Title: Rectifying Accounting Errors and Past Due Notices — San Diego, California Introduction: San Diego, California is a renowned city located on the picturesque Pacific coastline. Known for its stunning beaches, vibrant culture, and thriving economy, San Diego is home to numerous businesses and organizations. In the field of accounting, mistakes and past due notices can occur, causing inconvenience and strain on professional relationships. To address this, various types of San Diego, California Sample Letters for Apology for Accounting Errors and Past Due Notices are available. This comprehensive guide provides detailed descriptions of these letters to help rectify any inadvertent errors promptly. 1. Standard Apology Letter for Accounting Errors and Past Due Notices: This type of letter offers a concise apology for accounting errors and delays in sending past due notices. It acknowledges the mistake, reassures the recipient of actions being taken to rectify the issue, and expresses sincere regret for any inconvenience caused. It is a professional and straightforward letter that aims to mend relationships and restore trust. 2. Formal Business Apology Letter for Accounting Errors and Past Due Notices: The formal business apology letter is suitable for organizations that wish to maintain a formal tone while expressing accountability for the accounting errors. It emphasizes professionalism, acknowledges the impact of the errors, and provides reassurance regarding improved practices and procedures to prevent recurrences. This type of letter is usually used when addressing clients, business partners, or stakeholders. 3. Personalized Apology Letter for Accounting Errors and Past Due Notices: In certain cases, a personalized approach may be necessary to address significant accounting errors and past due notices. This type of letter includes specific details about the situation such as the recipient's name, account number, and the nature of the error. It permits a more tailored and empathetic apology, showing the recipient that their case is taken seriously and individually addressed. 4. Legal Compliance Apology Letter for Accounting Errors and Past Due Notices: When accounting errors create legal implications or contractual breaches, a legal compliance apology letter is vital. This type of letter focuses on acknowledging any potential legal consequences, expressing regret, and outlining steps being taken to rectify the situation. It reflects the importance of strict adherence to legal obligations and the intention to rectify the issues promptly. 5. Urgent Response Apology Letter for Accounting Errors and Past Due Notices: In situations where the errors or past due notices have caused significant distress, an urgent response apology letter provides immediate reassurance and addresses the issue promptly. This type of letter is drafted promptly, ensuring that the recipient is informed of the steps being taken to rectify the situation urgently. It aims to alleviate any anxiety or frustration experienced due to the accounting errors or overdue notices. Conclusion: San Diego, California Sample Letters for Apology for Accounting Errors and Past Due Notices encompass a range of options based on the severity and nature of the situation. Choosing the appropriate letter type allows businesses and organizations to maintain professional relationships, resolve conflicts, and take accountability for their mistakes. By utilizing these sample letters, one can navigate the process of acknowledging errors and rectifying financial discrepancies in a manner that protects professional relationships and promotes trust and transparency.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Modelo de carta de disculpa por errores contables y avisos de vencimiento - Sample Letter for Apology for Accounting Errors and Past Due Notices

Description

How to fill out San Diego California Modelo De Carta De Disculpa Por Errores Contables Y Avisos De Vencimiento?

Preparing documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft San Diego Sample Letter for Apology for Accounting Errors and Past Due Notices without professional help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid San Diego Sample Letter for Apology for Accounting Errors and Past Due Notices by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the San Diego Sample Letter for Apology for Accounting Errors and Past Due Notices:

