A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

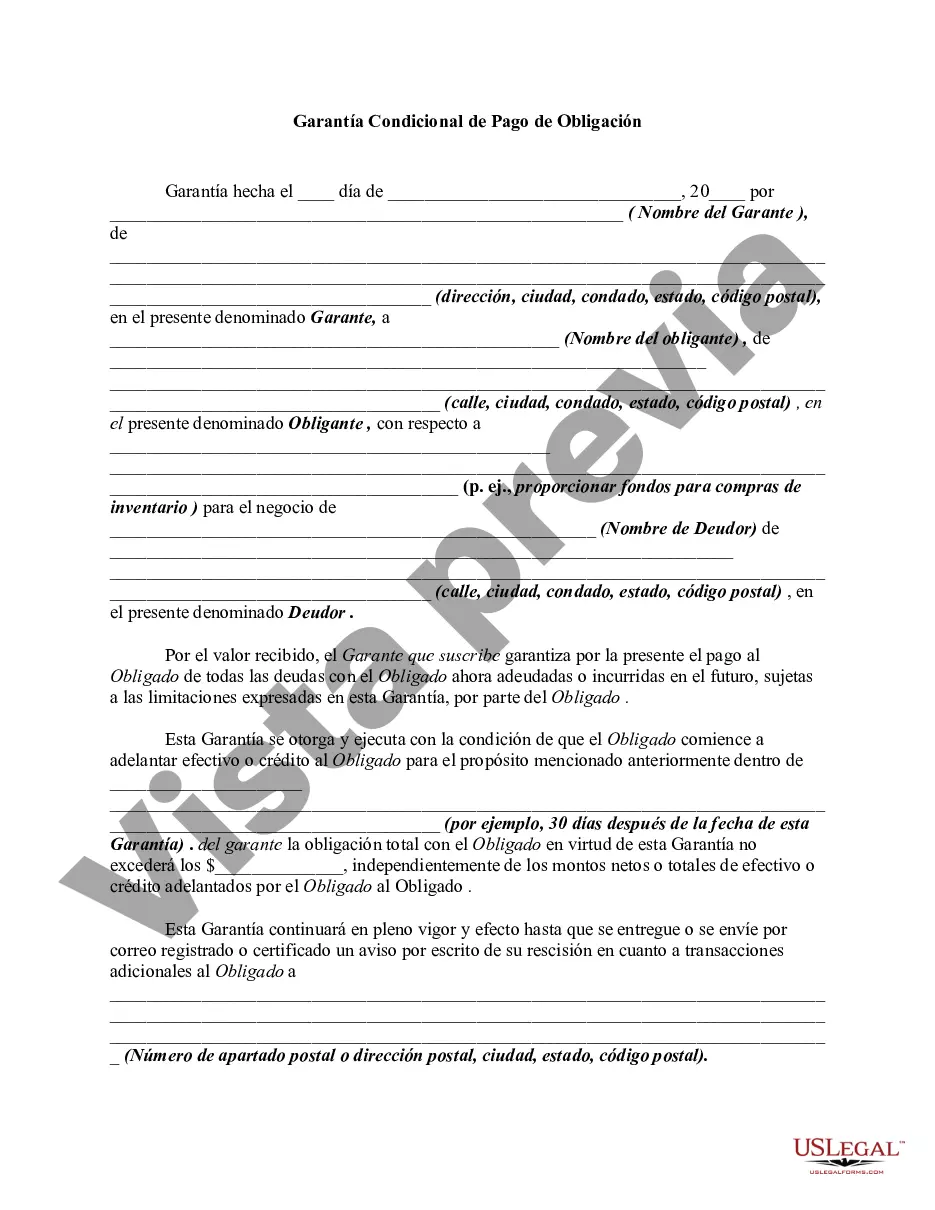

A Conditional Guaranty of Payment of Obligation is a legal document that binds a guarantor to be responsible for the payment of a debt or obligation in the event that the original borrower or obligated party fails to fulfill their financial obligations. Specifically, in the context of Collin, Texas, there may be specific types of Conditional Guaranty of Payment of Obligation that are commonly encountered. Here are some relevant details and types to consider: 1. Collin County, Texas: Located in the northeastern part of Texas, Collin County is one of the fastest-growing regions in the United States. It encompasses several cities, including Plano, McKinney, Allen, and Frisco, known for their thriving economies, residential areas, and vibrant community life. 2. Conditional Guaranty: A Conditional Guaranty is a legally binding contract that establishes the guarantor's obligation to pay a debt or fulfill an obligation under particular conditions. This means the guarantor's responsibility only arises if the primary borrower fails to meet their obligations. 3. Parties Involved: A Collin Texas Conditional Guaranty of Payment of Obligation typically involves three parties: a. Creditor/Lender: The entity or individual who lends money or extends credit to the primary borrower. b. Primary Borrower/Debtor: The individual or organization who is initially responsible for repaying the debt or fulfilling the obligation. c. Guarantor: The third party who agrees to assume liability for the debt or obligation if the primary borrower defaults. 4. Types of Collin Texas Conditional Guaranty of Payment of Obligation: a. Personal Guaranty: This type of guaranty involves an individual (often the owner or principal of a business) personally guaranteeing the payment or fulfillment of a debt or obligation. b. Corporate Guaranty: In this scenario, a business entity (such as a corporation or limited liability company) guarantees the repayment or fulfillment of a debt on behalf of another entity or individual. This type of guaranty separates the liability from the individual's personal assets and makes use of the company's resources. When considering a Collin Texas Conditional Guaranty of Payment of Obligation, it is important to consult with legal professionals who specialize in contract law or financial matters to ensure all parties involved fully understand their rights, responsibilities, and potential consequences.A Conditional Guaranty of Payment of Obligation is a legal document that binds a guarantor to be responsible for the payment of a debt or obligation in the event that the original borrower or obligated party fails to fulfill their financial obligations. Specifically, in the context of Collin, Texas, there may be specific types of Conditional Guaranty of Payment of Obligation that are commonly encountered. Here are some relevant details and types to consider: 1. Collin County, Texas: Located in the northeastern part of Texas, Collin County is one of the fastest-growing regions in the United States. It encompasses several cities, including Plano, McKinney, Allen, and Frisco, known for their thriving economies, residential areas, and vibrant community life. 2. Conditional Guaranty: A Conditional Guaranty is a legally binding contract that establishes the guarantor's obligation to pay a debt or fulfill an obligation under particular conditions. This means the guarantor's responsibility only arises if the primary borrower fails to meet their obligations. 3. Parties Involved: A Collin Texas Conditional Guaranty of Payment of Obligation typically involves three parties: a. Creditor/Lender: The entity or individual who lends money or extends credit to the primary borrower. b. Primary Borrower/Debtor: The individual or organization who is initially responsible for repaying the debt or fulfilling the obligation. c. Guarantor: The third party who agrees to assume liability for the debt or obligation if the primary borrower defaults. 4. Types of Collin Texas Conditional Guaranty of Payment of Obligation: a. Personal Guaranty: This type of guaranty involves an individual (often the owner or principal of a business) personally guaranteeing the payment or fulfillment of a debt or obligation. b. Corporate Guaranty: In this scenario, a business entity (such as a corporation or limited liability company) guarantees the repayment or fulfillment of a debt on behalf of another entity or individual. This type of guaranty separates the liability from the individual's personal assets and makes use of the company's resources. When considering a Collin Texas Conditional Guaranty of Payment of Obligation, it is important to consult with legal professionals who specialize in contract law or financial matters to ensure all parties involved fully understand their rights, responsibilities, and potential consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.