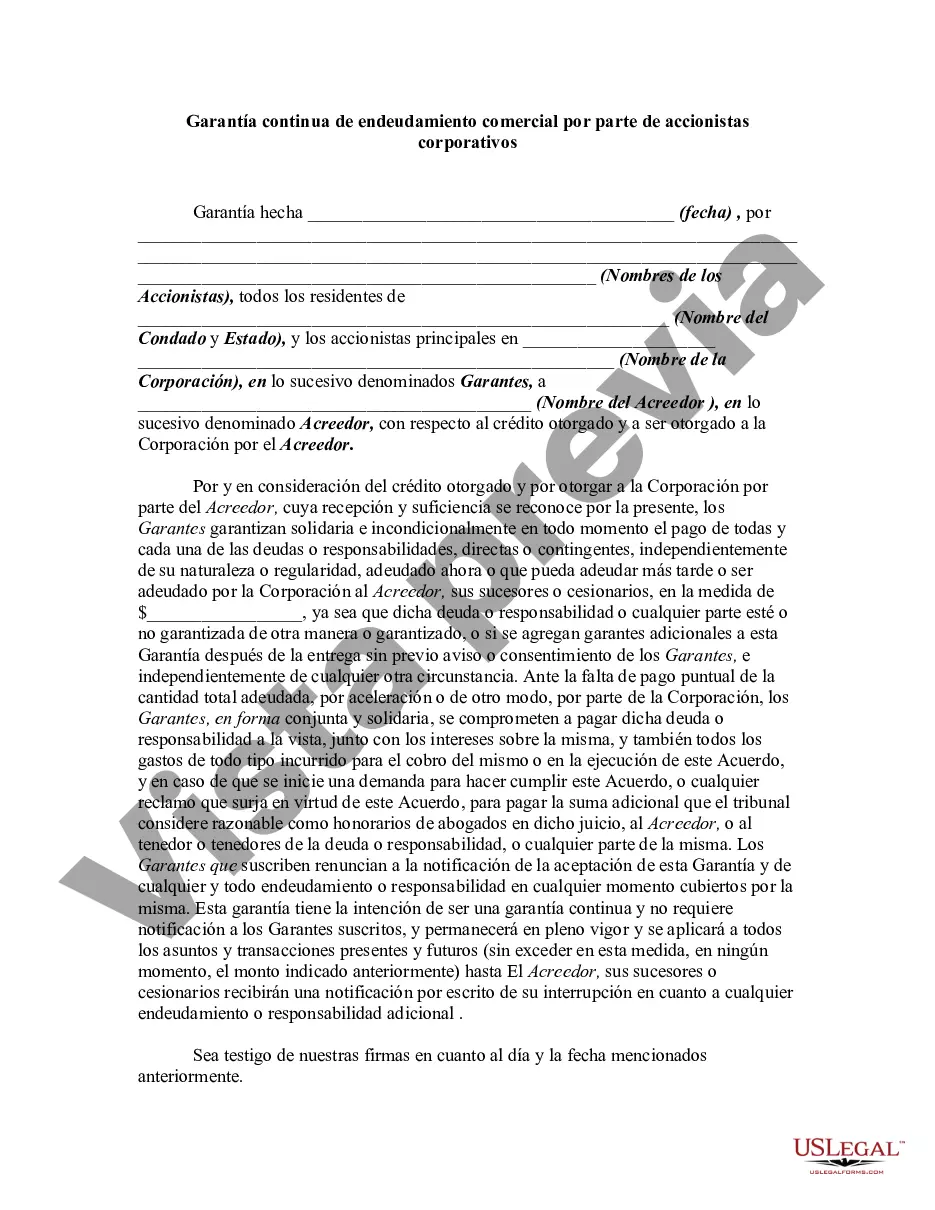

A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Orange California Continuing Guaranty of Business Indebtedness by Corporate Stockholders is a legal agreement that involves the guarantee of business debts by stockholders in the city of Orange, California. This guarantee provides financial security to lenders by ensuring that corporate stockholders will be held responsible for repaying business debts in the event of default or insolvency. This type of guaranty is particularly beneficial for lenders as it ensures an additional layer of protection against potential losses. It offers creditors the ability to pursue remedies not only against the business entity but also against the individual stockholders who have committed to the guaranty. This increases the likelihood of recovering outstanding debts owed by the business. Keywords: Orange California, continuing guaranty, business indebtedness, corporate stockholders, legal agreement, guarantee, lenders, financial security, default, insolvency, repayment, benefits, protection, creditors, remedies, individual stockholders, outstanding debts, recovery. Different types of Orange California Continuing Guaranty of Business Indebtedness By Corporate Stockholders include: 1. Limited Guaranty: This type of guaranty limits the stockholder's liability to a specific amount or a defined period. It provides a level of protection for stockholders by capping their potential liability. 2. Unconditional Guaranty: An unconditional guaranty holds the stockholders liable for the entirety of the business indebtedness, without any limitations or conditions. Stockholders must fulfill their obligations to repay the debts in full, regardless of the circumstances. 3. Joint and Several guaranties: In a joint and several guaranties, each stockholder is individually and collectively responsible for the entire business indebtedness. This means that creditors can pursue anyone or all of the stockholders to recover the outstanding debts, offering more flexibility in seeking debt recovery. 4. Limited Time Guaranty: This type of guaranty sets a specific time frame during which the stockholders are liable for the business debts. Once the specified period elapses, the guarantor's responsibility ceases. 5. Continuing Guaranty: A continuing guaranty is an ongoing commitment by the stockholders to be held liable for the business debts until a specific condition or event occurs, such as the complete repayment of the debts or termination of the guaranty contract. It ensures long-term financial security for the creditors. When entering into an Orange California Continuing Guaranty of Business Indebtedness By Corporate Stockholders agreement, it is crucial for both parties to seek legal advice and thoroughly understand the terms and conditions of the guaranty to protect