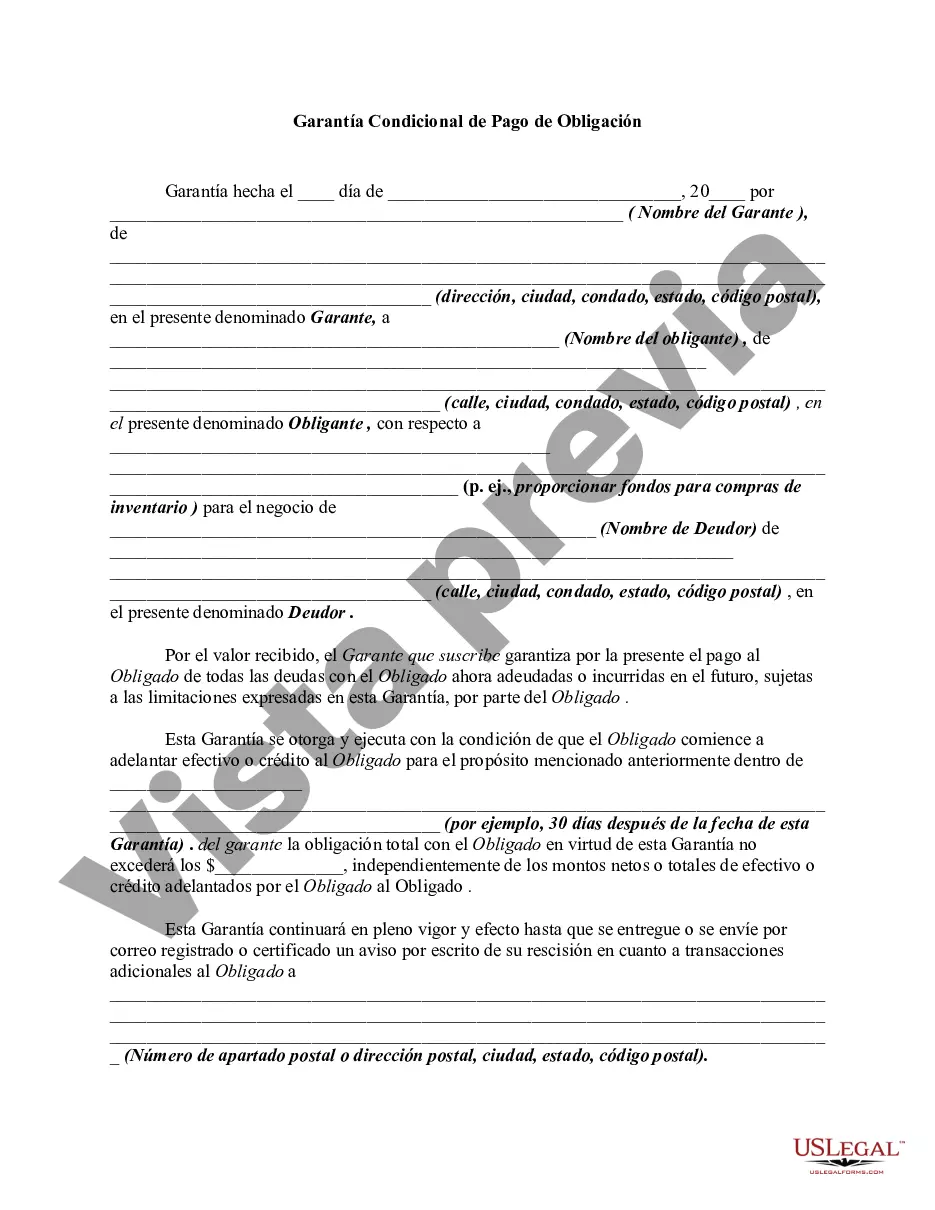

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Cuyahoga Ohio Conditional Guaranty: The Cuyahoga Ohio Conditional Guaranty of Payment of Obligation is a legally binding agreement that provides a guarantee for the repayment of a specific obligation or debt. This type of guarantee is conditional and requires the guarantor to fulfill certain conditions stated within the agreement. Keywords: Cuyahoga, Ohio, conditional, guaranty, payment, obligation. There are different types of Cuyahoga Ohio Conditional Guaranty of Payment of Obligation, including: 1. Personal Guaranty: A personal guaranty is provided by an individual who agrees to be held responsible for the repayment of the obligation. This type of guaranty may require the guarantor to use personal assets to fulfill the payment if the primary debtor fails to meet their obligations. 2. Corporate Guaranty: A corporate guaranty is provided by a company or corporation, wherein the entity agrees to guarantee the payment of the obligation. This type of guaranty can be particularly helpful when dealing with business-related obligations. 3. Limited Guaranty: A limited guaranty places certain restrictions on the responsibility of the guarantor. The guarantor's liability is limited to a certain amount or specific conditions as stated in the agreement. 4. Unconditional Guaranty: In contrast to a conditional guaranty, an unconditional guaranty requires the guarantor to be liable for the repayment of the obligation without any specified conditions being met. The guarantor becomes directly responsible for the payment. 5. Continuing Guaranty: A continuing guaranty applies to obligations that extend over a period of time or involve multiple transactions. It ensures that the guarantor's responsibility remains in effect for the duration of the specified period or until the underlying obligation is fully satisfied. 6. Absolute Guaranty: An absolute guaranty places the guarantor in a position where they are entirely responsible for the repayment of the debt, regardless of any conditions or circumstances. It is a form of guaranty with no limitations or restrictions. In Cuyahoga, Ohio, the Conditional Guaranty of Payment of Obligation plays a vital role in securing financial transactions and ensuring the fulfillment of obligations. It offers protection to the lender or creditor by holding a guarantor responsible for the repayment if the primary debtor fails