A guaranty is an agreement by one person (the guarantor) to perform an obligation in the event of default by the debtor or obligor. A guaranty acts as a type of collateral for an obligation of another person (the debtor or obligor). A guaranty agreement is a type of contract. Questions regarding such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

The Hennepin Minnesota Guaranty of Payment of Rent under Lease Agreement is a legal provision that serves as a guarantee for the payment of rent by a tenant. This agreement acts as a safeguard for landlords in Hennepin County, Minnesota, ensuring that they will receive the agreed-upon rental income despite any non-payment or default by the tenant. Under this particular type of guaranty, the guarantor assumes responsibility for paying the rent if the tenant fails to do so. Landlords often require this guaranty from tenants who may have limited income, poor credit history, or insufficient rental references. It provides an additional layer of protection for property owners, especially when renting to individuals or businesses with potential financial risks. There are different types or variations of the Hennepin Minnesota Guaranty of Payment of Rent under Lease Agreement, depending on the specific circumstances and parties involved. Some common variations may include: 1. Personal Guarantee: This type of guaranty involves an individual, typically the tenant's family member or friend, who agrees to be personally responsible for the rental payments. The personal guarantor's assets and income can be used to satisfy the unpaid rent. 2. Corporate Guarantee: In this case, a separate legal entity, such as a corporation or LLC, guarantees the rental payments instead of an individual. The corporate guarantor assumes liability for the rent and may be required to provide financial statements or collateral to support their commitment. 3. Limited Guarantee: This type of guaranty places limitations on the guarantor's liability, specifying a maximum amount or a fixed duration during which the guarantor is responsible for payment. Landlords may opt for this variation to reduce the guarantor's risk exposure. 4. Conditional Guarantee: A conditional guaranty includes specific conditions that must be met before the guarantor's obligation to pay rent arises. For instance, the guarantor may only become responsible for payment if the tenant fails to pay rent for a specified period or breaches certain lease terms. Overall, the Hennepin Minnesota Guaranty of Payment of Rent under Lease Agreement ensures that landlords in Hennepin County can mitigate financial risks associated with renting their properties. By obtaining the necessary guarantees from tenants or their guarantors, landlords can have peace of mind knowing that they have additional recourse in case of non-payment or defaults.The Hennepin Minnesota Guaranty of Payment of Rent under Lease Agreement is a legal provision that serves as a guarantee for the payment of rent by a tenant. This agreement acts as a safeguard for landlords in Hennepin County, Minnesota, ensuring that they will receive the agreed-upon rental income despite any non-payment or default by the tenant. Under this particular type of guaranty, the guarantor assumes responsibility for paying the rent if the tenant fails to do so. Landlords often require this guaranty from tenants who may have limited income, poor credit history, or insufficient rental references. It provides an additional layer of protection for property owners, especially when renting to individuals or businesses with potential financial risks. There are different types or variations of the Hennepin Minnesota Guaranty of Payment of Rent under Lease Agreement, depending on the specific circumstances and parties involved. Some common variations may include: 1. Personal Guarantee: This type of guaranty involves an individual, typically the tenant's family member or friend, who agrees to be personally responsible for the rental payments. The personal guarantor's assets and income can be used to satisfy the unpaid rent. 2. Corporate Guarantee: In this case, a separate legal entity, such as a corporation or LLC, guarantees the rental payments instead of an individual. The corporate guarantor assumes liability for the rent and may be required to provide financial statements or collateral to support their commitment. 3. Limited Guarantee: This type of guaranty places limitations on the guarantor's liability, specifying a maximum amount or a fixed duration during which the guarantor is responsible for payment. Landlords may opt for this variation to reduce the guarantor's risk exposure. 4. Conditional Guarantee: A conditional guaranty includes specific conditions that must be met before the guarantor's obligation to pay rent arises. For instance, the guarantor may only become responsible for payment if the tenant fails to pay rent for a specified period or breaches certain lease terms. Overall, the Hennepin Minnesota Guaranty of Payment of Rent under Lease Agreement ensures that landlords in Hennepin County can mitigate financial risks associated with renting their properties. By obtaining the necessary guarantees from tenants or their guarantors, landlords can have peace of mind knowing that they have additional recourse in case of non-payment or defaults.

