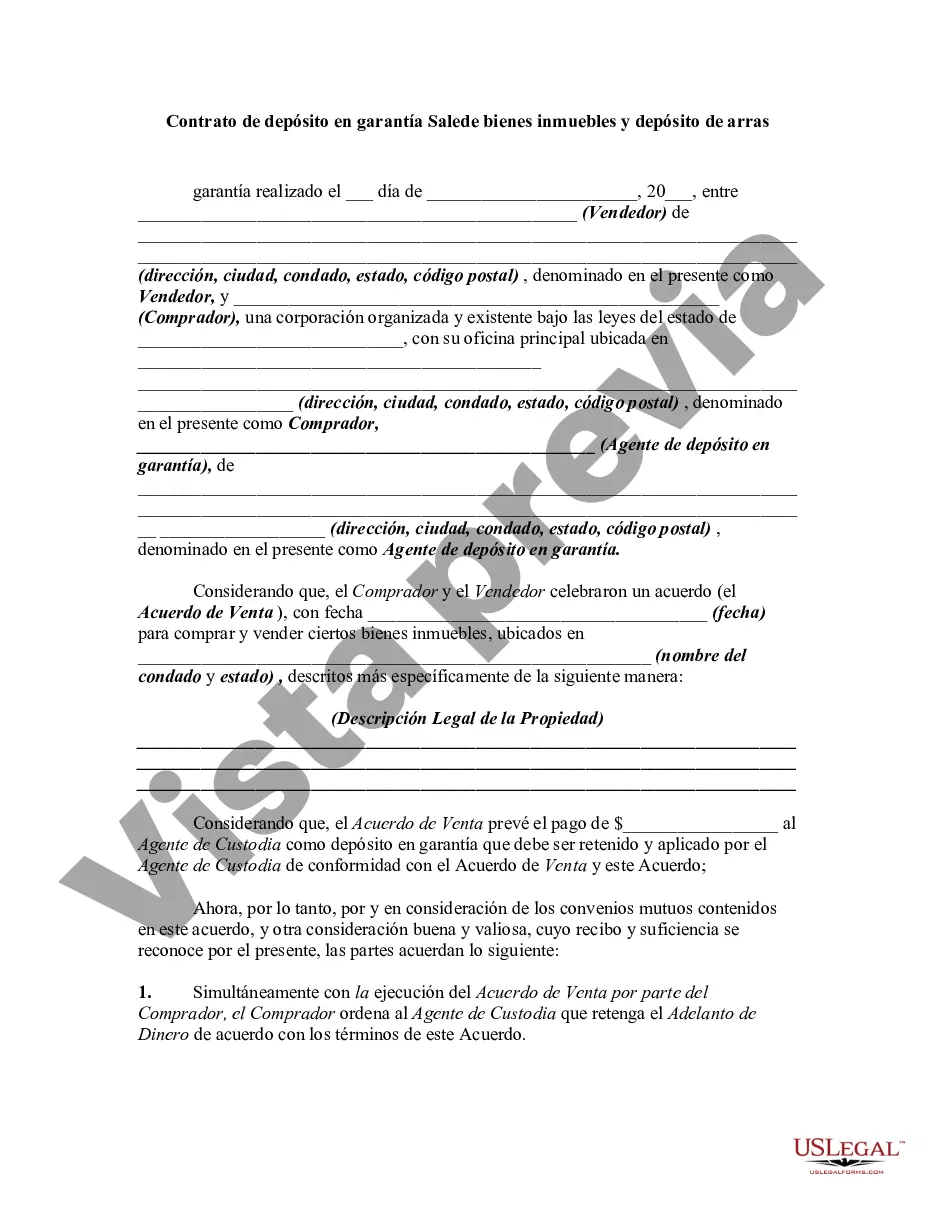

An escrow is the deposit of a written instrument or something of value with a third person with instructions to deliver it to another when a stated condition is performed or a specified event occurs. The use of an escrow is most common in real estate sales transactions where the grantee deposits earnest money with the escrow agent to be delivered to the grantor upon consummation of the purchase and sale of the real estate and performance of other specified conditions.

