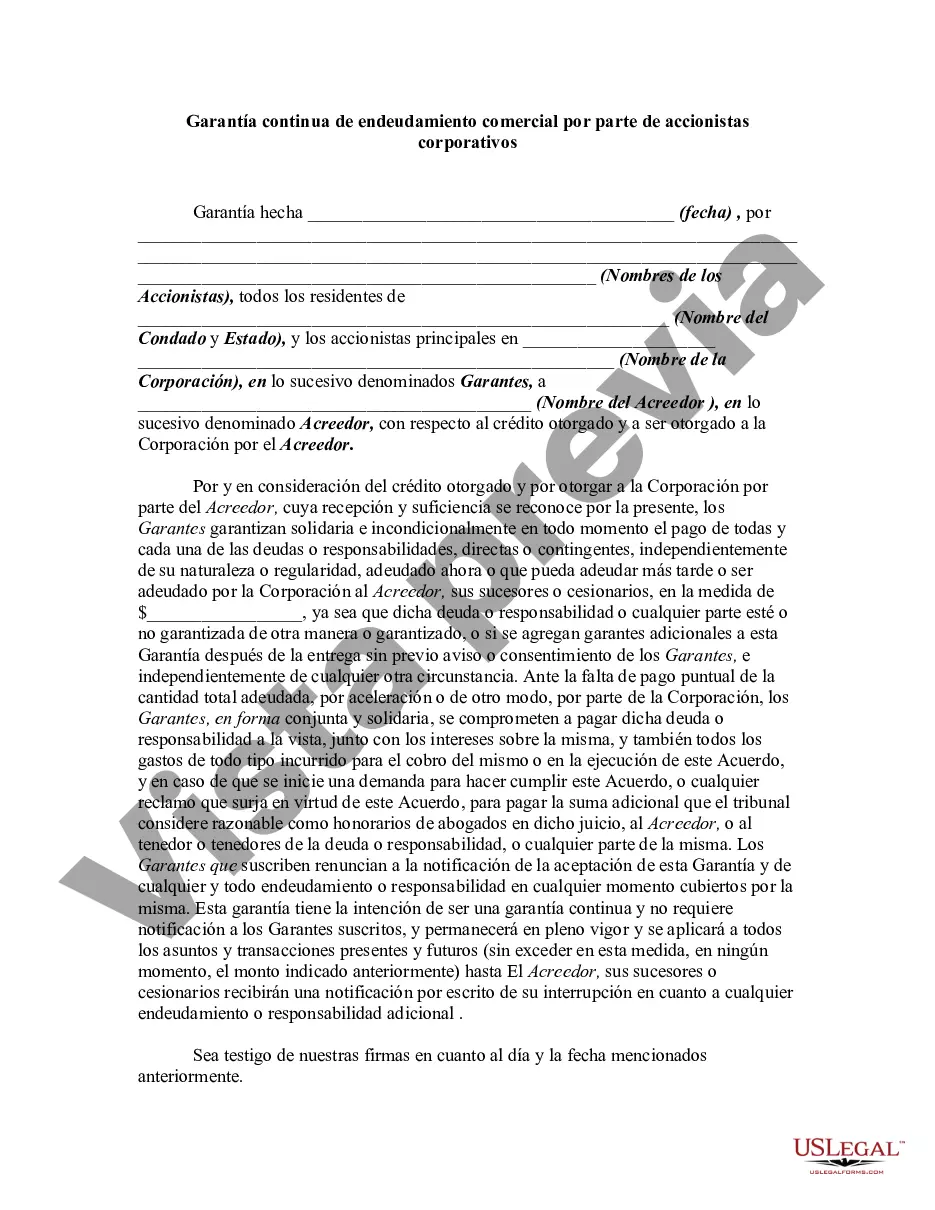

A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Miami-Dade Florida Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legal document that outlines the obligations and responsibilities of corporate stockholders when guaranteeing business debts in Miami-Dade County, Florida. This guaranty serves as a security measure for lenders, ensuring that they have recourse in recovering outstanding debts from a corporation's stockholders. By signing this guaranty, corporate stockholders pledge their personal assets and agree to be personally liable for any outstanding debts or obligations of the business entity. This provides an added layer of protection for lenders, giving them the confidence to provide financing to corporations operating in Miami-Dade County. The Miami-Dade Florida Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a binding legal agreement that imposes certain obligations on stockholders. It typically outlines the following key aspects: 1. Identification of Parties: The guaranty identifies the stockholders providing the guaranty and the business entity they are affiliated with, including its legal structure and relevant details. 2. Debt Obligations: The guaranty specifies the types of debts or obligations that are covered under the agreement. This can include loans, lines of credit, leases, or any other financial obligations incurred by the business entity. 3. Guaranty Scope: The document clarifies whether the guaranty is limited to a specific debt or obligation or extends to all present and future debts of the corporation. It may also specify any limitations or exclusions, if applicable. 4. Continuing Nature: The guaranty establishes that the guarantor's obligations extend beyond the initial debt or obligation and continue until all outstanding debts of the business entity have been fully satisfied or released. 5. Joint and Several liabilities: The guaranty may impose joint and several liabilities on all stockholders, making each individual stockholder responsible for the entire debt or obligation if others are unable or unwilling to fulfill their responsibilities. It is important to note that while this description provides an overview of a generic Miami-Dade Florida Continuing Guaranty of Business Indebtedness By Corporate Stockholders, there may be variations or different types of guaranties that incorporate additional terms or have specific requirements based on the circumstances of the business and the lenders involved. Therefore, it is advisable to consult with an attorney familiar with Miami-Dade County laws and regulations to draft or review the specific provisions of such guaranties to ensure compliance with the applicable legal framework.Miami-Dade Florida Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legal document that outlines the obligations and responsibilities of corporate stockholders when guaranteeing business debts in Miami-Dade County, Florida. This guaranty serves as a security measure for lenders, ensuring that they have recourse in recovering outstanding debts from a corporation's stockholders. By signing this guaranty, corporate stockholders pledge their personal assets and agree to be personally liable for any outstanding debts or obligations of the business entity. This provides an added layer of protection for lenders, giving them the confidence to provide financing to corporations operating in Miami-Dade County. The Miami-Dade Florida Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a binding legal agreement that imposes certain obligations on stockholders. It typically outlines the following key aspects: 1. Identification of Parties: The guaranty identifies the stockholders providing the guaranty and the business entity they are affiliated with, including its legal structure and relevant details. 2. Debt Obligations: The guaranty specifies the types of debts or obligations that are covered under the agreement. This can include loans, lines of credit, leases, or any other financial obligations incurred by the business entity. 3. Guaranty Scope: The document clarifies whether the guaranty is limited to a specific debt or obligation or extends to all present and future debts of the corporation. It may also specify any limitations or exclusions, if applicable. 4. Continuing Nature: The guaranty establishes that the guarantor's obligations extend beyond the initial debt or obligation and continue until all outstanding debts of the business entity have been fully satisfied or released. 5. Joint and Several liabilities: The guaranty may impose joint and several liabilities on all stockholders, making each individual stockholder responsible for the entire debt or obligation if others are unable or unwilling to fulfill their responsibilities. It is important to note that while this description provides an overview of a generic Miami-Dade Florida Continuing Guaranty of Business Indebtedness By Corporate Stockholders, there may be variations or different types of guaranties that incorporate additional terms or have specific requirements based on the circumstances of the business and the lenders involved. Therefore, it is advisable to consult with an attorney familiar with Miami-Dade County laws and regulations to draft or review the specific provisions of such guaranties to ensure compliance with the applicable legal framework.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.