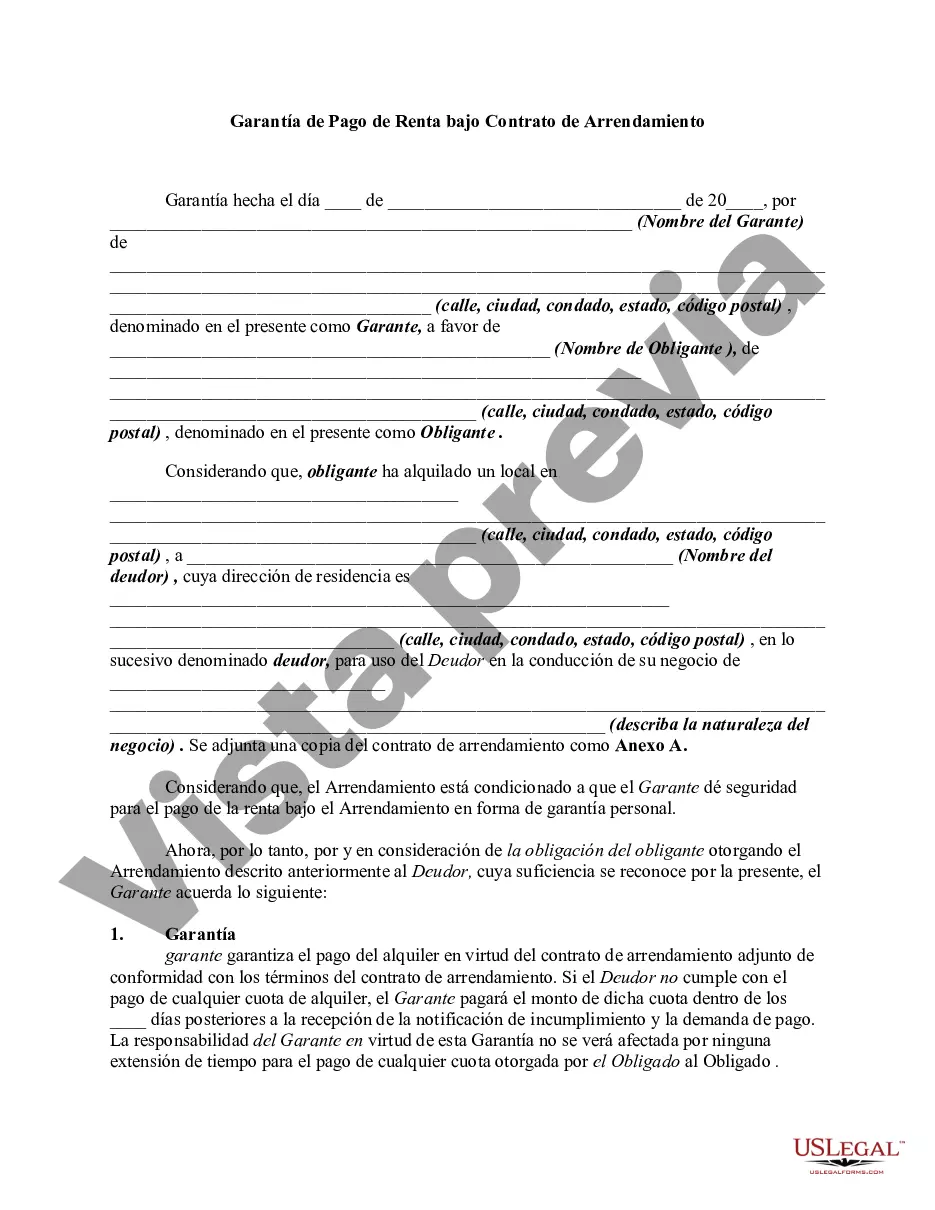

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.