The San Diego California Escrow Agreement for Sale of Real Property and Deposit of Earnest Money is a legally binding agreement that facilitates the secure and regulated transfer of property ownership. This agreement outlines the rights and responsibilities of the parties involved, including the buyer, seller, and escrow agent. In San Diego, there are various types of escrow agreements for the sale of real property and deposit of earnest money. Some common types include residential escrow agreements, commercial property escrow agreements, and vacant land escrow agreements. A residential escrow agreement is specifically designed for the purchase or sale of single-family homes, condos, townhouses, or other residential properties. It covers the unique aspects of residential real estate transactions, such as contingencies, disclosures, and inspection periods. Commercial property escrow agreements cater to the purchase or sale of commercial buildings, office spaces, retail centers, industrial properties, and more. They often include provisions for lease assignments, environmental assessments, and zoning compliance. Vacant land escrow agreements are used when buying or selling undeveloped land. These agreements may address issues like land use restrictions, survey requirements, and potential environmental concerns related to the land being transferred. Regardless of the specific type, these escrow agreements serve as a safeguard for all parties involved in a real estate transaction. They ensure that the buyer's earnest money deposit is securely held by a neutral third-party escrow agent until all terms and conditions of the sale are met. This can include fulfilling any contingencies, obtaining financing, completing inspections, and adjusting prorated costs like property taxes or insurance. Once these requirements are met, the escrow agent will disburse the earnest money to the seller, and the property's title will be transferred to the buyer. Importantly, if the transaction fails to close due to either party's default or failure to meet agreed-upon conditions, the escrow agreement will outline the steps for refunding the earnest money or resolving any disputes that may arise. In summary, the San Diego California Escrow Agreement for Sale of Real Property and Deposit of Earnest Money is a critical document for facilitating real estate transactions. It ensures a transparent, secure, and fair process for both buyers and sellers, protecting their interests throughout the sale.The San Diego California Escrow Agreement for Sale of Real Property and Deposit of Earnest Money is a legally binding agreement that facilitates the secure and regulated transfer of property ownership. This agreement outlines the rights and responsibilities of the parties involved, including the buyer, seller, and escrow agent. In San Diego, there are various types of escrow agreements for the sale of real property and deposit of earnest money. Some common types include residential escrow agreements, commercial property escrow agreements, and vacant land escrow agreements. A residential escrow agreement is specifically designed for the purchase or sale of single-family homes, condos, townhouses, or other residential properties. It covers the unique aspects of residential real estate transactions, such as contingencies, disclosures, and inspection periods. Commercial property escrow agreements cater to the purchase or sale of commercial buildings, office spaces, retail centers, industrial properties, and more. They often include provisions for lease assignments, environmental assessments, and zoning compliance. Vacant land escrow agreements are used when buying or selling undeveloped land. These agreements may address issues like land use restrictions, survey requirements, and potential environmental concerns related to the land being transferred. Regardless of the specific type, these escrow agreements serve as a safeguard for all parties involved in a real estate transaction. They ensure that the buyer's earnest money deposit is securely held by a neutral third-party escrow agent until all terms and conditions of the sale are met. This can include fulfilling any contingencies, obtaining financing, completing inspections, and adjusting prorated costs like property taxes or insurance. Once these requirements are met, the escrow agent will disburse the earnest money to the seller, and the property's title will be transferred to the buyer. Importantly, if the transaction fails to close due to either party's default or failure to meet agreed-upon conditions, the escrow agreement will outline the steps for refunding the earnest money or resolving any disputes that may arise. In summary, the San Diego California Escrow Agreement for Sale of Real Property and Deposit of Earnest Money is a critical document for facilitating real estate transactions. It ensures a transparent, secure, and fair process for both buyers and sellers, protecting their interests throughout the sale.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.