In today's tax system, estate and gift taxes may be levied every time assets change hands from one generation to the next. Dynasty trusts avoided those taxes by creating a second estate that could outlive most of the family members, and continue providing for future generations. Dynasty trusts are long-term trusts created specifically for descendants of all generations. Dynasty trusts can survive 21 years beyond the death of the last beneficiary alive when the trust was written.

Palm Beach, Florida is a renowned coastal town famous for its picturesque beaches, luxury lifestyle, and vibrant cultural scene. In this affluent community, individuals or families often establish Irrevocable Generation Skipping or Dynasty Trust Agreements for the Benefit of Trust or's Children and Grandchildren. These legal arrangements aim to ensure the smooth transfer of wealth across successive generations while maximizing tax benefits and asset protection. Firstly, let's explore the concept of an Irrevocable Generation Skipping Trust (GST). This type of trust involves the transfer of assets directly to grandchildren or subsequent generations, bypassing the children as immediate beneficiaries. By doing so, the trust or can potentially minimize estate taxes that would otherwise be imposed upon their children's inheritances. A Palm Beach Irrevocable Generation Skipping Trust Agreement for the Benefit of Trust or's Children and Grandchildren is especially relevant for wealthy individuals looking to strategically preserve their wealth for future generations. Secondly, the Dynasty Trust Agreement is another popular option in Palm Beach. Similar to the GST, the Dynasty Trust aims to provide long-term financial benefits to multiple generations. However, unlike the GST, this arrangement allows for ongoing control over the trust's assets by a designated trustee. By creating a Palm Beach Dynasty Trust Agreement, the trust or can ensure the wealth remains within the family bloodline while providing support for their descendants, including children and grandchildren. Palm Beach, Florida, being a community with a significant population of affluent residents, often witnesses the creation of various types of Irrevocable Generation Skipping or Dynasty Trust Agreements for the Benefit of Trust or's Children and Grandchildren. Some specific examples include charitable dynasty trusts, incentive dynasty trusts, and personal residence dynasty trusts. A charitable dynasty trust enables the trust or to leave a portion of their estate to a chosen charitable organization while also providing for the future financial well-being of their children and grandchildren. This arrangement ensures that philanthropic endeavors and the family's financial security are simultaneously taken care of. Incentive dynasty trusts serve as a means to motivate beneficiaries towards achieving specific goals or milestones by offering monetary rewards. By setting conditions within the trust, such as educational achievements or successful entrepreneurial ventures, the trust or can encourage their descendants to strive for personal growth and accomplishments. Lastly, a personal residence dynasty trust focuses on preserving a family's primary or vacation residence for future generations. By designating the property within a trust, the family ensures that subsequent generations can continue to enjoy the cherished home while avoiding potential estate taxes and disputes over ownership. To sum up, in Palm Beach, Florida, Irrevocable Generation Skipping or Dynasty Trust Agreements for the Benefit of Trust or's Children and Grandchildren are a popular choice among wealthy individuals seeking to secure their family's financial prosperity for years to come. Whether it be the traditional GST, the versatile Dynasty Trust, or specialized trust variations like charitable, incentive, or personal residence dynasty trusts, these legally binding agreements offer various options for asset protection and tax optimization while safeguarding the legacy of Palm Beach's affluent families.

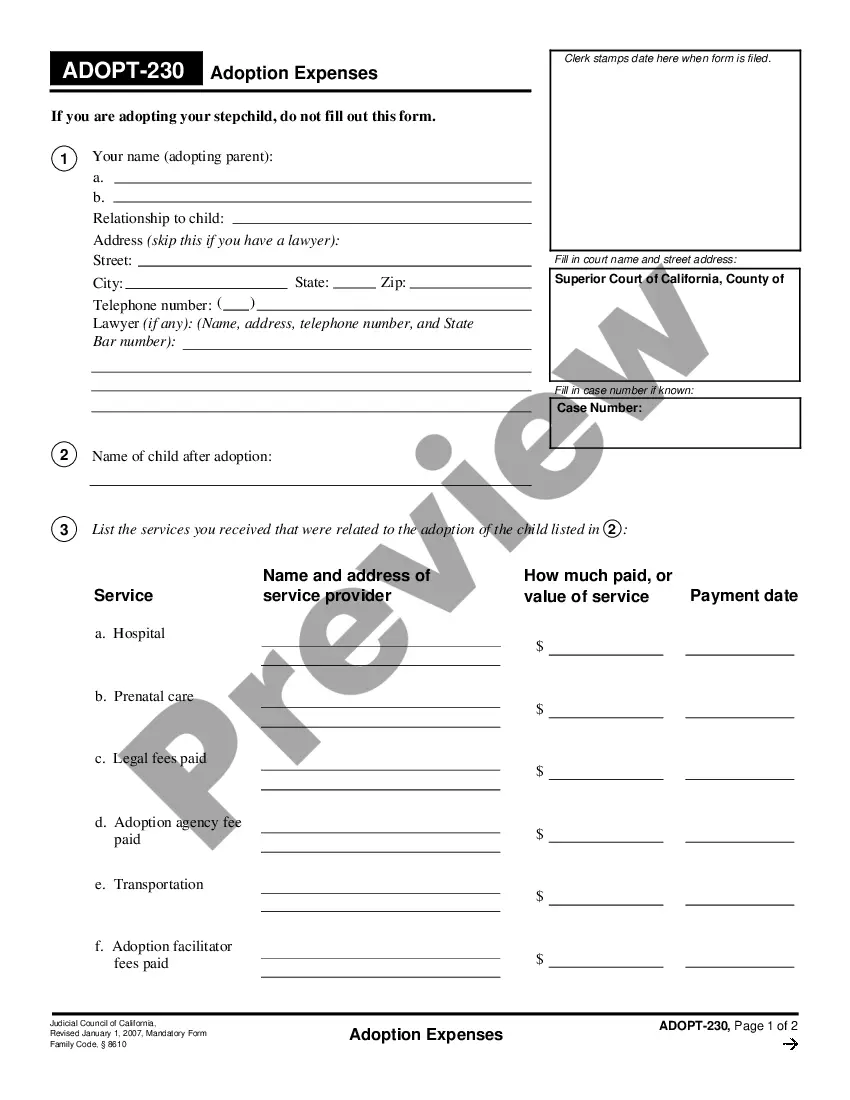

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.