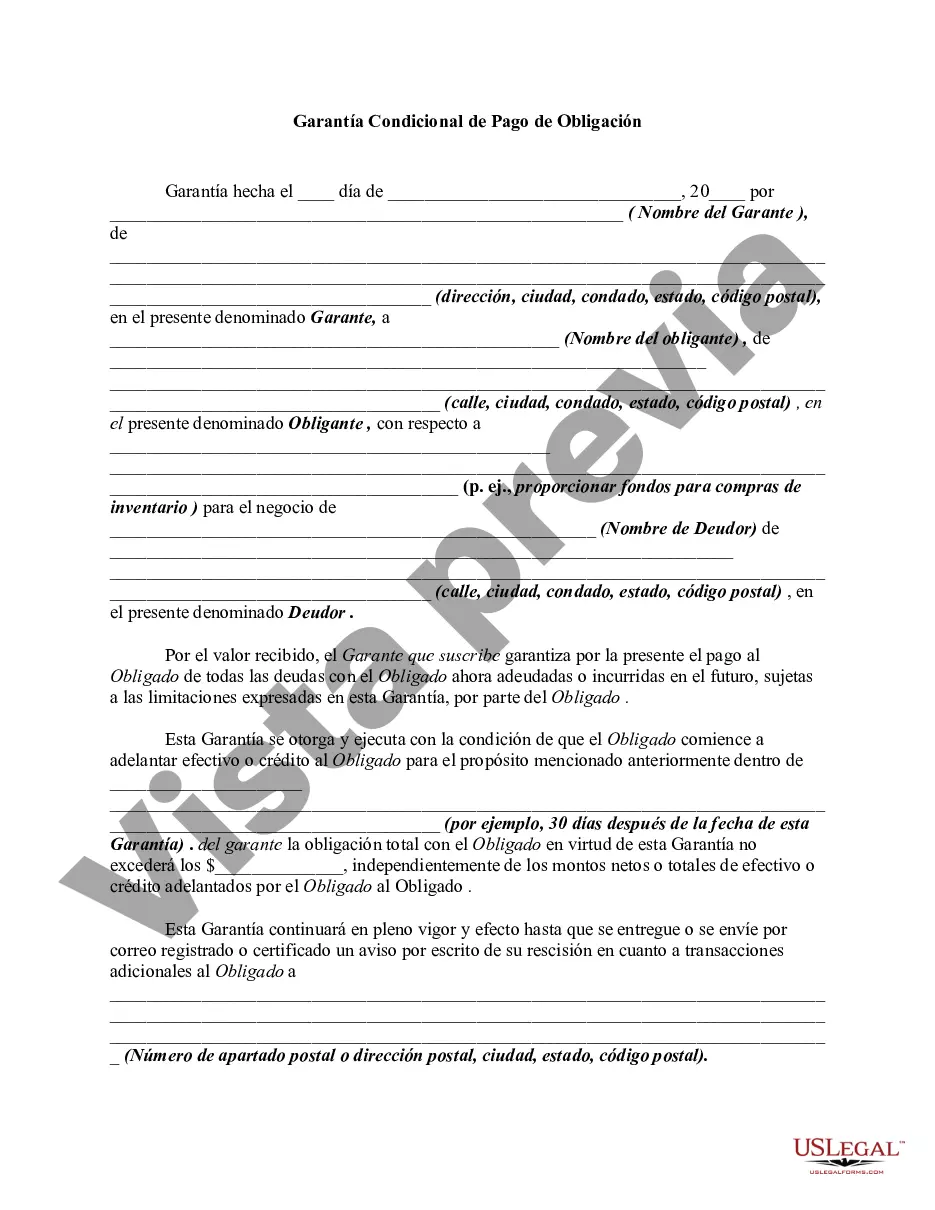

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

A Contra Costa California Conditional Guaranty of Payment of Obligation is a legal document that outlines the terms and conditions under which a guarantor agrees to repay a debt or fulfill an obligation if the primary borrower defaults. Keywords: Contra Costa California, conditional guaranty, payment, obligation, legal document, terms and conditions, guarantor, debt, default. There are different types of Contra Costa California Conditional Guaranty of Payment of Obligation, such as: 1. Personal Guarantee: This type of guaranty involves an individual who personally agrees to be held financially responsible for the debt or obligation in case of default by the borrower. 2. Corporate Guarantee: In this case, a corporation or business entity assumes the responsibility of guaranteeing the payment or performance of another party's obligation. This type of guarantee is commonly used in commercial transactions. 3. Conditional Guarantee: A conditional guaranty specifies certain conditions that must be met before the guarantor becomes liable for the debt or obligation. This could include specific events or triggers defined in the agreement, such as a certain period of delinquency or a failure on the part of the borrower to perform specific duties. 4. Continuing Guaranty: Unlike a conditional guaranty, a continuing guaranty remains in effect until it is revoked or terminated by the guarantor. This means that the guarantor will be responsible for future obligations and debts incurred by the borrower until a formal revocation occurs. 5. Unlimited Guaranty: An unlimited guaranty means that the guarantor is fully liable for the entire debt or obligation, without any limitation on the amount owed. This type of guaranty poses a higher degree of risk for the guarantor. When entering into a Contra Costa California Conditional Guaranty of Payment of Obligation, it is essential for all parties involved to carefully review and understand the terms and conditions to ensure clarity and prevent any future disputes. Legal advice should be sought to ensure compliance with relevant laws and regulations in Contra Costa County, California, to protect the rights and interests of all parties involved.A Contra Costa California Conditional Guaranty of Payment of Obligation is a legal document that outlines the terms and conditions under which a guarantor agrees to repay a debt or fulfill an obligation if the primary borrower defaults. Keywords: Contra Costa California, conditional guaranty, payment, obligation, legal document, terms and conditions, guarantor, debt, default. There are different types of Contra Costa California Conditional Guaranty of Payment of Obligation, such as: 1. Personal Guarantee: This type of guaranty involves an individual who personally agrees to be held financially responsible for the debt or obligation in case of default by the borrower. 2. Corporate Guarantee: In this case, a corporation or business entity assumes the responsibility of guaranteeing the payment or performance of another party's obligation. This type of guarantee is commonly used in commercial transactions. 3. Conditional Guarantee: A conditional guaranty specifies certain conditions that must be met before the guarantor becomes liable for the debt or obligation. This could include specific events or triggers defined in the agreement, such as a certain period of delinquency or a failure on the part of the borrower to perform specific duties. 4. Continuing Guaranty: Unlike a conditional guaranty, a continuing guaranty remains in effect until it is revoked or terminated by the guarantor. This means that the guarantor will be responsible for future obligations and debts incurred by the borrower until a formal revocation occurs. 5. Unlimited Guaranty: An unlimited guaranty means that the guarantor is fully liable for the entire debt or obligation, without any limitation on the amount owed. This type of guaranty poses a higher degree of risk for the guarantor. When entering into a Contra Costa California Conditional Guaranty of Payment of Obligation, it is essential for all parties involved to carefully review and understand the terms and conditions to ensure clarity and prevent any future disputes. Legal advice should be sought to ensure compliance with relevant laws and regulations in Contra Costa County, California, to protect the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.