A guaranty is an agreement by one person (the guarantor) to perform an obligation in the event of default by the debtor or obligor. A guaranty acts as a type of collateral for an obligation of another person (the debtor or obligor). A guaranty agreement is a type of contract. Questions regarding such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Orange California Guaranty of Payment of Rent under Lease Agreement is a legal document that serves as a financial guarantee for landlords renting out properties in Orange, California. This agreement ensures that the rent will be paid on time and in full, even if the tenant fails to make the payment. It provides landlords with an extra layer of security and minimizes any potential financial loss. Under this lease agreement, the guarantor agrees to take responsibility for the rent if the tenant defaults. The guarantor can be an individual, such as a family member or friend, or a corporate entity, such as a company. The guarantor's creditworthiness and financial stability are crucial factors considered during the assessment process. The purpose of a Guaranty of Payment of Rent under Lease Agreement is to protect the landlord's interests and mitigate the risks associated with leasing a property. It ensures that landlords receive consistent rental income, which is vital for maintaining the property, paying mortgage obligations, and covering other expenses. Different types of Guaranty of Payment of Rent under Lease Agreement may include: 1. Individual Guarantor: This type of guarantor is typically a person close to the tenant, such as a parent or spouse, who agrees to assume the responsibility of rent payment if the tenant defaults. 2. Corporate Guarantor: In some cases, especially commercial leases, a corporate entity may act as a guarantor for payment of rent. This can provide a higher level of financial security for landlords as the company is often more reliable and has better financial resources. 3. Limited Guaranty: A limited guaranty places restrictions on the guarantor's liability and may cap their financial obligations. This type of agreement may specify a maximum dollar amount or a limited duration for which the guarantor is accountable. 4. Conditional Guaranty: A conditional guaranty is subject to specific conditions being met, such as the tenant defaulting on rent payments for a certain period or violating certain terms of the lease agreement. This type of guaranty provides added protection for landlords while still giving tenants a chance to rectify their default. 5. Unconditional Guaranty: An unconditional guarantor assumes full responsibility for rent payment from the beginning of the lease agreement. They have no additional requirements or limitations, providing the highest level of protection for landlords. Landlords seeking to safeguard their rental income in Orange, California, can benefit from implementing a Guaranty of Payment of Rent under Lease Agreement. This document ensures greater financial security while facilitating a smoother rental process.Orange California Guaranty of Payment of Rent under Lease Agreement is a legal document that serves as a financial guarantee for landlords renting out properties in Orange, California. This agreement ensures that the rent will be paid on time and in full, even if the tenant fails to make the payment. It provides landlords with an extra layer of security and minimizes any potential financial loss. Under this lease agreement, the guarantor agrees to take responsibility for the rent if the tenant defaults. The guarantor can be an individual, such as a family member or friend, or a corporate entity, such as a company. The guarantor's creditworthiness and financial stability are crucial factors considered during the assessment process. The purpose of a Guaranty of Payment of Rent under Lease Agreement is to protect the landlord's interests and mitigate the risks associated with leasing a property. It ensures that landlords receive consistent rental income, which is vital for maintaining the property, paying mortgage obligations, and covering other expenses. Different types of Guaranty of Payment of Rent under Lease Agreement may include: 1. Individual Guarantor: This type of guarantor is typically a person close to the tenant, such as a parent or spouse, who agrees to assume the responsibility of rent payment if the tenant defaults. 2. Corporate Guarantor: In some cases, especially commercial leases, a corporate entity may act as a guarantor for payment of rent. This can provide a higher level of financial security for landlords as the company is often more reliable and has better financial resources. 3. Limited Guaranty: A limited guaranty places restrictions on the guarantor's liability and may cap their financial obligations. This type of agreement may specify a maximum dollar amount or a limited duration for which the guarantor is accountable. 4. Conditional Guaranty: A conditional guaranty is subject to specific conditions being met, such as the tenant defaulting on rent payments for a certain period or violating certain terms of the lease agreement. This type of guaranty provides added protection for landlords while still giving tenants a chance to rectify their default. 5. Unconditional Guaranty: An unconditional guarantor assumes full responsibility for rent payment from the beginning of the lease agreement. They have no additional requirements or limitations, providing the highest level of protection for landlords. Landlords seeking to safeguard their rental income in Orange, California, can benefit from implementing a Guaranty of Payment of Rent under Lease Agreement. This document ensures greater financial security while facilitating a smoother rental process.

