 3. Ground Lease with NNN provisions: This type of triple net lease is often used when leasing land for development purposes. The tenant is responsible for all expenses related to land maintenance, property construction, and other applicable costs. Harris Texas Triple Net Leases are a common arrangement in commercial real estate, allowing both tenants and landlords to establish clear cost-sharing agreements. It is crucial for both parties to carefully review and understand the lease terms to avoid any misunderstandings or disputes relating to financial responsibilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Arrendamiento neto triple - Triple Net Lease

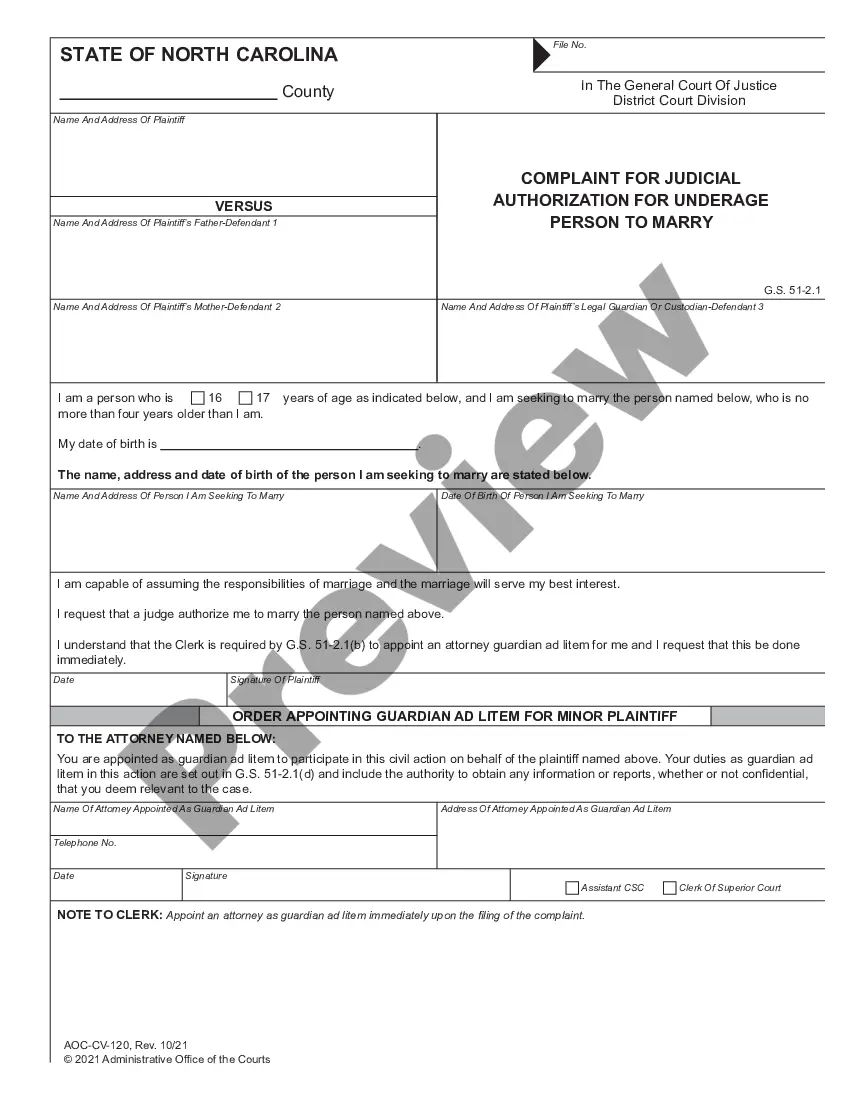

Description

How to fill out Harris Texas Arrendamiento Neto Triple?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your county, including the Harris Triple Net Lease.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Harris Triple Net Lease will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the Harris Triple Net Lease:

- Ensure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Harris Triple Net Lease on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!