Orange County, California, is a vibrant and affluent region known for its beautiful landscape, diverse culture, and numerous business opportunities. One popular form of commercial leasing in this area is the Orange California Triple Net Lease, which allows businesses to rent properties while taking responsibility for various expenses. A Triple Net Lease, commonly referred to as NNN lease, is a type of lease agreement where the tenant assumes the responsibility for paying property taxes, insurance premiums, and maintenance costs, in addition to the base rent. This arrangement is highly favored by landlords as it allows them to pass on some property-related expenses to the tenant, easing their financial burden. In Orange California, there are different types of Triple Net Leases tailored to specific needs and preferences: 1. Absolute Triple Net Lease: This type of lease places the highest level of responsibility on the tenant, requiring them to pay for all operating expenses, including structural repairs and replacements. 2. Modified Gross Triple Net Lease: In this lease, the tenant pays for the base rent, a portion of property taxes, and insurance premiums. However, the landlord assumes responsibility for maintenance costs. 3. Bendable Lease: Typically used for high-value properties, this lease includes an additional bond that the tenant must obtain as collateral against any potential damages. 4. Ground Lease: This lease applies to tenants who wish to lease land only, allowing them to construct and operate their own building. The tenant is responsible for all costs, including land development, construction, and maintenance. 5. Sale-Leaseback: In this unique arrangement, a property owner sells their property to an investor and then leases it back for a specific period. The investor becomes the landlord, and the original owner becomes the tenant, assuming the responsibilities associated with a Triple Net Lease. Triple Net Leases often benefit both landlords and tenants. Landlords can enjoy a steady income stream while offloading some financial obligations, while tenants can gain the flexibility to manage and control the property as per their business needs. In conclusion, Orange California Triple Net Leases offer businesses the opportunity to rent commercial properties while taking responsibility for various property expenses. These leases come in different types, such as Absolute Triple Net Lease, Modified Gross Triple Net Lease, Bendable Lease, Ground Lease, and Sale-Leaseback, catering to the diverse needs of tenants in Orange County, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Arrendamiento neto triple - Triple Net Lease

Description

How to fill out Orange California Arrendamiento Neto Triple?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Orange Triple Net Lease.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Orange Triple Net Lease will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Orange Triple Net Lease:

- Ensure you have opened the right page with your local form.

