A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

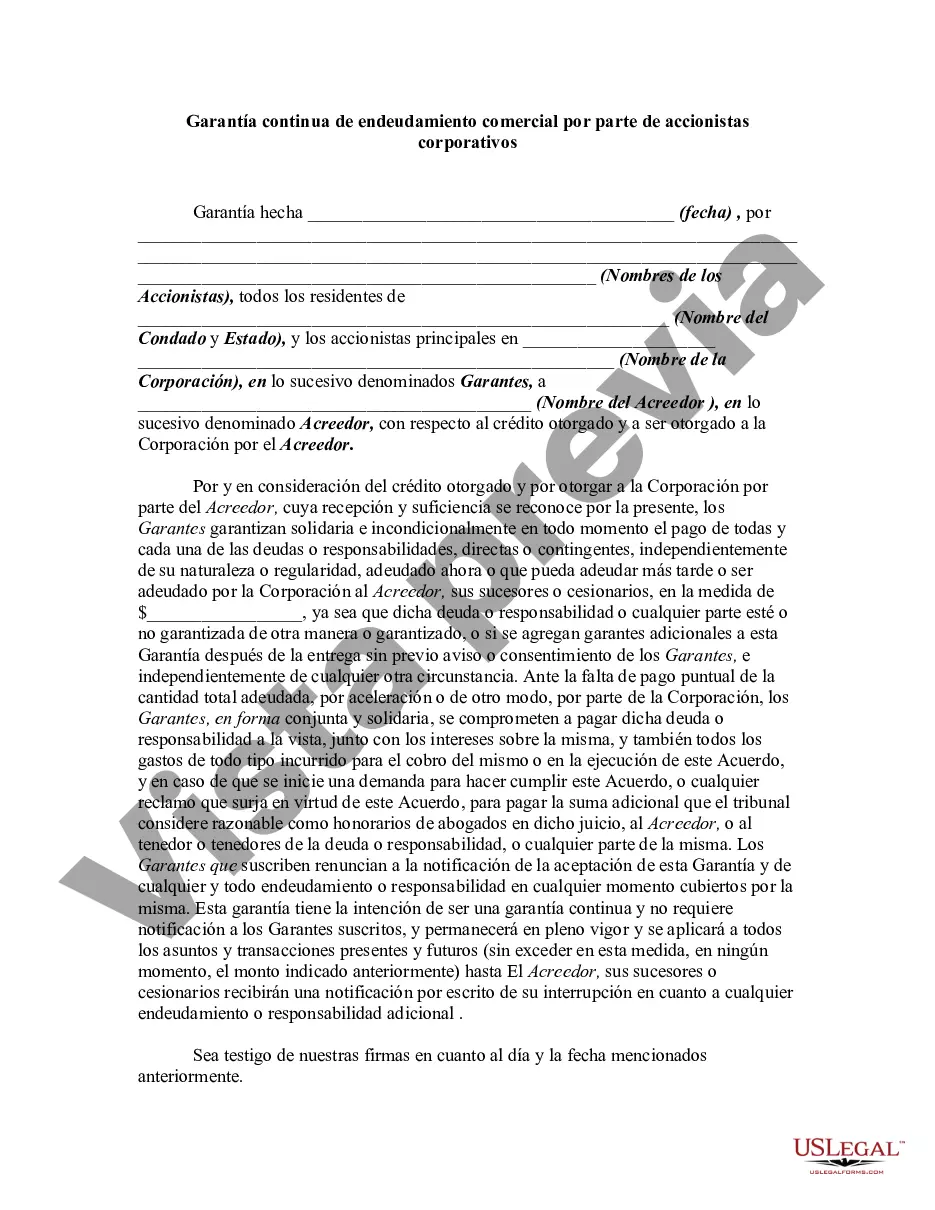

The Clark Nevada Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legally binding document that outlines the responsibilities and obligations of corporate stockholders when guaranteeing business debts. It provides a guarantee that the stockholders will be personally liable for the business debts in the event that the business is unable to fulfill its financial obligations. This type of guaranty is commonly used in situations where a corporation needs to secure a loan or credit line for its operations. Lenders often require additional security to ensure the repayment of the debt, and the guaranty by corporate stockholders serves as such security. By signing the guaranty, the stockholders agree to assume responsibility for the indebtedness if the business fails to meet its payment obligations. The Clark Nevada Continuing Guaranty is designed to provide ongoing protection for the lender throughout the duration of the loan or credit facility. It is important to note that this type of guaranty is not limited to a specific debt or timeframe. Instead, it remains in effect until the lender releases the guarantors from their obligations in writing. There are no different types of the Clark Nevada Continuing Guaranty of Business Indebtedness By Corporate Stockholders. However, variations of this type of guaranty may exist in different states or jurisdictions, each with its own specific requirements and regulations. It is crucial for corporate stockholders to consult with legal professionals familiar with the laws of their respective jurisdictions before entering into any guaranty agreements. In summary, the Clark Nevada Continuing Guaranty of Business Indebtedness By Corporate Stockholders provides lenders with an added layer of security when extending credit to a corporation. It ensures that stockholders will be personally liable for the business debts, protecting the lender's interests in case of default. Corporate stockholders should carefully review and understand the terms of the guaranty before signing, seeking legal advice if necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.