A guaranty is an agreement by one person (the guarantor) to perform an obligation in the event of default by the debtor or obligor. A guaranty acts as a type of collateral for an obligation of another person (the debtor or obligor). A guaranty agreement is a type of contract. Questions regarding such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

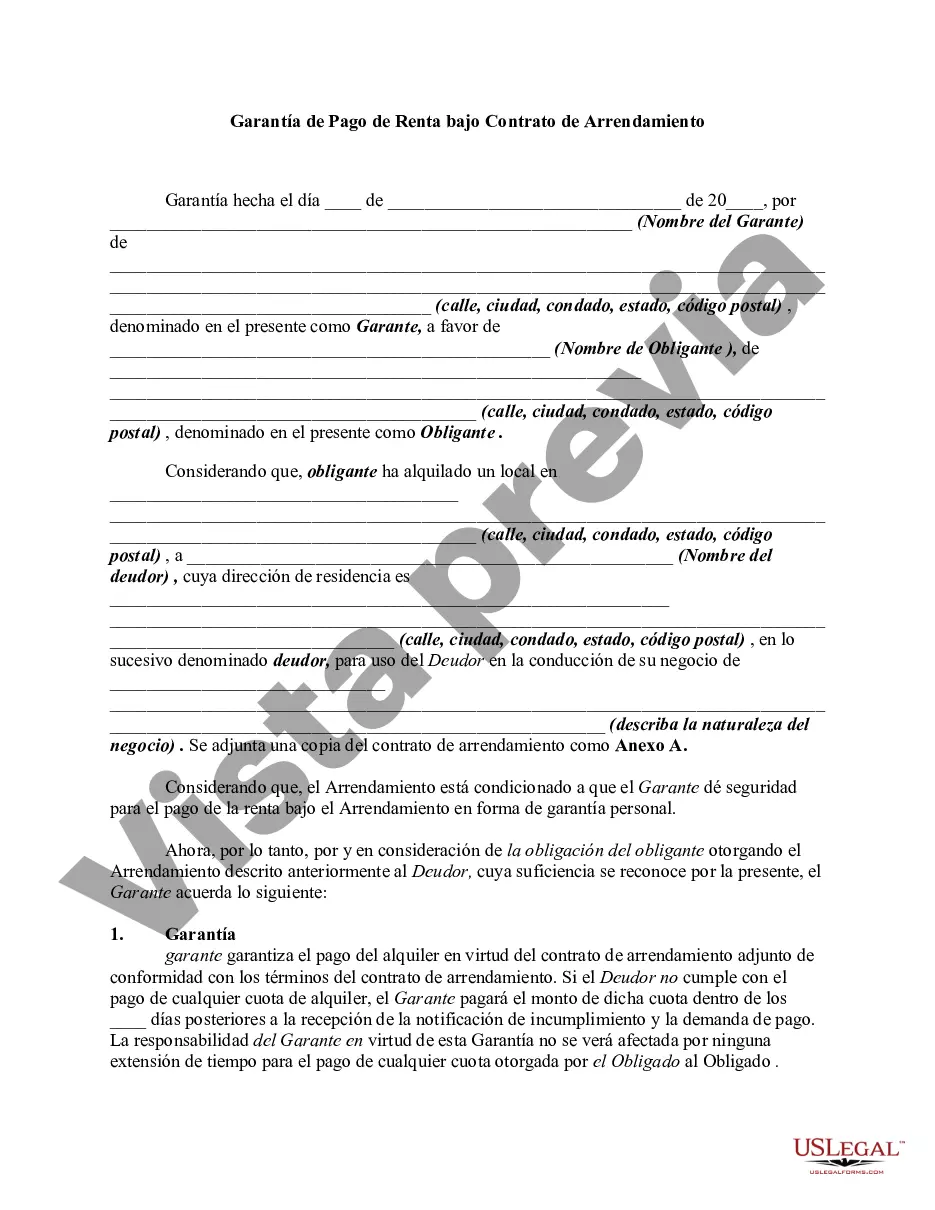

A Hillsborough Florida Guaranty of Payment of Rent under Lease Agreement is a legal document designed to provide additional security for landlords in the event that a tenant is unable to meet their rental payment obligations. This agreement acts as a guarantee, ensuring that the landlord receives the rental income agreed upon in the lease, regardless of any financial difficulties the tenant may face. The Hillsborough Florida Guaranty of Payment of Rent under Lease Agreement serves as a contract between the landlord, the tenant, and a third party guarantor who willingly assumes responsibility for paying the rent on behalf of the tenant. This guarantee can be particularly beneficial for landlords who want to mitigate potential risks associated with renting out their property. In Hillsborough Florida, there may be different types of Guaranty of Payment of Rent under Lease Agreements available, depending on the specific terms and conditions agreed upon by the parties involved. These may include: 1. Individual Guarantor: This type of guarantor is typically a financially stable individual who agrees to assume responsibility for rent payments should the tenant fail to do so. The individual's income, assets, and creditworthiness may be assessed to ensure their ability to fulfill their obligations. 2. Corporate Guarantor: In some cases, a commercial or corporate entity may act as a guarantor, providing an additional level of security for the landlord. This type of guarantor may be required when dealing with businesses or large commercial lease agreements. 3. Parental Guarantor: When renting to a student or young individual who may have limited income or credit history, a parent or legal guardian may act as a guarantor, promising to cover the rent if the tenant is unable to do so. 4. Co-Signer Guarantor: A co-signer guarantor is someone who signs the lease agreement alongside the tenant, taking on the responsibility for rental payments if the tenant defaults. Co-signers are often used when the primary tenant has a weaker credit history or limited income. By implementing a Hillsborough Florida Guaranty of Payment of Rent under Lease Agreement, landlords can protect themselves against financial loss due to tenant default or non-payment. This agreement provides peace of mind and confidence in collecting rental income promptly, ultimately helping to maintain a stable and profitable rental property investment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.