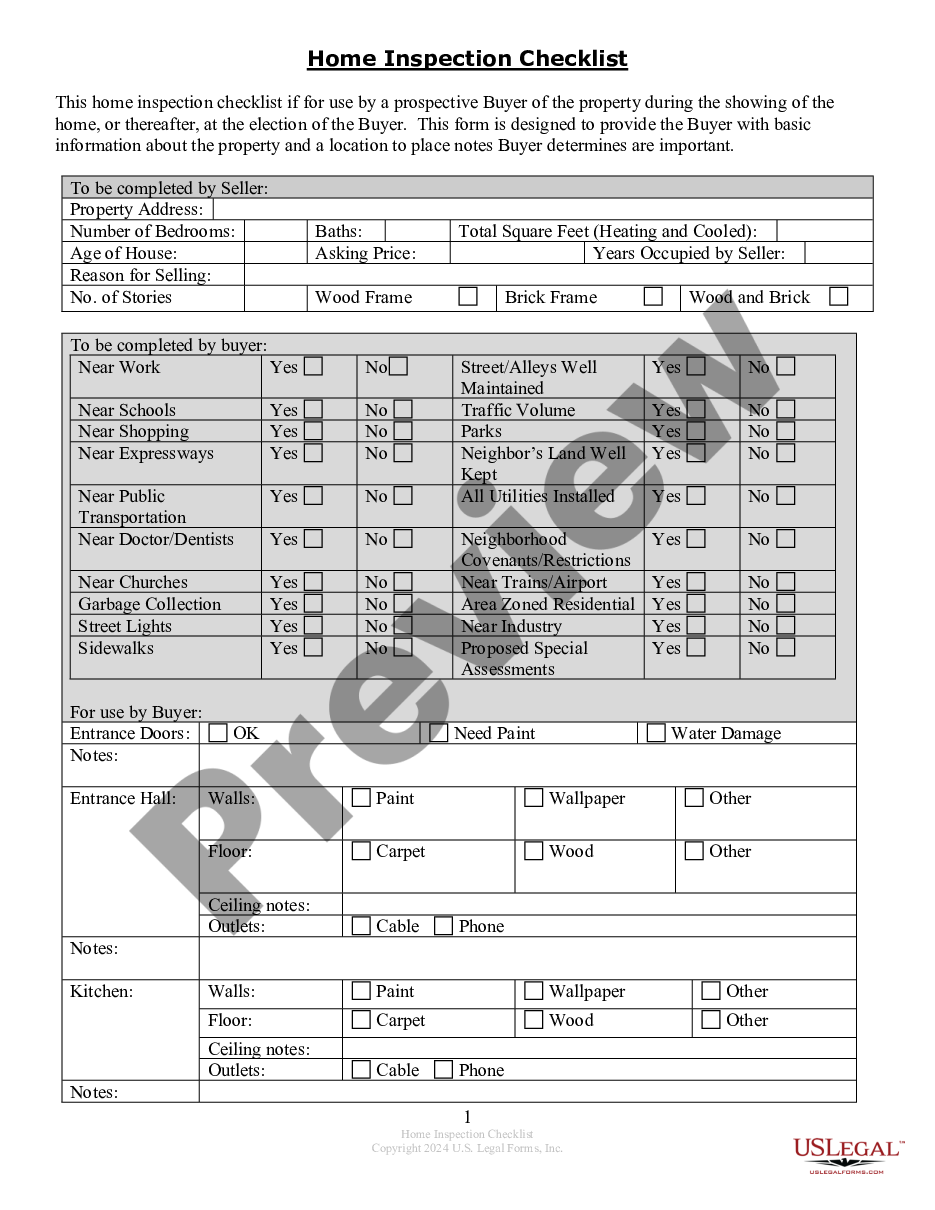

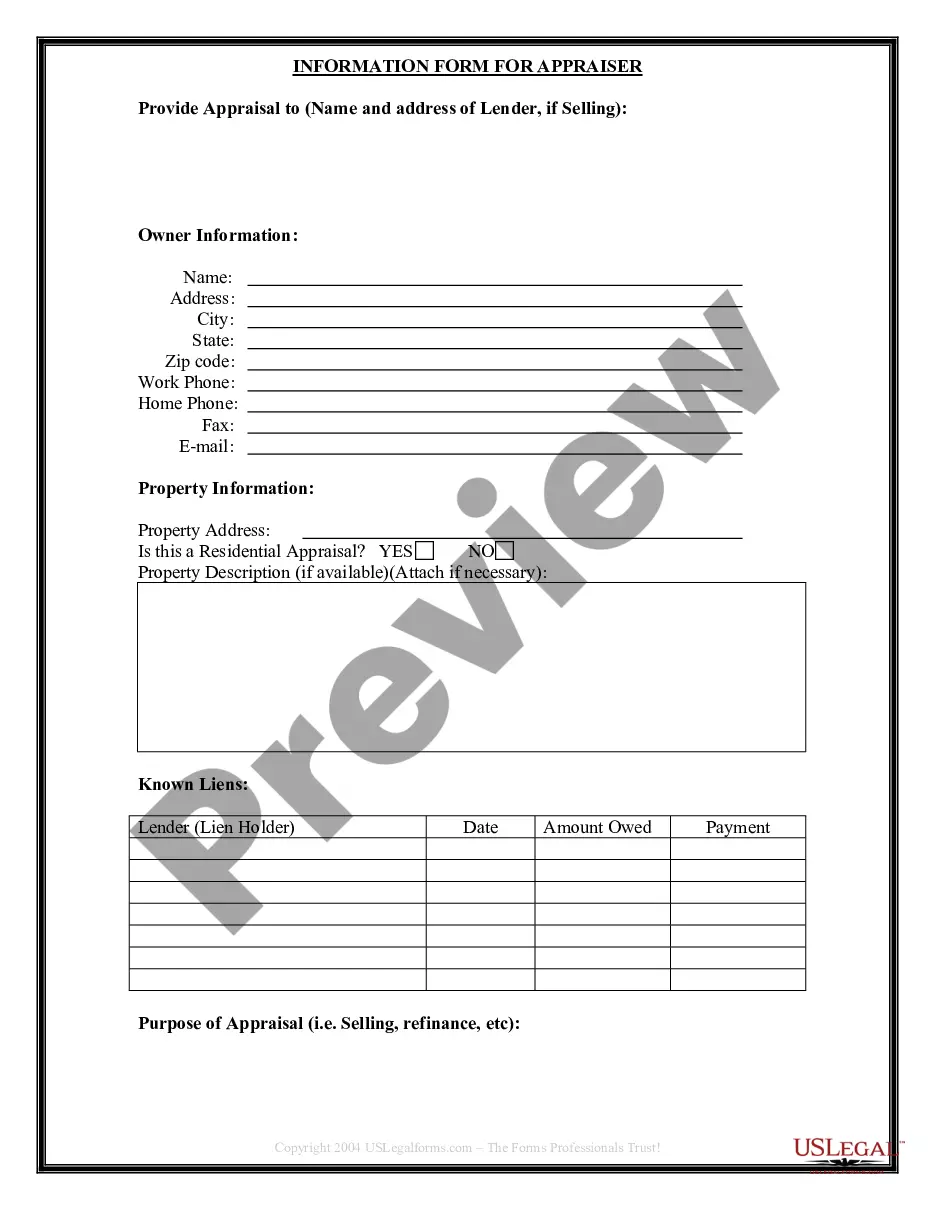

