A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

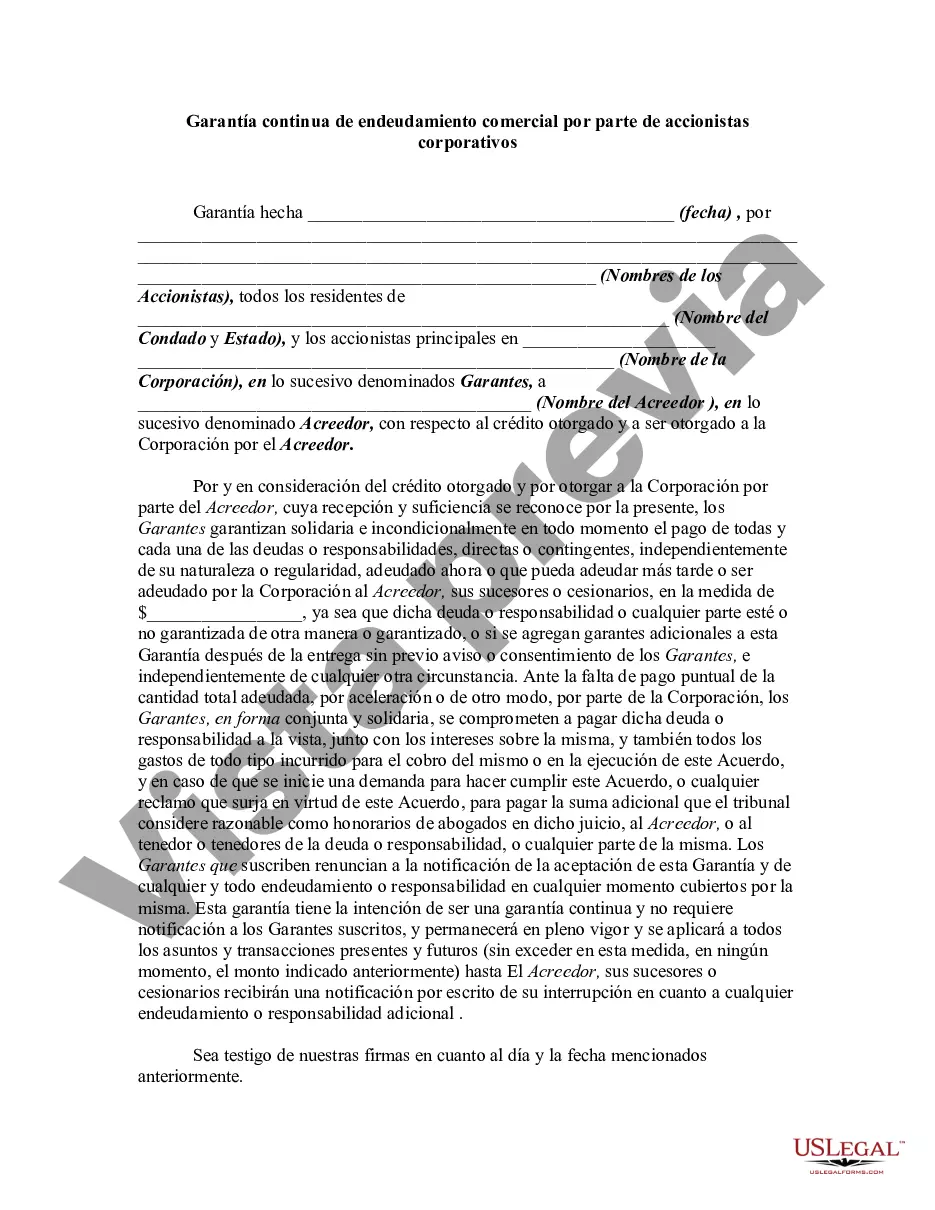

A Fulton Georgia Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legal document that outlines the obligations and responsibilities of corporate stockholders in guaranteeing the indebtedness of a business in Fulton, Georgia. This type of guaranty is commonly used in commercial transactions and provides lenders with assurance that they will be able to recoup their loaned funds in case the business defaults on its payments. Corporate stockholders, who hold shares or ownership in the business, agree to act as guarantors and personally guarantee the business's debts. This means that if the business fails to repay the borrowed amount, the stockholders become personally liable for the outstanding balance and are legally obligated to make the payments on behalf of the business. This guaranty serves as a form of security for lenders, giving them confidence that they will be repaid even if the business faces financial difficulties. The Fulton Georgia Continuing Guaranty of Business Indebtedness By Corporate Stockholders includes various terms and conditions that both the stockholders and the lender must agree upon. These may include details such as the maximum amount of debt that can be guaranteed, the duration of the guaranty, and any restrictions or limitations on the stockholders' liability. The terms may also include provisions for the repayment schedule, interest rates, and any penalties for default. Different types of Fulton Georgia Continuing Guaranty of Business Indebtedness By Corporate Stockholders may exist depending on the specific requirements and agreements made between the stockholders and the lender. Some variations may include limited guaranties, where the stockholders' liability is limited to a certain amount, or unconditional guaranties, where the stockholders are fully responsible for any outstanding debts. It is important for corporate stockholders to fully understand the implications and responsibilities associated with a Fulton Georgia Continuing Guaranty of Business Indebtedness. Seeking legal counsel and reviewing the document thoroughly before signing is crucial to ensure that all parties involved are protected and aware of their obligations. This type of guaranty can have long-term financial implications and should not be entered into lightly. In conclusion, a Fulton Georgia Continuing Guaranty of Business Indebtedness By Corporate Stockholders serves as a legal agreement that establishes the personal liability of corporate stockholders in guaranteeing the debts of a business in Fulton, Georgia. It offers lenders added security and assurance when providing loans to businesses, knowing that stockholders are willing to back the indebtedness. Different variations of this guaranty may exist, each outlining specific terms and conditions that both parties must agree on. Consulting with legal professionals is highly advised to ensure a clear understanding of the obligations involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.