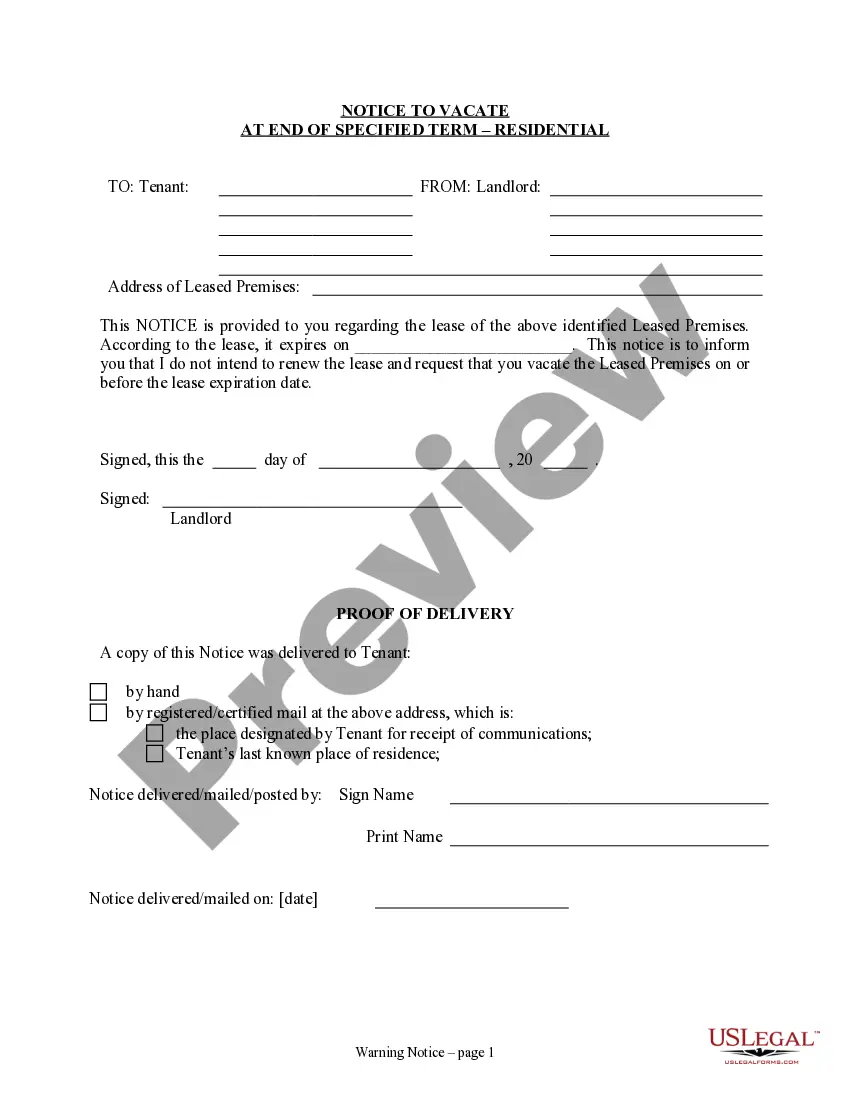

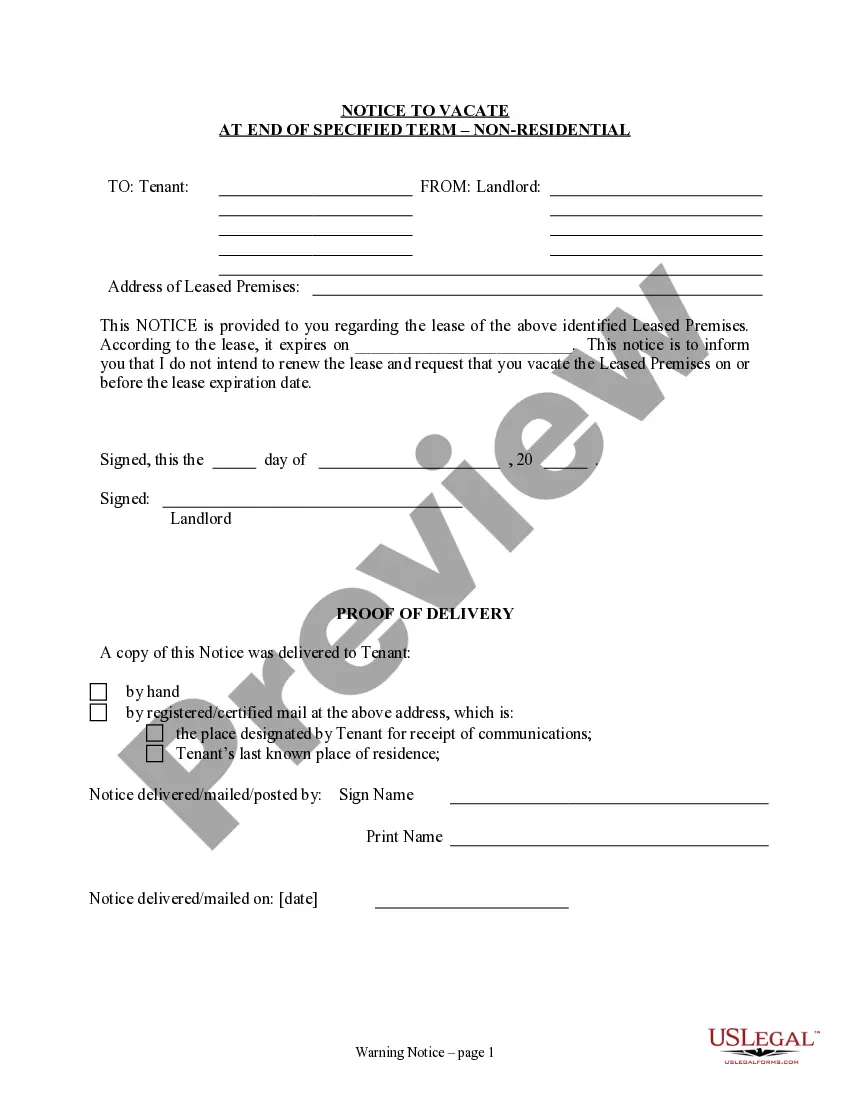

