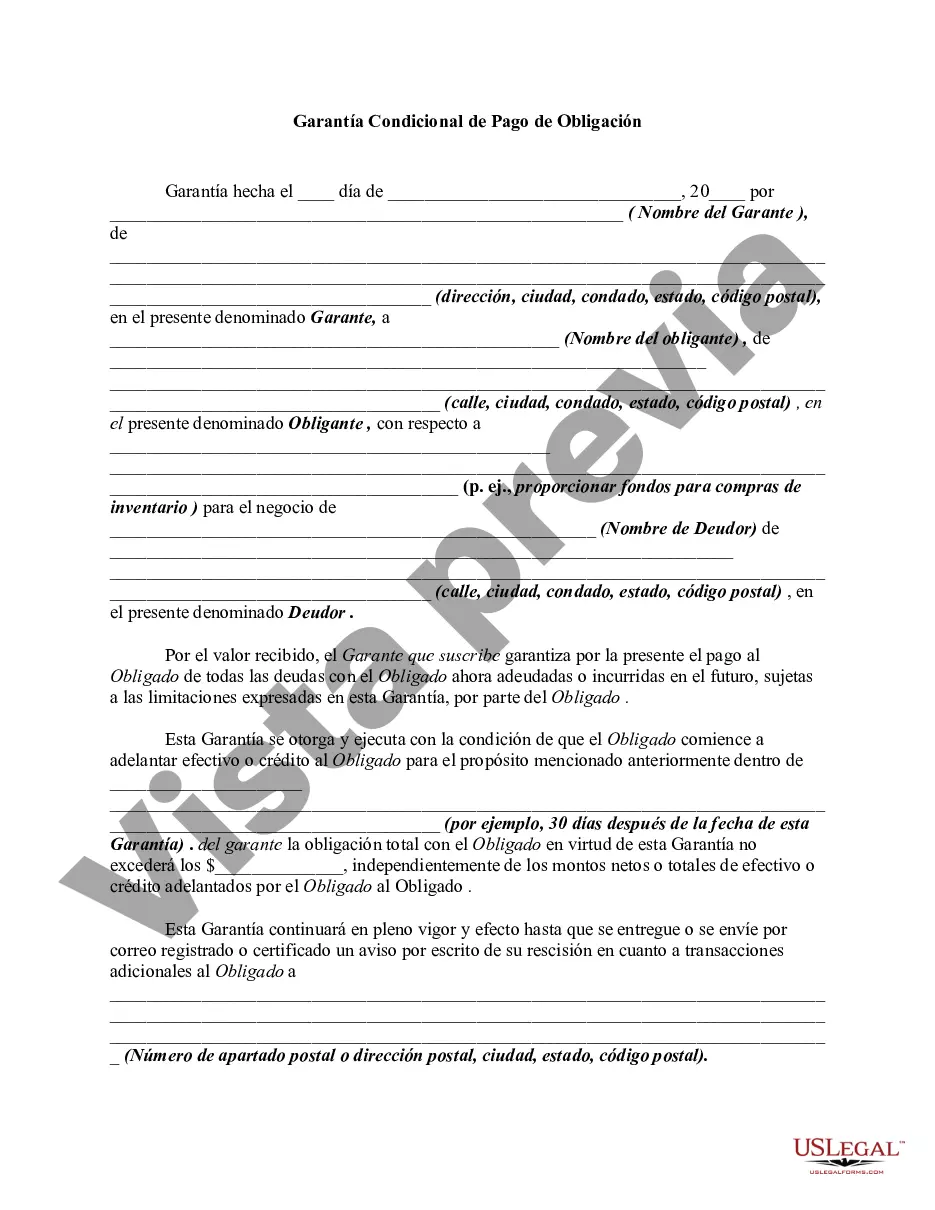

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

A Fulton Georgia Conditional Guaranty of Payment of Obligation refers to a legally binding agreement that outlines the conditions under which a guarantor will be held responsible for a specific debt or obligation in Fulton County, Georgia. This guarantee serves as a safeguard for creditors, providing them with an extra layer of assurance that their debts will be repaid. In Fulton County, there may be different types or variations of conditional guaranties of payment of obligation, each tailored to the specific circumstances or requirements of the parties involved. Some common types include: 1. Personal Guaranty: This type of conditional guaranty involves an individual assuming responsibility for the payment of a debt or obligation on behalf of another individual or entity. The guarantor becomes personally liable for the debt if the primary debtor fails to fulfill their obligation. 2. Corporate Guaranty: In the case of a corporate guaranty, a business entity agrees to guarantee the debt or obligation of another business entity. This assures the creditor that if the debtor company defaults, the guarantor company will step in and fulfill the payment obligation. 3. Limited Guaranty: A limited guaranty imposes restrictions on the extent of the guarantor's liability. It may limit the guarantor's responsibility to a specific portion of the debt or a predefined time frame. This type of guaranty provides some protection to the guarantor, minimizing their potential liability. 4. Unconditional Guaranty: Unlike a conditional guaranty, an unconditional guaranty does not impose any specified conditions or requirements for the guarantor to fulfill their obligation. The guarantor becomes fully liable for the debt or obligation right from the start, regardless of the actions or circumstances of the primary debtor. It's important to note that the exact terms and conditions of a Fulton Georgia Conditional Guaranty of Payment of Obligation may vary depending on the specific agreement between the guarantor and the creditor. It is crucial for all parties involved to carefully review and understand the terms of the guaranty before entering into the agreement. Seeking legal advice or consulting an attorney experienced in contract law is advisable to ensure all parties' rights and obligations are adequately protected.A Fulton Georgia Conditional Guaranty of Payment of Obligation refers to a legally binding agreement that outlines the conditions under which a guarantor will be held responsible for a specific debt or obligation in Fulton County, Georgia. This guarantee serves as a safeguard for creditors, providing them with an extra layer of assurance that their debts will be repaid. In Fulton County, there may be different types or variations of conditional guaranties of payment of obligation, each tailored to the specific circumstances or requirements of the parties involved. Some common types include: 1. Personal Guaranty: This type of conditional guaranty involves an individual assuming responsibility for the payment of a debt or obligation on behalf of another individual or entity. The guarantor becomes personally liable for the debt if the primary debtor fails to fulfill their obligation. 2. Corporate Guaranty: In the case of a corporate guaranty, a business entity agrees to guarantee the debt or obligation of another business entity. This assures the creditor that if the debtor company defaults, the guarantor company will step in and fulfill the payment obligation. 3. Limited Guaranty: A limited guaranty imposes restrictions on the extent of the guarantor's liability. It may limit the guarantor's responsibility to a specific portion of the debt or a predefined time frame. This type of guaranty provides some protection to the guarantor, minimizing their potential liability. 4. Unconditional Guaranty: Unlike a conditional guaranty, an unconditional guaranty does not impose any specified conditions or requirements for the guarantor to fulfill their obligation. The guarantor becomes fully liable for the debt or obligation right from the start, regardless of the actions or circumstances of the primary debtor. It's important to note that the exact terms and conditions of a Fulton Georgia Conditional Guaranty of Payment of Obligation may vary depending on the specific agreement between the guarantor and the creditor. It is crucial for all parties involved to carefully review and understand the terms of the guaranty before entering into the agreement. Seeking legal advice or consulting an attorney experienced in contract law is advisable to ensure all parties' rights and obligations are adequately protected.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.