A guaranty is an agreement by one person (the guarantor) to perform an obligation in the event of default by the debtor or obligor. A guaranty acts as a type of collateral for an obligation of another person (the debtor or obligor). A guaranty agreement is a type of contract. Questions regarding such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

A Mecklenburg North Carolina Guaranty of Payment of Rent under Lease Agreement is a legally binding contract that protects landlords and property owners when leasing out residential or commercial properties. This agreement ensures the payment of rent by providing an additional party, known as a guarantor, who agrees to be responsible for any unpaid rent or lease-related expenses in the event that the tenant fails to fulfill their financial obligations. The purpose of a Mecklenburg North Carolina Guaranty of Payment of Rent under Lease Agreement is to minimize financial risks for landlords and property owners, particularly when dealing with tenants who may have limited financial resources or a history of rent payment issues. By having a reliable guarantor involved, landlords can mitigate potential losses and ensure a stable rental income. This agreement typically includes details such as the property address, the names of the tenant and guarantor, the terms of the lease, and the amount of rent to be paid. It also outlines the responsibilities and liabilities of the guarantor, including the obligation to make rent payments on behalf of the tenant, as well as any additional charges or damages that may occur during the lease term. In Mecklenburg North Carolina, there are different types of Guaranty of Payment of Rent under Lease Agreements, which may vary depending on the specific circumstances and parties involved. Some common variations include: 1. Individual Guarantor: This is the most common type of guarantor, where an individual (often a family member or close friend) agrees to guarantee the payment of rent on behalf of the tenant. This type of guarantor is personally liable for any unpaid rent or lease-related expenses. 2. Corporate Guarantor: In some cases, a corporation or company may act as a guarantor for the tenant. This can occur when the tenant is a subsidiary or an employee of the company, and the company agrees to shoulder the financial responsibility of the lease. 3. Limited Guarantor: In certain situations, a guarantor may limit their liability by specifying a cap on the amount they are willing to guarantee. This type of guarantor is only responsible for payment up to the specified limit. It is important to note that the specific terms and requirements of a Mecklenburg North Carolina Guaranty of Payment of Rent under Lease Agreement may vary, and it is advisable for both landlords and tenants to seek legal counsel to ensure compliance with local laws and regulations.A Mecklenburg North Carolina Guaranty of Payment of Rent under Lease Agreement is a legally binding contract that protects landlords and property owners when leasing out residential or commercial properties. This agreement ensures the payment of rent by providing an additional party, known as a guarantor, who agrees to be responsible for any unpaid rent or lease-related expenses in the event that the tenant fails to fulfill their financial obligations. The purpose of a Mecklenburg North Carolina Guaranty of Payment of Rent under Lease Agreement is to minimize financial risks for landlords and property owners, particularly when dealing with tenants who may have limited financial resources or a history of rent payment issues. By having a reliable guarantor involved, landlords can mitigate potential losses and ensure a stable rental income. This agreement typically includes details such as the property address, the names of the tenant and guarantor, the terms of the lease, and the amount of rent to be paid. It also outlines the responsibilities and liabilities of the guarantor, including the obligation to make rent payments on behalf of the tenant, as well as any additional charges or damages that may occur during the lease term. In Mecklenburg North Carolina, there are different types of Guaranty of Payment of Rent under Lease Agreements, which may vary depending on the specific circumstances and parties involved. Some common variations include: 1. Individual Guarantor: This is the most common type of guarantor, where an individual (often a family member or close friend) agrees to guarantee the payment of rent on behalf of the tenant. This type of guarantor is personally liable for any unpaid rent or lease-related expenses. 2. Corporate Guarantor: In some cases, a corporation or company may act as a guarantor for the tenant. This can occur when the tenant is a subsidiary or an employee of the company, and the company agrees to shoulder the financial responsibility of the lease. 3. Limited Guarantor: In certain situations, a guarantor may limit their liability by specifying a cap on the amount they are willing to guarantee. This type of guarantor is only responsible for payment up to the specified limit. It is important to note that the specific terms and requirements of a Mecklenburg North Carolina Guaranty of Payment of Rent under Lease Agreement may vary, and it is advisable for both landlords and tenants to seek legal counsel to ensure compliance with local laws and regulations.