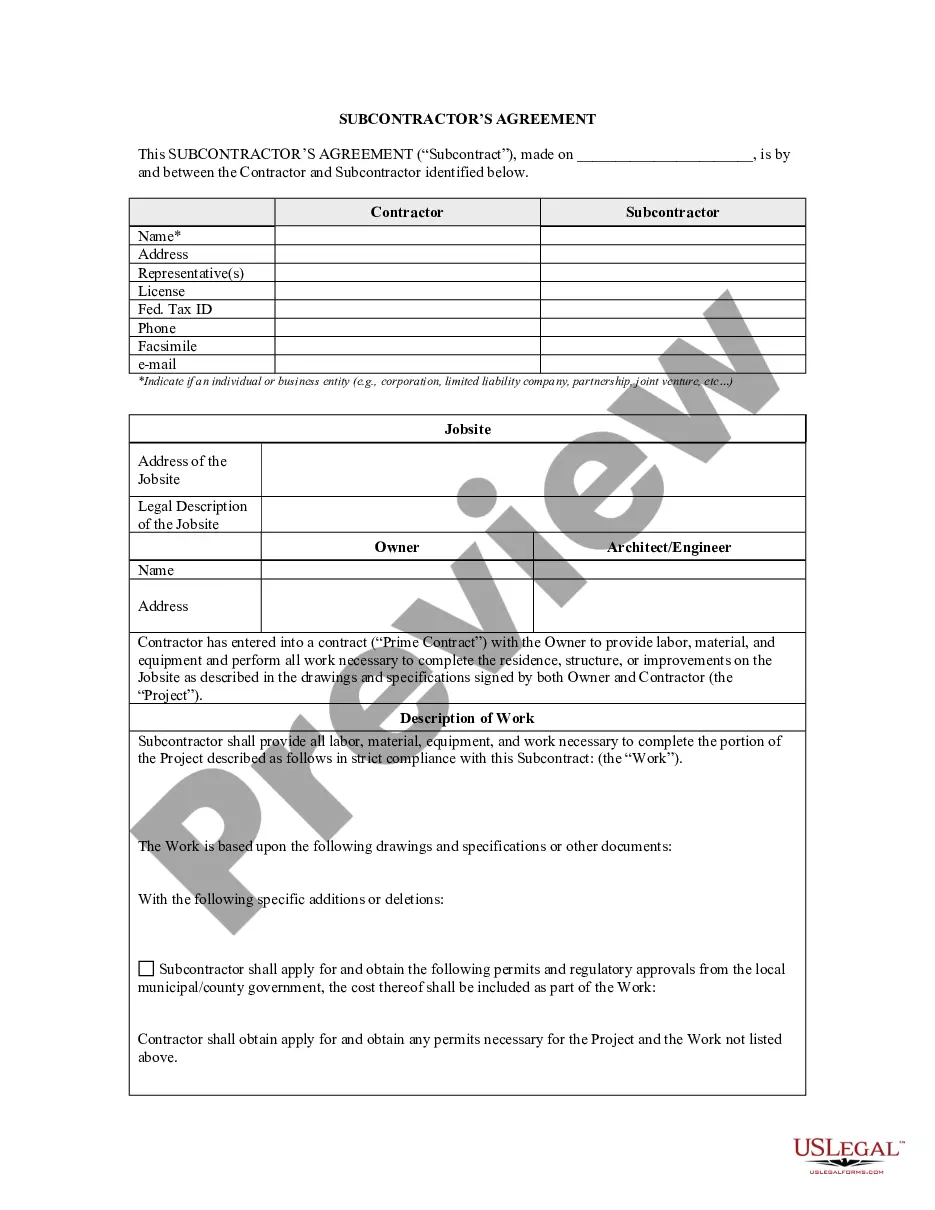

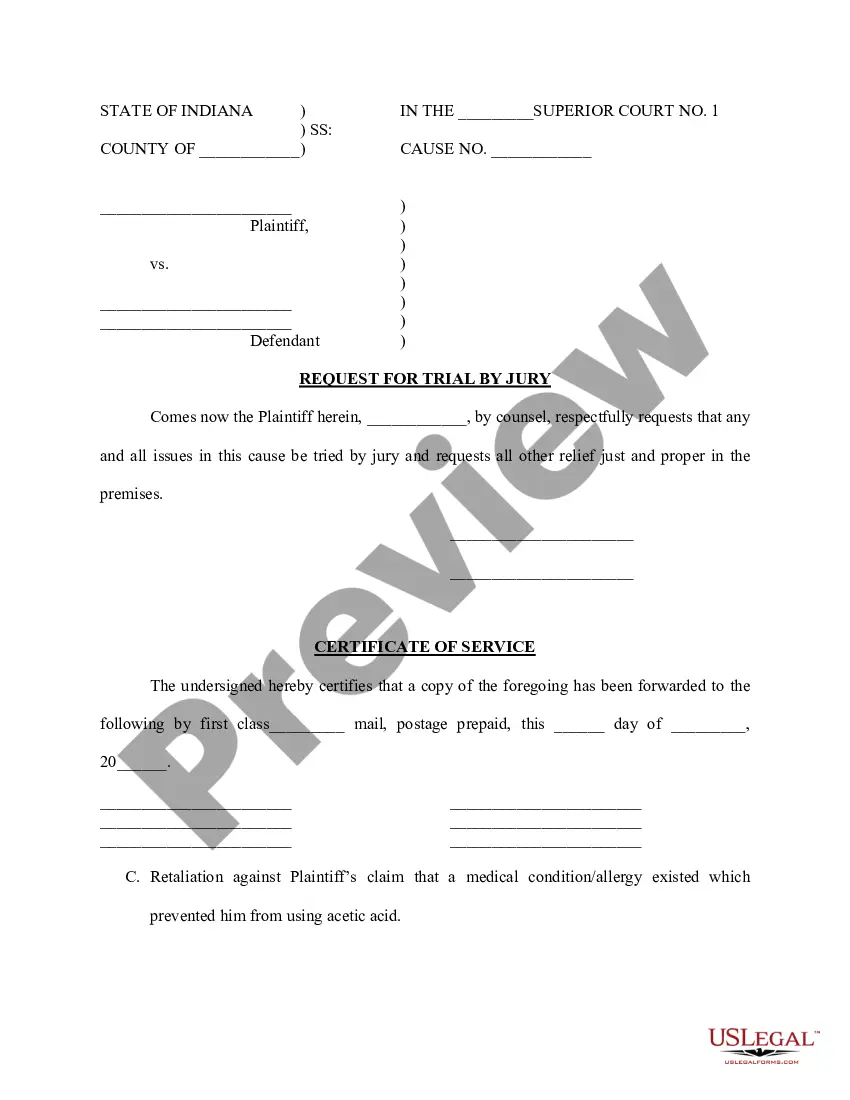

- Examine the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!