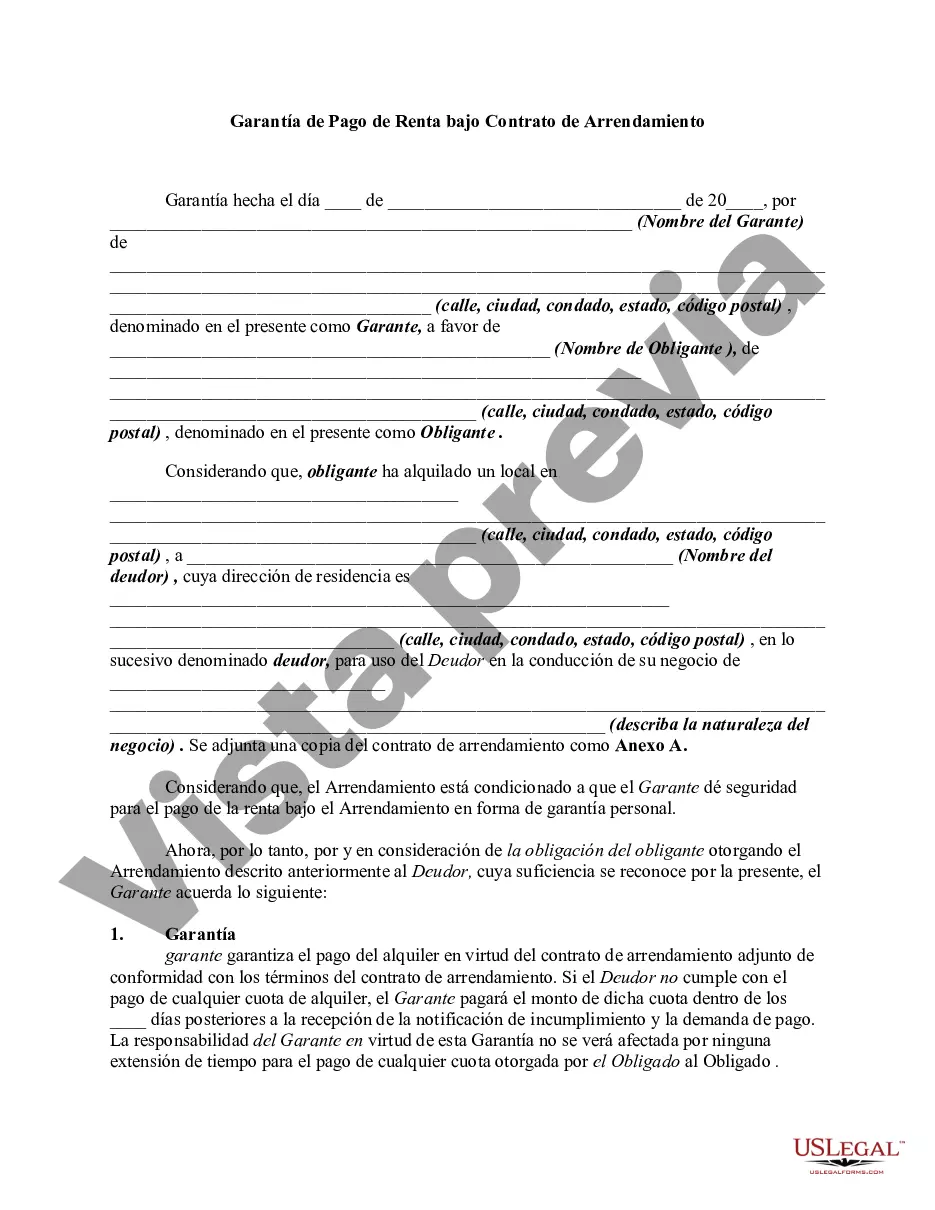

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.