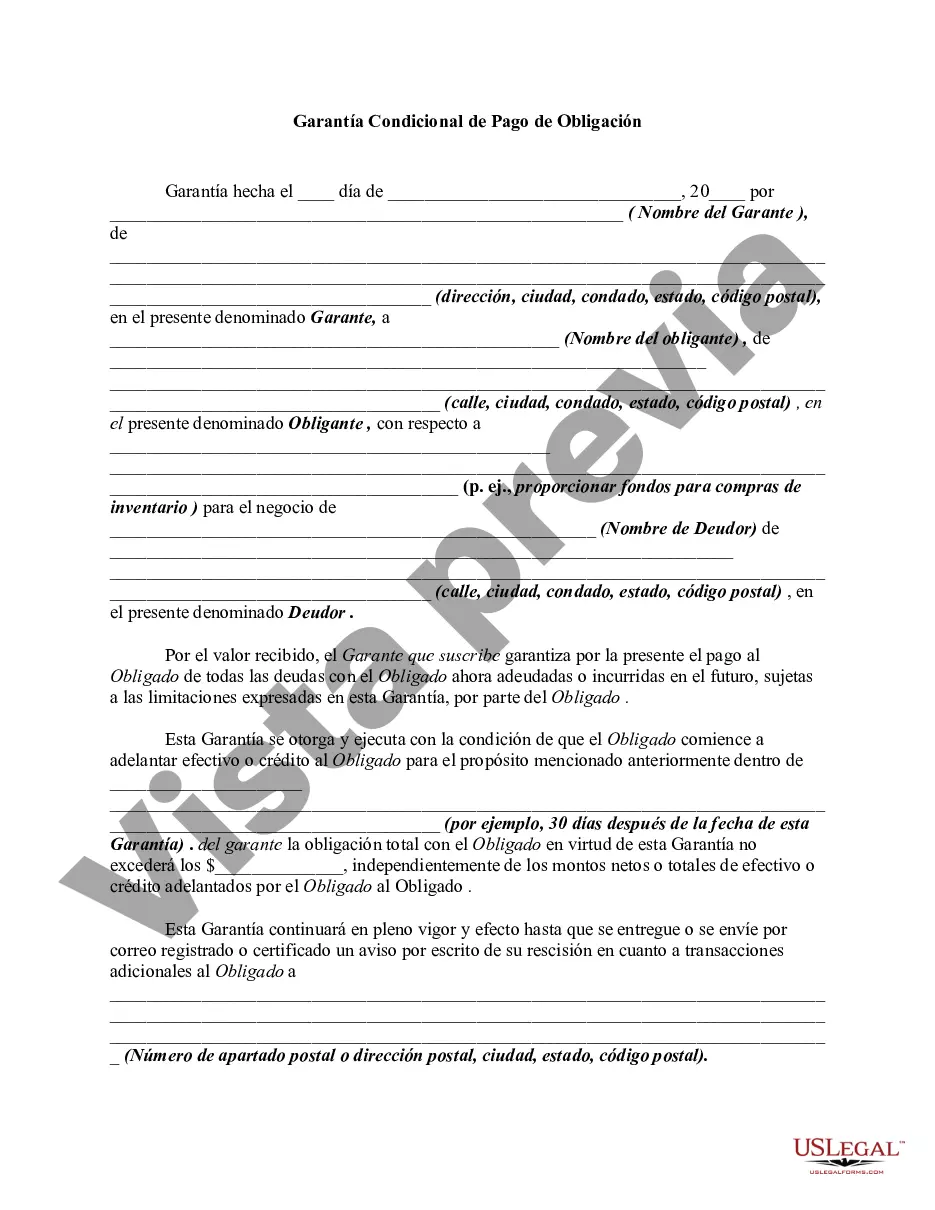

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

The Cook Illinois Conditional Guaranty of Payment of Obligation is a legally binding agreement that ensures certain financial obligations are met in a specified manner. This guaranty is commonly used in the context of loans, leases, or other financial arrangements where a third party takes on the responsibility of payment in case the primary party defaults. The Cook Illinois Conditional Guaranty of Payment of Obligation acts as a safety net for lenders or lessors by providing an additional layer of security in the event that the borrower or lessee fails to fulfill their payment obligations. It assures the creditor that they will receive the payment they are owed, even if the principal debtor cannot fulfill their part of the agreement. This type of guaranty is conditional in nature, meaning that it is dependent on the occurrence of a specific event, such as the default of the primary party, before the guarantor becomes obligated to make the required payment. The conditions for triggering the guarantor's obligation are typically outlined in the guaranty agreement itself. Different types of Cook Illinois Conditional Guaranty of Payment of Obligation may exist based on variations in the specific terms, conditions, and parties involved. For instance, there may be guaranties that pertain specifically to loans, while others may be specific to leases or other contractual arrangements. The details of each type of guaranty can vary, but the underlying purpose remains the same: to provide an assurance of payment to the creditor if the primary party fails to fulfill their obligations. Overall, the Cook Illinois Conditional Guaranty of Payment of Obligation is a contractual agreement that provides financial protection for creditors by ensuring payment in case of default. This type of guaranty plays a crucial role in mitigating risks associated with lending or leasing transactions and contributes to maintaining a secure financial environment.The Cook Illinois Conditional Guaranty of Payment of Obligation is a legally binding agreement that ensures certain financial obligations are met in a specified manner. This guaranty is commonly used in the context of loans, leases, or other financial arrangements where a third party takes on the responsibility of payment in case the primary party defaults. The Cook Illinois Conditional Guaranty of Payment of Obligation acts as a safety net for lenders or lessors by providing an additional layer of security in the event that the borrower or lessee fails to fulfill their payment obligations. It assures the creditor that they will receive the payment they are owed, even if the principal debtor cannot fulfill their part of the agreement. This type of guaranty is conditional in nature, meaning that it is dependent on the occurrence of a specific event, such as the default of the primary party, before the guarantor becomes obligated to make the required payment. The conditions for triggering the guarantor's obligation are typically outlined in the guaranty agreement itself. Different types of Cook Illinois Conditional Guaranty of Payment of Obligation may exist based on variations in the specific terms, conditions, and parties involved. For instance, there may be guaranties that pertain specifically to loans, while others may be specific to leases or other contractual arrangements. The details of each type of guaranty can vary, but the underlying purpose remains the same: to provide an assurance of payment to the creditor if the primary party fails to fulfill their obligations. Overall, the Cook Illinois Conditional Guaranty of Payment of Obligation is a contractual agreement that provides financial protection for creditors by ensuring payment in case of default. This type of guaranty plays a crucial role in mitigating risks associated with lending or leasing transactions and contributes to maintaining a secure financial environment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.