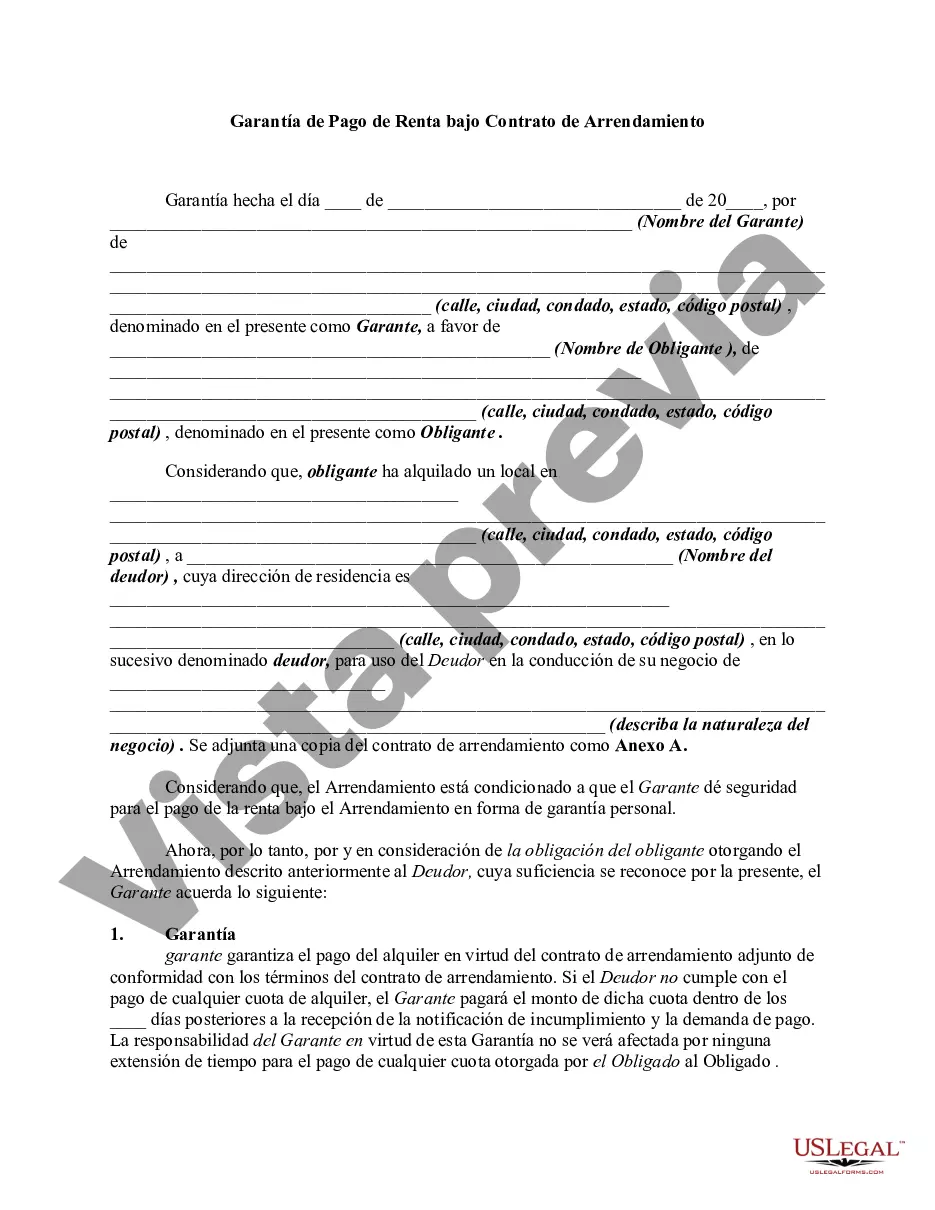

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.