their rights and obligations.Orange California Continuing Guaranty of Business Indebtedness by Corporate Stockholders is a legal agreement that involves the guarantee of business debts by stockholders in the city of Orange, California. This guarantee provides financial security to lenders by ensuring that corporate stockholders will be held responsible for repaying business debts in the event of default or insolvency. This type of guaranty is particularly beneficial for lenders as it ensures an additional layer of protection against potential losses. It offers creditors the ability to pursue remedies not only against the business entity but also against the individual stockholders who have committed to the guaranty. This increases the likelihood of recovering outstanding debts owed by the business. Keywords: Orange California, continuing guaranty, business indebtedness, corporate stockholders, legal agreement, guarantee, lenders, financial security, default, insolvency, repayment, benefits, protection, creditors, remedies, individual stockholders, outstanding debts, recovery. Different types of Orange California Continuing Guaranty of Business Indebtedness By Corporate Stockholders include: 1. Limited Guaranty: This type of guaranty limits the stockholder's liability to a specific amount or a defined period. It provides a level of protection for stockholders by capping their potential liability. 2. Unconditional Guaranty: An unconditional guaranty holds the stockholders liable for the entirety of the business indebtedness, without any limitations or conditions. Stockholders must fulfill their obligations to repay the debts in full, regardless of the circumstances. 3. Joint and Several guaranties: In a joint and several guaranties, each stockholder is individually and collectively responsible for the entire business indebtedness. This means that creditors can pursue anyone or all of the stockholders to recover the outstanding debts, offering more flexibility in seeking debt recovery. 4. Limited Time Guaranty: This type of guaranty sets a specific time frame during which the stockholders are liable for the business debts. Once the specified period elapses, the guarantor's responsibility ceases. 5. Continuing Guaranty: A continuing guaranty is an ongoing commitment by the stockholders to be held liable for the business debts until a specific condition or event occurs, such as the complete repayment of the debts or termination of the guaranty contract. It ensures long-term financial security for the creditors. When entering into an Orange California Continuing Guaranty of Business Indebtedness By Corporate Stockholders agreement, it is crucial for both parties to seek legal advice and thoroughly understand the terms and conditions of the guaranty to protect their rights and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.