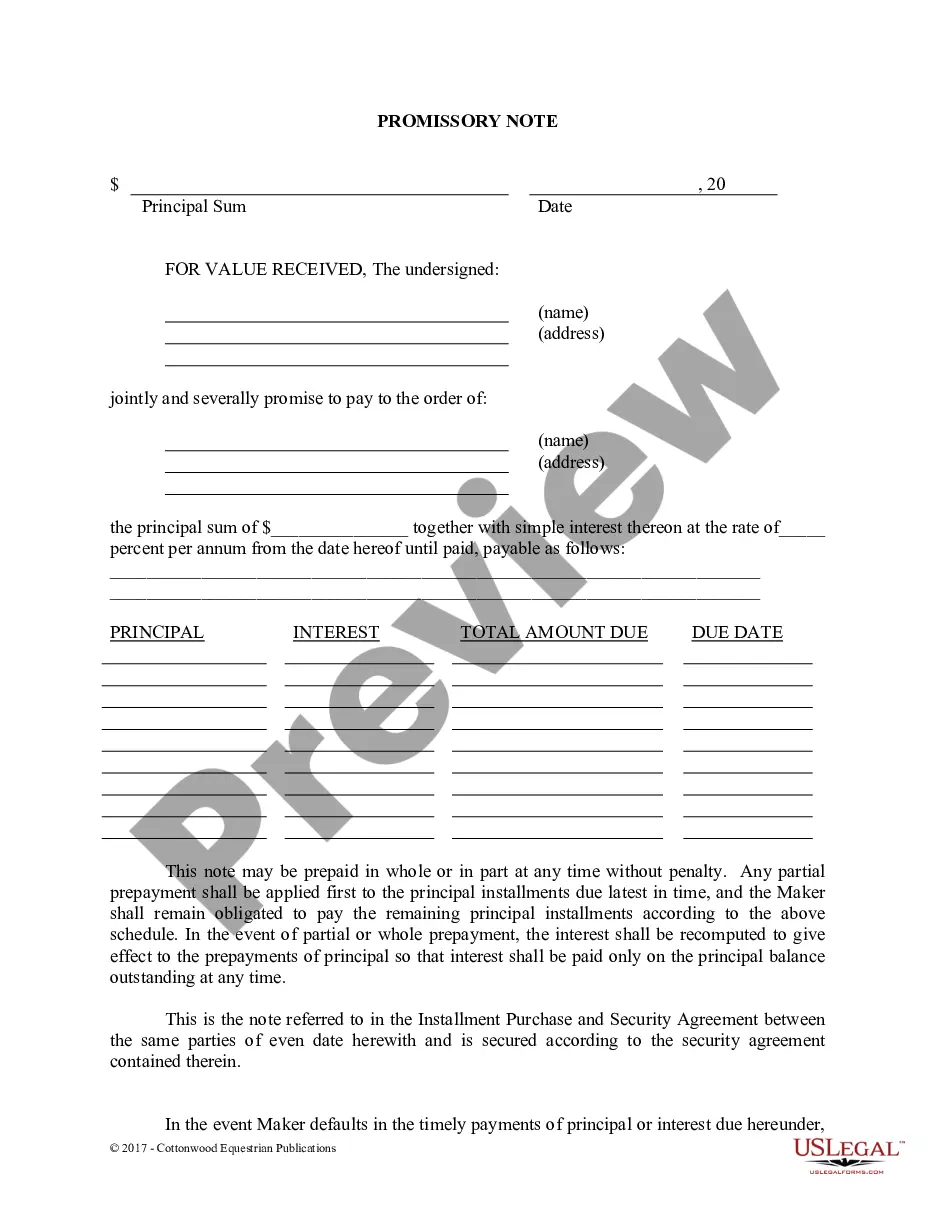

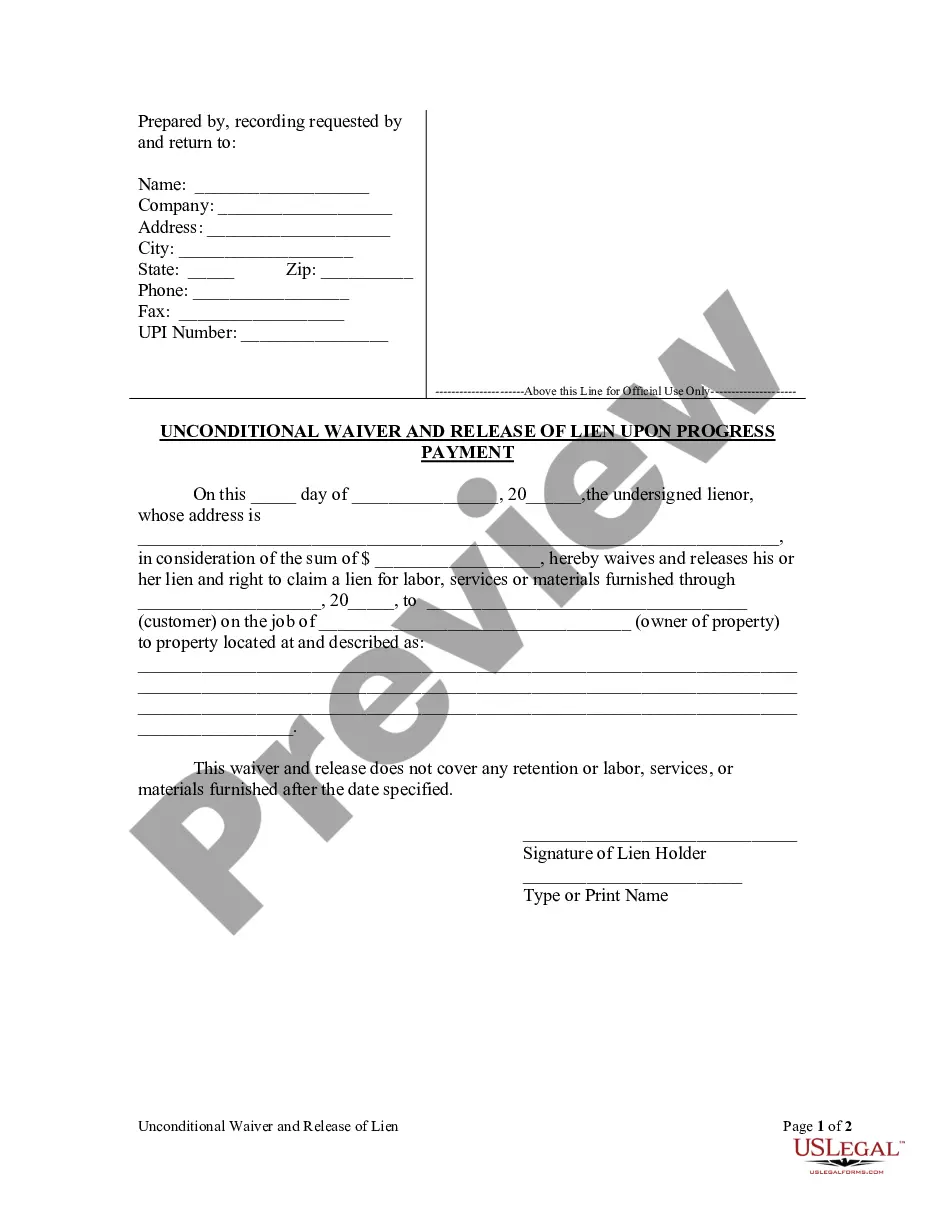

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Orange Triple Net Lease on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!