to meet their obligations.Cuyahoga Ohio Conditional Guaranty: The Cuyahoga Ohio Conditional Guaranty of Payment of Obligation is a legally binding agreement that provides a guarantee for the repayment of a specific obligation or debt. This type of guarantee is conditional and requires the guarantor to fulfill certain conditions stated within the agreement. Keywords: Cuyahoga, Ohio, conditional, guaranty, payment, obligation. There are different types of Cuyahoga Ohio Conditional Guaranty of Payment of Obligation, including: 1. Personal Guaranty: A personal guaranty is provided by an individual who agrees to be held responsible for the repayment of the obligation. This type of guaranty may require the guarantor to use personal assets to fulfill the payment if the primary debtor fails to meet their obligations. 2. Corporate Guaranty: A corporate guaranty is provided by a company or corporation, wherein the entity agrees to guarantee the payment of the obligation. This type of guaranty can be particularly helpful when dealing with business-related obligations. 3. Limited Guaranty: A limited guaranty places certain restrictions on the responsibility of the guarantor. The guarantor's liability is limited to a certain amount or specific conditions as stated in the agreement. 4. Unconditional Guaranty: In contrast to a conditional guaranty, an unconditional guaranty requires the guarantor to be liable for the repayment of the obligation without any specified conditions being met. The guarantor becomes directly responsible for the payment. 5. Continuing Guaranty: A continuing guaranty applies to obligations that extend over a period of time or involve multiple transactions. It ensures that the guarantor's responsibility remains in effect for the duration of the specified period or until the underlying obligation is fully satisfied. 6. Absolute Guaranty: An absolute guaranty places the guarantor in a position where they are entirely responsible for the repayment of the debt, regardless of any conditions or circumstances. It is a form of guaranty with no limitations or restrictions. In Cuyahoga, Ohio, the Conditional Guaranty of Payment of Obligation plays a vital role in securing financial transactions and ensuring the fulfillment of obligations. It offers protection to the lender or creditor by holding a guarantor responsible for the repayment if the primary debtor fails to meet their obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.