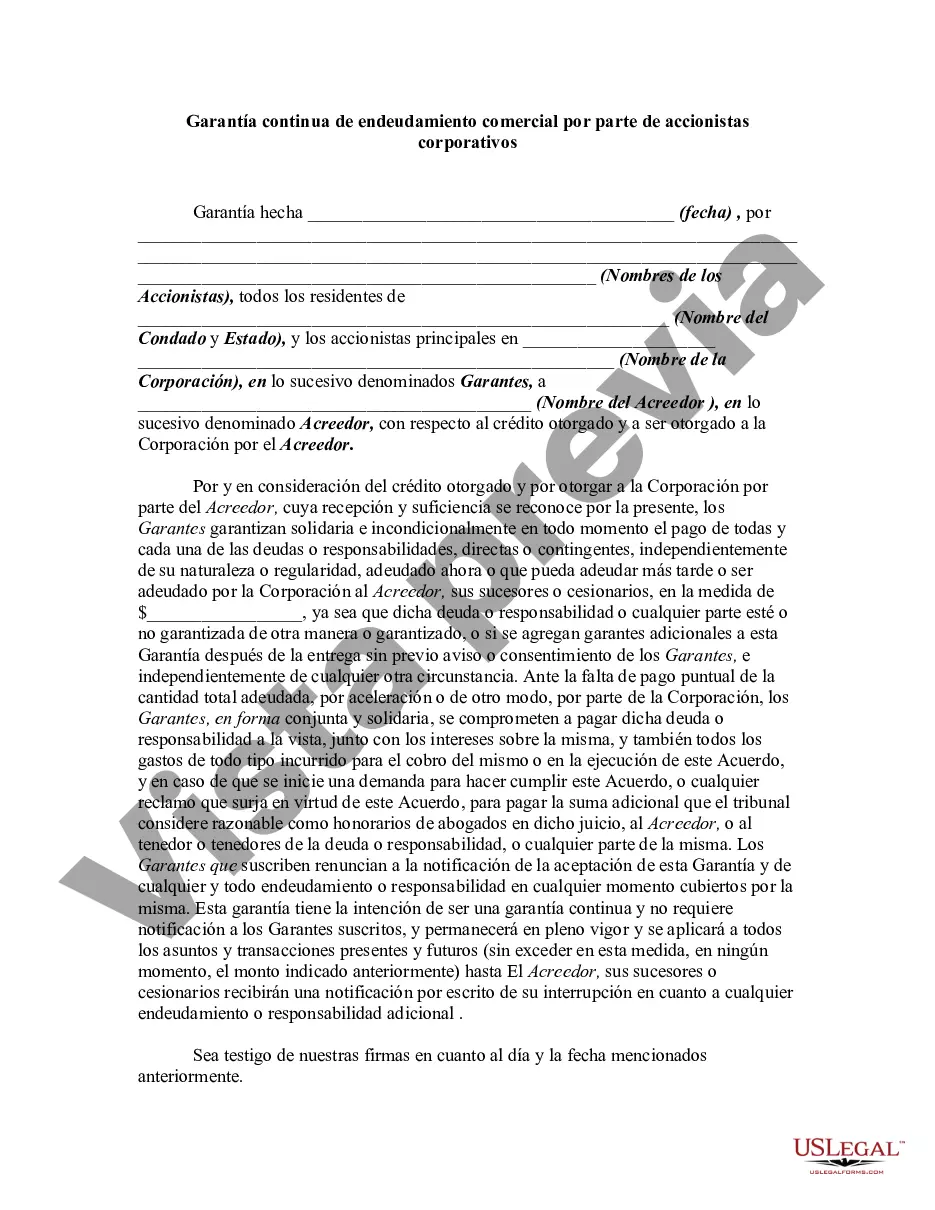

A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Fairfax Virginia Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legally binding document that outlines the agreement between a corporation and its stockholders. In this agreement, the stockholders agree to guarantee the business's financial obligations and debts. This ensures that the corporation has access to sufficient funding and ensures the repayment of debts in case of default. Keywords: Fairfax Virginia, Continuing Guaranty, Business Indebtedness, Corporate Stockholders. There are different types of Fairfax Virginia Continuing Guaranty of Business Indebtedness By Corporate Stockholders, including: 1. Limited Guaranty: A limited guaranty specifies a predetermined maximum amount that a stockholder is liable for in the event of default. This type of guaranty provides protection to stockholders by limiting their liability to a certain extent. 2. Unlimited Guaranty: An unlimited guaranty holds the stockholders fully responsible for the corporation's debts. It means that even if the business defaults on a significant amount, the stockholders are liable to cover the entire debt. This type of guaranty offers maximum protection to creditors. 3. Joint and Several guaranties: This type of guaranty makes all the stockholders collectively responsible for the corporation's obligations and debts, allowing creditors to recover the entire amount from any single stockholder. It provides flexibility to creditors by allowing them to pursue any or all stockholders to recover a debt. 4. Continuing Guaranty: A continuing guaranty implies that the stockholder's obligations extend beyond a single transaction or a specific period. This means that even if the business incurs additional debt in the future, the stockholder's responsibility still stands. In Fairfax Virginia, Continuing Guaranty of Business Indebtedness By Corporate Stockholders plays a significant role in securing financial transactions and ensuring the stability of businesses. It protects creditors by offering an additional layer of assurance, giving them more confidence in lending funds or extending credit to corporations. At the same time, it imposes certain responsibilities on the stockholders, making them accountable for the corporation's debts and obligations.Fairfax Virginia Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legally binding document that outlines the agreement between a corporation and its stockholders. In this agreement, the stockholders agree to guarantee the business's financial obligations and debts. This ensures that the corporation has access to sufficient funding and ensures the repayment of debts in case of default. Keywords: Fairfax Virginia, Continuing Guaranty, Business Indebtedness, Corporate Stockholders. There are different types of Fairfax Virginia Continuing Guaranty of Business Indebtedness By Corporate Stockholders, including: 1. Limited Guaranty: A limited guaranty specifies a predetermined maximum amount that a stockholder is liable for in the event of default. This type of guaranty provides protection to stockholders by limiting their liability to a certain extent. 2. Unlimited Guaranty: An unlimited guaranty holds the stockholders fully responsible for the corporation's debts. It means that even if the business defaults on a significant amount, the stockholders are liable to cover the entire debt. This type of guaranty offers maximum protection to creditors. 3. Joint and Several guaranties: This type of guaranty makes all the stockholders collectively responsible for the corporation's obligations and debts, allowing creditors to recover the entire amount from any single stockholder. It provides flexibility to creditors by allowing them to pursue any or all stockholders to recover a debt. 4. Continuing Guaranty: A continuing guaranty implies that the stockholder's obligations extend beyond a single transaction or a specific period. This means that even if the business incurs additional debt in the future, the stockholder's responsibility still stands. In Fairfax Virginia, Continuing Guaranty of Business Indebtedness By Corporate Stockholders plays a significant role in securing financial transactions and ensuring the stability of businesses. It protects creditors by offering an additional layer of assurance, giving them more confidence in lending funds or extending credit to corporations. At the same time, it imposes certain responsibilities on the stockholders, making them accountable for the corporation's debts and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.