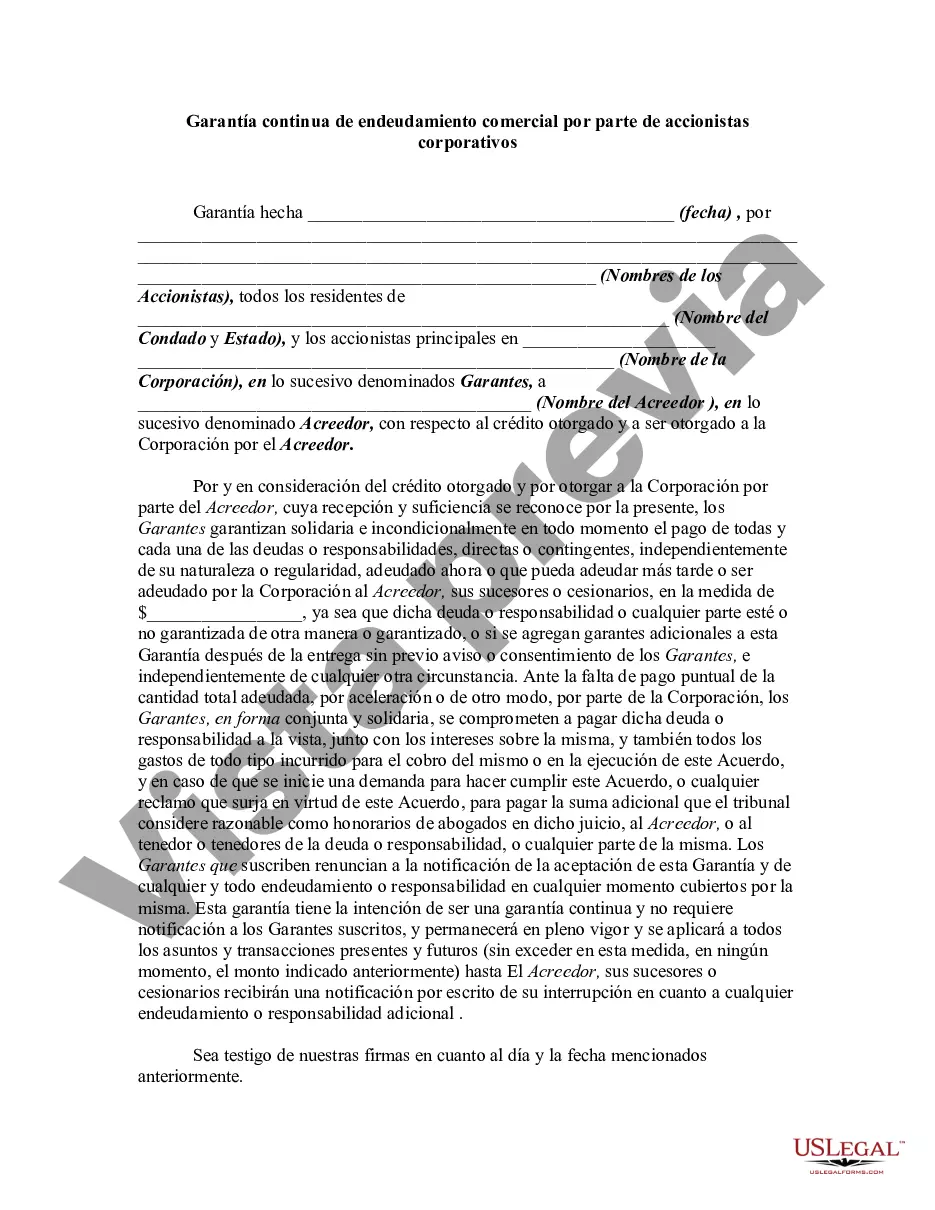

A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

A San Diego California Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legal agreement that outlines the obligations and responsibilities of corporate stockholders in guaranteeing the indebtedness of their business. It serves as a financial security measure for lenders and creditors, ensuring that the debts incurred by the business will be repaid. This type of guaranty is particularly important in the context of business loans and credit facilities, where lenders may require additional assurance that the corporate entity will fulfill its repayment obligations. By signing a continuing guaranty, stockholders agree to be personally liable for the business debts, thereby granting the creditor the right to seek repayment from their personal assets in the event that the business fails to make timely payments. There are different variations of San Diego California Continuing Guaranty of Business Indebtedness By Corporate Stockholders, such as: 1. Limited Guaranty: This type of guaranty imposes a cap on the liability of stockholders, limiting their personal exposure to a specific amount or percentage of the total debt. This provides some level of protection for stockholders if the business defaults on its obligations. 2. Unconditional Guaranty: In contrast to a limited guaranty, an unconditional guaranty holds stockholders fully liable for the entire amount of the business indebtedness, regardless of any limitations or defenses that may apply. This type of guaranty offers the highest level of assurance to lenders. 3. Joint and Several guaranties: With a joint and several guaranties, stockholders collectively and individually guarantee the business indebtedness. This means that each stockholder can be held responsible for the entire debt if the others are unable to fulfill their obligations. It provides flexibility for the creditor, as they can pursue repayment from any or all stockholders. Before entering into a San Diego California Continuing Guaranty of Business Indebtedness By Corporate Stockholders, it is crucial for stockholders to carefully review and understand the terms and conditions of the agreement. Seeking legal advice is highly recommended ensuring compliance with applicable laws and to protect the interests of all parties involved.A San Diego California Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legal agreement that outlines the obligations and responsibilities of corporate stockholders in guaranteeing the indebtedness of their business. It serves as a financial security measure for lenders and creditors, ensuring that the debts incurred by the business will be repaid. This type of guaranty is particularly important in the context of business loans and credit facilities, where lenders may require additional assurance that the corporate entity will fulfill its repayment obligations. By signing a continuing guaranty, stockholders agree to be personally liable for the business debts, thereby granting the creditor the right to seek repayment from their personal assets in the event that the business fails to make timely payments. There are different variations of San Diego California Continuing Guaranty of Business Indebtedness By Corporate Stockholders, such as: 1. Limited Guaranty: This type of guaranty imposes a cap on the liability of stockholders, limiting their personal exposure to a specific amount or percentage of the total debt. This provides some level of protection for stockholders if the business defaults on its obligations. 2. Unconditional Guaranty: In contrast to a limited guaranty, an unconditional guaranty holds stockholders fully liable for the entire amount of the business indebtedness, regardless of any limitations or defenses that may apply. This type of guaranty offers the highest level of assurance to lenders. 3. Joint and Several guaranties: With a joint and several guaranties, stockholders collectively and individually guarantee the business indebtedness. This means that each stockholder can be held responsible for the entire debt if the others are unable to fulfill their obligations. It provides flexibility for the creditor, as they can pursue repayment from any or all stockholders. Before entering into a San Diego California Continuing Guaranty of Business Indebtedness By Corporate Stockholders, it is crucial for stockholders to carefully review and understand the terms and conditions of the agreement. Seeking legal advice is highly recommended ensuring compliance with applicable laws and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.